A sole proprietorship in the UAE is the simplest way to turn your skills, ideas, or profession into a legally recognized business. You operate under your own name or a trade name, you make the decisions, and you carry the responsibility. No partners, no shareholders, no internal politics. Just you and the business you run.

This structure is especially popular with consultants, freelancers, and independent professionals who want control without complexity. In practical terms, the business and the owner are closely connected — financially and legally. That connection is powerful when things move fast, and demanding when they don’t.

If you are asking what is sole proprietorship and whether it fits your plans in the UAE, this article walks you through the meaning, the rules, the risks, and the real-life trade-offs — without hiding the fine print.

What Is Sole Proprietorship and How Does It Work?

A sole proprietorship is a business owned and run by one person, where control and responsibility sit in the same hands. You register the activity, get the license, open a bank account, and start operating — there is no separation between “the company” and you as the owner.

Day to day, this setup is refreshingly direct. You sign contracts yourself, invoice clients under your trade name, and receive income straight into your business account. There are no boards to consult and no partners to negotiate with. Decisions move at your speed, not someone else’s calendar.

Legally, this simplicity comes with weight. Any obligations the business creates are yours personally. That is the trade-off that defines how a sole proprietorship works: freedom on one side, full accountability on the other. For many professionals, that balance feels fair — especially at the early or service-based stage of a business journey.

Sole Proprietorship Meaning in Business and Legal Context

The sole proprietorship meaning shifts slightly depending on who you ask — an entrepreneur or a lawyer. From a business point of view, it means independence. You own the idea, the income, the client relationships, and the direction. There is no separate legal personality standing between you and the work you do.

From a legal perspective, the picture is more precise. A sole proprietorship is not a standalone entity in the way an LLC is. The law treats the business and the owner as one. Contracts are signed by you, liabilities sit with you, and compliance obligations follow your personal profile.

This overlap is neither good nor bad on its own. It simply defines the rules of the game. For service-based professionals, the clarity can be an advantage. You always know where responsibility starts and ends — and there is no confusion about who is ultimately in charge.

Want to learn more about UAE business setup services?

What Is Sole Proprietorship in the UAE?

In the UAE, a sole proprietorship is a straightforward business format where one person owns the activity and runs it under their own responsibility. You apply for a license tied to a specific activity, register a trade name if you want one, and then operate as a single-owner business. In Dubai, the Dubai Department of Economy and Tourism (DET) is one of the key authorities involved in registration and licensing on the mainland.

A sole proprietorship UAE setup is most common when the “product” is you: your expertise, your service, your professional output. It works well for consulting, design, training, IT services, and similar work where you don’t need partners to function.

Who Can Open a Sole Proprietorship in the UAE

UAE nationals and GCC nationals can open a sole proprietorship under the standard rules. Foreigners can also open one, especially for professional activities, but the exact requirements depend on the emirate and the licensed activity. In cases where a local service agent is required, that agent does not own shares and does not run the business.

Want the clean answer for your case? Message Consulting.ae and we’ll map out sole proprietorship vs LLC options and the fastest compliant route to registration.

Sole Proprietorship Examples Across Different Industries

If you want sole proprietorship examples that feel real, think about jobs where the client hires a person, not “a company.” A consultant who walks into a boardroom with a laptop and a plan. A freelance designer who ships layouts, not excuses. A copywriter, translator, or editor working with agencies in Dubai today and with Europe tomorrow. That’s classic sole proprietorship UAE territory.

It also fits hands-on specialists. Personal trainers, tutors, photographers, videographers, and event professionals often run solo because the work depends on their name and their delivery. The same goes for many tech roles: independent developers, SEO specialists, paid ads managers, and cybersecurity freelancers.

There’s a pattern here: the business is built around expertise and output, not around staff, warehouses, or complex ownership. When the service is personal and the workflow is lean, a sole proprietorship usually feels like the natural starting shape.

Sole Proprietorship UAE: Advantages and Disadvantages

A sole proprietorship UAE license feels light on paperwork and heavy on personal control — which is exactly why people like it. You don’t build a mini-corporation. You build a working business around one owner: you.

Advantages that actually matter in real life

- You decide everything, fast — pricing, clients, direction

- Setup is usually simpler than forming a company structure

- Day-to-day admin stays manageable

- You keep the profit flow clean and direct

Disadvantages you must treat seriously

- The business is legally tied to you, so liability can become personal

- Bigger contracts can feel riskier without a liability shield

- Some corporate clients lean toward LLCs for vendor onboarding

- If you plan to scale with partners or investors, you may need to restructure

This is why the “best” choice depends on your risk profile, not your ego. A sole proprietorship can be perfect for professional services — and uncomfortable for anything that carries high exposure, high volume, or high stakes.

LLC vs Sole Proprietorship: What Is the Difference?

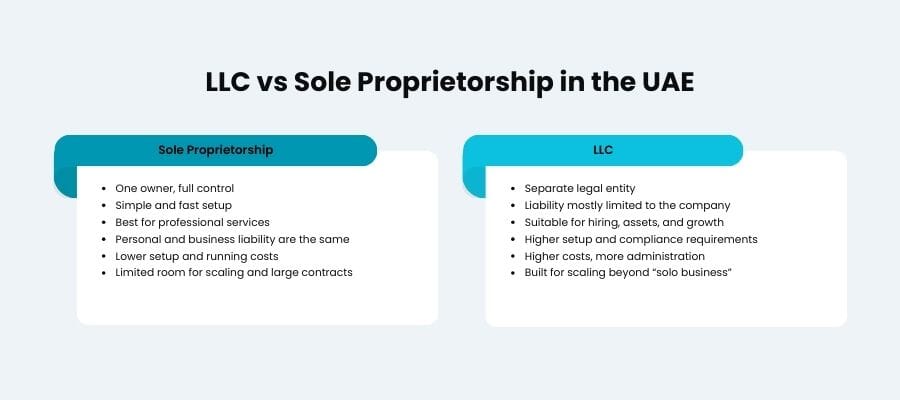

The LLC vs sole proprietorship debate is rarely about “which one is cooler.” It’s about your appetite for exposure, the kind of clients you deal with, and how much structure you want around your work. A sole proprietorship keeps things direct: one owner, one license, one decision-maker. An LLC adds a corporate layer — not to complicate your life for fun, but to separate you from the business on paper.

If your income comes from professional services and you like moving fast, a sole proprietorship often feels natural. If you plan to hire, sign bigger contracts, hold assets, or scale beyond “you + laptop,” that’s where sole proprietorship vs LLC becomes a serious choice, not a branding preference.

Sole Proprietorship vs LLC in Terms of Liability

Here’s the hard truth, stated plainly. With a sole proprietorship, the business and the owner are treated as the same person in legal terms. If a dispute turns into a claim or debt, your personal finances can be part of the conversation.

With an LLC, liability is generally contained within the company, which is why many people choose it even when the setup feels heavier. In sole proprietorship vs LLC, the liability shield is the main reason an LLC exists.

Want to learn more about UAE business setup services?

Sole Proprietorship vs LLC in Terms of Cost and Setup

Costs swing by emirate, activity, office requirements, and visa needs — but the ranges are real. In Dubai, a professional license for a sole establishment is often quoted around AED 10,000–18,000 (and in some cases AED 15,000–30,000, depending on what’s bundled). If a local service agent is required, agreements commonly sit around AED 5,000–8,000 per year.

An LLC usually comes in higher because you’re paying for a fuller corporate setup and ongoing obligations. You spend more, you file more, you manage more — but you also buy that extra separation. That’s the trade most founders are actually making when they weigh LLC vs sole proprietorship.

Sole Proprietorship UAE Decision: Simple, Fast, and Not for Everyone

A sole proprietorship in the UAE is a clean fit when your business is essentially your expertise: you deliver the service, you manage the client, you own the workflow. It keeps the structure light and the control absolute. But it also keeps responsibility personal — and that part is not negotiable.

If your work stays in the “professional services” lane, a sole proprietorship can feel like the right kind of minimal. If you expect larger contracts, higher exposure, or a setup that needs partners and scaling room, the sole proprietorship vs LLC question becomes less theoretical and more urgent.

You don’t need a generic answer. You need the right structure for your activity, emirate, and plans.Talk to Consulting.ae for a clear recommendation, side-by-side LLC vs sole proprietorship comparison, and full UAE business setup support from first step to license.

In LLC vs sole proprietorship, an LLC is separate from you; a sole proprietorship is you. That changes risk and paperwork. Match it to your activity.

No, a sole proprietorship has no limited liability. Your personal assets can be exposed. That’s why sole proprietorship vs LLC matters.

Yes, foreigners can open a sole proprietorship UAE, mainly for professional activities. Rules vary by emirate and license activity. Check eligibility early.

Often yes: sole proprietorship UAE costs are usually lower than an LLC. You pay less structure, not less legitimacy. Compare full annual costs.