Imagine you’ve just gotten a job in the UAE.

Then you would like to know, “What is ILOE insurance?” This isn't just another administrative procedure; it's a crucial financial safety net that protects all employees in both the commercial and federal government sectors.

Understanding what is ILOE insurance is essential in case you’ve suddenly lost your work. ILOE is meant to help you with the immediate financial stress and give you peace of mind.

ILOE is a new way to make the national economy stronger and draw in the best workers by giving them the security they need.

Today's post helps UAE-based employees, HR professionals, and expats better grasp their rights, responsibilities, and ILOE benefits.

What Is ILOE Insurance?

ILOE Meaning and Full Definition

The UAE's Involuntary Loss of Employment (ILOE) insurance program is a very important safety net for workers in both the public and commercial sectors.

It might be hard to be unemployed when you didn't expect it. ILOE insurance meaning is that this unique program empowers to people who qualify. For three months, a small monthly payment guarantees up to 60% of basic wages. This important financial help creates a safety net that lets people look for new jobs with confidence and makes it easier to switch careers.

What Is ILOE Insurance in the UAE Context

The Involuntary Loss of Employment (ILOE) insurance system is a breakthrough effort by the United Arab Emirates to improve social security. Federal Decree-Law No. 13 of 2022 officially launched this important framework, which protects the finances of all working people, including those in the private sector and the federal government.

The program gives people who lose their jobs through no fault of their own short-term financial help. It specifically does not cover cases where someone chooses to quit or is fired for documented bad behavior.

People who want to be part of this required program have to make a small, recurring contribution of up to 60% of their baseline income over a set period of time that can't be more than three months in a row.

Meaning of ILOE in Employment Law and Labour Rights

So, what is ILOE insurance UAE?

The UAE's Involuntary Loss of Employment (ILOE) program changes the way people in the country feel about job security in a big way. It gives eligible employees a legal right to short-term financial help if they lose their job for reasons beyond of their control.

This revolutionary program strongly shows how committed the UAE is to strong labor standards and the overall well-being of workers. By providing a crucial financial cushion during times of unemployment, ILOE greatly reduces the severe economic stress that comes with losing a job, giving people more confidence and stability as they move from one job to another. This proactive strategy not only protects the health of workers, but it also makes the UAE's labor market more resilient as a whole.

It encourages a more secure and appealing employment market by requiring only a small amount of personal input for a lot of help. Not following the rules can lead to legal sanctions, which makes the plan even more necessary.

Why ILOE Insurance Was Introduced in the UAE

Background and Policy Goals

Let’s now dive deeper into what is ILOE in UAE.

The UAE's Involuntary Loss of Employment (ILOE) program is a big step forward for social welfare since it gives those who lose their jobs through no fault of their own important short-term financial help. ILOE not only provides immediate assistance, but it also strengthens the economy in the long run by attracting and keeping top people with a secure social safety net.

Benefits for Employees and the Labour Market

This new initiative has two benefits: it stabilizes individual workers and the UAE labor market as a whole. It makes the worker more secure and confident by softening the blow of losing a job, which in turn leads to more participation and new ideas. ILOE also encourages workers to move about by making them less afraid of changing jobs and making the UAE's employment rules more in line with global standards. This shows a strong commitment to the well-being of workers.

How ILOE Insurance Works

Subscription Process and Platforms

Signing up for the UAE's ILOE insurance is easy and quick, making it available to as many people as possible. Dubai Insurance runs the program, which includes signing people up and paying out benefits.

The main steps for signing up are easy to understand:

- Choose a platform that is allowed,

- Please tell us what kind of work you do (private or federal government).

- To verify, please provide your Emirates ID and UAE cellphone number.

Core subscription platforms:

Official ILOE Portal (www.iloe.ae): This is the main and best way to get information online. The ILOE plan is simple and doesn't have any extra service fees.

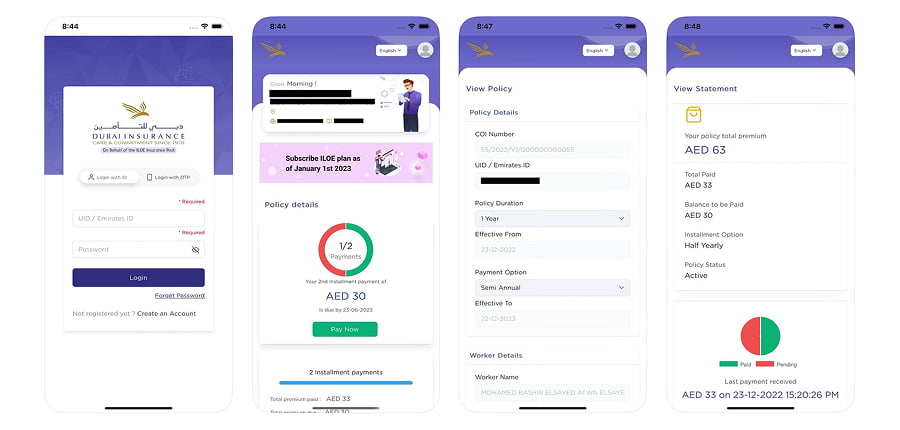

The ILOE mobile app, which works on both Apple and Android smartphones, makes it easy to manage your policy and sign up.

Do you prefer to meet in person? You can pay cash for subscriptions and policy management at Al Ansari Exchange outlets all around the UAE. Tasheel and Tawjeeh are two MOHRE Business Service Centers that help people register for services.

Payment Kiosks: These machines are available from a number of companies, including Upay and MBME Pay. You can find them at malls and supermarkets.

Some bank apps in the UAE, such C3Pay and Botim, let you sign up for ILOE as part of their services.

SMS: For e& (Etisalat) clients, you can usually sign up by texting your Emirates ID number to a special short code (for example, ID [Emirates ID] to 2120).

You can also subscribe or seek help by calling the ILOE Call Center at 600599555.

ILOE Certificate Meaning and How to Obtain It

According to Federal Decree-Law No. 13 of 2022, the UAE's ILOE Certificate formally indicates that you must sign up for the Involuntary Loss of Employment insurance. It proves that you are actively involved, have a good payment history, and are eligible for financial help after losing your job unexpectedly. It is important for legal compliance and sometimes directly linked to Labour Card operations.

Once you've finished your subscription, getting your ILOE Certificate is easy. The process is mostly online:

- The ILOE Portal.

- ILOE Mobile App.

- Confirmation by email.

Contribution Amounts, Categories, and Coverage Detail

The ILOE program puts employees into groups depending on their base pay to figure out how much they should contribute and how much they can get paid.

What is ILOE insurance in UAE? The ILOE program has a two-tiered contribution system, which means that anyone can join based on how much money they make.

In the UAE, the ILOE framework works on a two-tier income-based basis. People in Category A make AED 16,000 or less a month and pay AED 5 a month (or AED 60 a year) + VAT. People in Category B have basic wages over AED 16,000 and pay AED 10 a month (or AED 120 a year) + VAT. Subscribers can pick how often they want to pay: every month, every three months, every six months, or every year. Value Added Tax is only charged on the first payment within the time frame that you choose.

The UAE's ILOE program is an important safety net for people who lose their jobs without their consent. Benefits are paid out for up to three months per claim. Beneficiaries in Category A can get up to AED 10,000 a month, while those in Category B can get up to AED 20,000.

To be eligible, you must have made consistent contributions for at least 12 months in a row, and you must not have quit your employment or been fired for disciplinary reasons. You have 30 days after losing your job to file a claim. There is a lifetime maximum of 12 monthly benefits, no matter how many claims are made.

ILOE Insurance Eligibility and Deadlines

Who Is Required to Subscribe

The UAE government has made the Involuntary Loss of Employment (ILOE) insurance mandatory for most salaried employees in the private sector, regardless of their nationality. This rule applies to anyone who work for the federal government, semi-governmental organizations, and firms in free zones. However, some groups are not included, such as business owners, household staff, workers with very short contracts, those under 18, and Emirati retirees who get a pension and go back to work.

When You Must Enroll

There is no room for negotiation on timely premium payments. If you don't pay your monthly contributions for more than three months, you will be fined and your insurance certificate will be voided.

As of January 2024, it is now required to have a valid ILOE policy to get or renew a UAE Labour Card. This important connection between your Involuntary Loss of Employment insurance and your legal right to work implies that you need to sign up quickly and pay your premiums on time to keep your job.

What Happens If You Miss the Deadline

Being this careful makes sure that coverage stays in place and helps avoid possible financial problems. Also, let's say someone who is enrolled doesn't pay their premiums for more than three months in a row. In such instance, they have to pay an extra AED 200 fine, which means their insurance certificate is immediately canceled and, most importantly, they lose their entitlement to any future benefits. This leaves them exposed if they lose their work involuntarily. To get coverage again, you need to sign up again.

Non-compliance can make it very hard for an employee to get or renew work permits and visas. This is because the Ministry of Human Resources and Emiratisation (MOHRE) links ILOE compliance directly to labor card processes.

What Is ILOE Fine and When It's Applied

ILOE Fine Meaning and Amounts

In the UAE, an ILOE penalty is a fine for workers who don't have the required Involuntary Loss of Employment insurance. These taxes make sure that people follow the federal decree-law, which protects the strength and long-term viability of the country's jobless support system.

There are usually two different types of ILOE fines:

If you don't subscribe, you will be charged AED 400. This punishment is for people who don't join the ILOE plan within the time limit set.

This penalty applies to people who are new to the UAE and don't sign up for the ILOE program within four months of arriving in the country or getting their work visa. Also, individuals who were already working in the UAE before the program fully started will have to pay this fine if they didn't meet the new enrollment cut-off date, which is October 1, 2023.

If you don't pay your premiums, you will be charged AED 200. This penalty happens when an enrolled employee doesn't make their monthly (or other set frequency) contributions for more than three months after the due date. In these cases, the insurance certificate is usually void, which means that coverage is lost.

The ILOE fines, plus VAT, can cause a lot of problems. Unpaid fines may make it harder to get or renew work permits and visas, and they could even be taken straight from salary or end-of-service rewards.

Common Reasons for ILOE Fines

ILOE fines in the UAE mostly come from two main problems with the statutory unemployment insurance plan, which is meant to make sure it works. Workers must understand these compliance requirements because punishments keep the system fair and protect its important purpose.

The most typical reason for getting an ILOE fine is not signing up on time, which costs AED 400. This often has an impact on:

Two main reasons for ILOE fines in the UAE are that new employees miss the four-month subscription deadline and long-term employees (those who started before October 2023) don't subscribe, often because they don't know they need to. These punishments keep the plan working and make sure people follow it.

An AED 200 fine will be given for not paying ILOE premiums on time after enrolling. If you miss more than three payments in a row, this penalty applies. It cancels your insurance coverage and makes you ineligible for any future benefits.

There are also other, less common, problems with not following the rules. These include giving false information about yourself or your job, however this happens less often now that systems are integrated. A chronic lack of knowledge also plays a role, since some people still don't know that the scheme is required or what will happen if they don't follow it. Lastly, technical problems that happen from time to time can create delays, but employees are usually still responsible for making sure that their subscriptions and payments went through.

How to Avoid or Remove ILOE Penalties

To avoid ILOE fines in the UAE, you need to be diligent about following the rules. Within four months of getting their visa, new employees must have insurance. If you are an established employee and missed a previous date (like October 1, 2023), you should sign up right away to avoid more fines for not paying on time, even if the first AED 400 late fee applies.

Pay your premiums on time, whether it's every month, every three months, every six months, or every year. Set reminders to keep things routine. If you get a fine, use MOHRE ILOE Quick Pay, the official ILOE portal or app, or the Al Hosn app to check what you owe and pay it right away to stay eligible.

Key Differences Between ILOE and Other Insurance Types

Some of the most important differences are:

Activation Event: The only thing that can trigger ILOE is an unexpected, non-blameworthy firing. On the other hand, other types of insurance cover a wide range of situations, such as disease (health), death (life), damage to property (house or car), or serious health problems (critical illness).

Obligatory vs. Choice: ILOE is a requirement for almost all workers in the Emirates that the government has set. Most types of alternative insurance, such extra health, personal life, or critical illness policies, are optional. However, many employers offer basic health care as part of their benefits.

The Involuntary Loss of Employment (ILOE) program gives money in a different way than other insurance benefits:

- ILOE gives people a temporary, partial wage replacement of up to 60% of their base earnings for a limited time, up to three months. This structure is substantially different from:

- Policies like life insurance or critical sickness coverage often pay out in one big lump amount.

- Direct payments for services that are standard in healthcare insurance plans.

Contribution Model: ILOE has fixed, low monthly premiums that are based on wage bands that are collected centrally. Other insurance plans include premiums that change a lot depending on the person's risk characteristics, the degree of coverage they want, and the providers they choose.

ILOE Insurance Impact on Job Security and Unemployment

The ILOE insurance program is changing the way people in the UAE think about job security and unemployment. It adds an important layer of protection, changing the experience for both workers and the economy as a whole.

The ILOE program gives each employee a fresh sense of job security. The prospect of partial income for up to three months after losing a job unexpectedly makes people feel a lot less stressed about money. This new sense of serenity gives people the power to look for jobs strategically, so they may look for jobs that fit their talents and work on their professional development while they are looking for a new job instead of just taking any job out of desperation.

Conclusion

ILOE insurance is a basic building block that supports a confident, stable, and thriving job market for everyone in the Emirates.

The main purpose of the ILOE project is to make society and the economy more stable during times of unemployment. It gives them a necessary financial buffer that helps them pay for living expenses and deal with losing their work more easily. This kind of insurance is different from other sorts since it only protects your personal stability. Other types protect your health, assets, or dependents.

Is ILOE insurance mandatory for everyone?

Most workers in the UAE, including Emiratis and foreigners working in the private, government, and free zone sectors, must sign up for the Involuntary Loss of Employment (ILOE) program. Business owners, domestic staff, those under 18, short-term contract workers, and pensioners who are hired again are all exempt.

What is the meaning of ILOE for expats?

ILOE insurance is a very important safety net for expats in case they lose their work unexpectedly. This makes things a lot less financially unstable, which makes it easier to look for work when you're unemployed.

Can I cancel my ILOE insurance once registered?

Once a person signs up for mandatory ILOE insurance, they can't stop coverage on their own if they are still eligible for work. If you don't pay your premiums for more than three months, your insurance will end, you'll have to pay a fine, and you won't be able to get any benefits in the future. Only when you leave the UAE or move to a job that is not covered by the law do your coverage requirements terminate.

How do I download my ILOE certificate?