If you’ve ever tried to set up a company in Dubai, you’ll know the excitement quickly meets reality: paperwork. The most important piece? A business license in Dubai. It’s not just a stamp from the government — it’s literally what tells you what you’re allowed to do. Pick the wrong one and you’ll hit roadblocks fast. Pick the right one, and suddenly doors open. This guide is here to help you make that choice with confidence.

What Is a Business License in Dubai and Why Is It Important?

Think of a business license as your permission slip to actually operate in Dubai. Without it, you don’t just risk a fine — you literally can’t trade, hire, or even open a bank account.

What makes it so important is that it’s not one-size-fits-all. Your license spells out exactly what you’re allowed to do. Selling products? That’s one track. Offering consultancy? That’s another. Each activity falls under a license category in the UAE, and regulators use this to check whether your business is playing by the rules.

So yes, every company — whether it’s a solo freelancer or a large investor — needs a UAE business license. It’s the foundation everything else rests on.

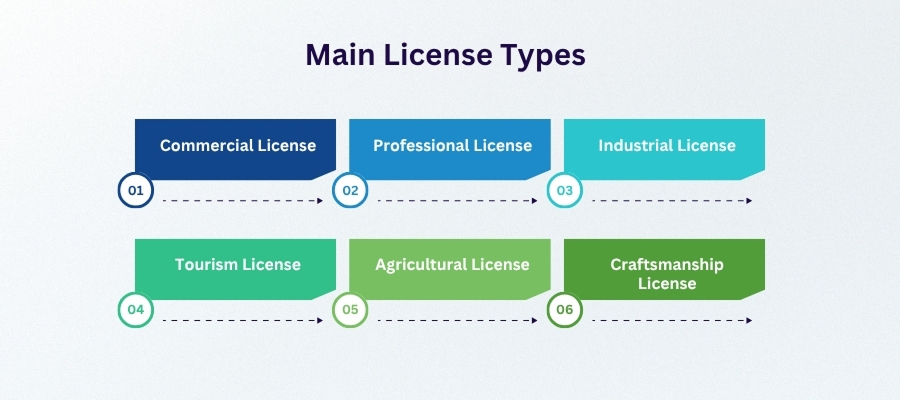

What Are the Main Types of Business Licenses in Dubai?

Here’s the thing: Dubai doesn’t hand out a single all-purpose license. Instead, you’ve got categories — each tied to the kind of work you’re planning to do. That’s why choosing the right one matters. If you pick the wrong box, you’ll waste time and money fixing it later. Let's talk about the most common types of business licenses in Dubai in simple terms.

- Commercial License. This is the most common. If your business is about buying and selling — whether it’s imports, exports, or retail — you’ll need a commercial license in Dubai. Think of trading companies, shops, and distributors.

- Professional License. Are you offering a service that depends on your knowledge or skill? Consultants, IT specialists, educators, designers — this is your lane. A professional license says, “I sell expertise, not products.”

- Industrial License. Making something instead of just selling it? Then you’re in industrial territory. Factories, workshops, and production units all need this. Be prepared for extra approvals, since safety and environmental checks apply.

- Tourism License. Dubai lives on tourism. If you want to run a travel agency, tour operator, or even a hotel, this is the license you’ll be applying for.

- Agricultural License. Farming and fisheries might not be the first thing you think of in Dubai, but they’re here. This license covers agriculture, livestock, and related activities.

- Craftsmanship License. Plumbers, carpenters, electricians — the people who keep things running. If your work is hands-on and skill-driven, this license fits.

Want to learn more about UAE business setup services?

Which Business License in Dubai Suits My Activities?

What kind of license you need depends on what your business does. It's not about guessing; it's about putting your main activity in the right category so you don't have problems later. Here’s a quick guide:

- Choose a commercial license if you trade goods, import, export, or run a retail shop.

- Choose a professional license if your business is based on skills or expertise — consulting, IT, design, marketing, or education.

- Choose an industrial license if you’re manufacturing, assembling, or processing products.

- Choose a tourism license if you manage hotels, tours, or travel services.

- Choose an agricultural license if you’re farming, raising livestock, or fishing.

- Choose a craftsmanship license if your work is hands-on — plumbing, carpentry, electrical.

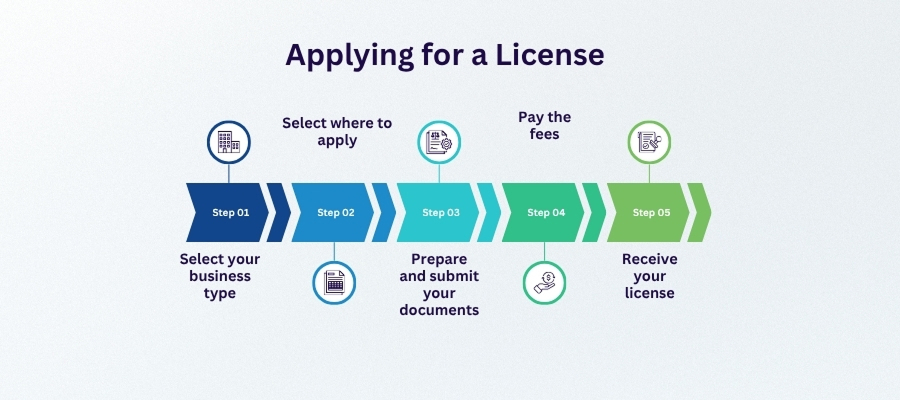

How Do I Apply for a Business License in Dubai?

Getting your license isn’t as overwhelming as it sounds once you know the sequence. Here’s the typical path most companies follow:

- Select your activity. Decide what your business will actually do — trading, consulting, manufacturing, tourism, etc. Your chosen activity determines the license type.

- Choose where to apply. Mainland businesses apply through Dubai’s Department of Economy and Tourism (often called DED). If you prefer a free zone, you’ll apply directly to that authority.

- Prepare and submit documents. Your application form, copies of your passport, a business plan, and sometimes approvals from other regulators are all part of the usual paperwork.

- Pay the fees. Costs differ based on the activity, structure, and jurisdiction.

- Receive your license. Your UAE business license lets you start operations after approval.

How Much Does a Business License in Dubai Cost?

Here’s the part everyone asks about: the price. The truth is, there isn’t a single number. A license might cost closer to AED 10,000 in one setup and nearly double that in another. It all depends on your activity, the jurisdiction, and whether you’re in the mainland or a free zone. Think of it less as a fixed fee and more as an entry ticket — one that varies with your chosen path.

Conclusion

Your business license in Dubai is more than just a piece of paper; it's your ticket to doing business. Pick the right one, and doors open: banks, visas, contracts, growth. Pick the wrong one, and you’ll be fixing problems instead of building your company. Take the time to choose carefully now, and you’ll thank yourself later.

Yes. You can amend your UAE business license, but it means filing paperwork, paying fees, and sometimes getting extra approvals. It’s common, so don’t worry if your business evolves.

Both are considered a UAE trade license, but they work differently. A free zone license usually limits you to that zone, while a mainland license lets you trade across Dubai and the UAE.

Operating outside your license category in the UAE can result in fines or suspension. Changing your license before expanding is smarter.

For some sectors, yes — education, healthcare, and food all need additional clearances from regulators.

Yes. Free zones allow 100% foreign ownership, and most mainland activities do too, though a few sensitive areas still need a partner