Why Choose the RAKEZ Free Zone for Business Setup?

RAKEZ is a free economic zone in the emirate of Ras Al Khaimah, which consistently ranks among the most affordable and practical options for starting a company in the UAE. RAKEZ Free Zone company formation is especially popular among start-up entrepreneurs and international investors due to its favourable regulatory environment, geographic accessibility and industry diversity. Here you can register a company completely remotely; everything can be done online, including video verification and signing documents. RAKEZ offers various types of licences, from consulting to manufacturing, as well as flexible visa packages and several levels of office solutions: from virtual workspaces to warehouses and industrial sites. Registration takes only a few business days, and licence prices are among the most affordable in the region. Thanks to its clear structure, favorable taxation, and government support, RAKEZ Free Zone remains a profitable choice for those who value clearness and efficiency.

About the RAKEZ Free Zone

RAKEZ (Ras Al Khaimah Economic Zone) was officially established in 2017 through the merger of two major entities. Today, it is recognised as one of the UAE’s fastest-growing hubs for RAKEZ business setup. Thanks to strong government support and integration with major logistics infrastructure, RAKEZ Free Zone company formation offers access to over 50 industries and a global network of partners. RAKEZ is integrated into the region's logistics ecosystem, including the Port of Saqr and the future Etihad Rail network, strengthening its position as an industrial and logistics hub.

Business Activities Allowed in RAKEZ Free Zone

RAKEZ company setup enables a wide range of commercial, service, industrial, media, educational, professional and e-commerce activities. Examples include: accounting and bookkeeping services, architectural and aviation consulting, engineering communications, equipment trade and manufacturing, FMCG, publishing, educational services, and e-commerce. Specialised industrial codes are provided for activities such as the production of β-food products, animal feed, metal-based air conditioners, etc. Some activities require pre-approval, especially licensed engineering, educational and health-oriented services. RAKEZ also offers unique codes available only in this zone, including motorcycle clubs, aviation clubs, and proprietary real estate management structures.

Step-by-Step RAKEZ Free Zone Company Formation and Registration

The process of registering a company in the RAKEZ Free Zone is designed so that entrepreneurs can start their businesses quickly and without unnecessary bureaucracy. It all starts with choosing the right type of activity and licence, after which an application is submitted and documents are prepared. It is important to understand the steps involved in order to avoid delays and unnecessary costs. Here is a strict guide to help you better understand the process of opening a company in this free zone.

Required Documents and Timeline

To open a company in the RAKEZ Free Zone, you must provide a minimum but clearly defined set of documents. The standard set includes:

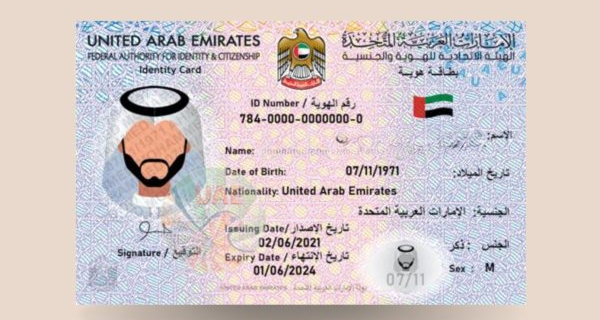

- a copy of the passport of all shareholders and the director;

- a colour passport-size photo;

- proof of residence (utility bill no older than 3 months);

- for non-residents - an entry visa or a copy of the last entry stamp to the UAE;

- if available - a resume or CV of the owner (for some professional licences);

- in the case of a corporate shareholder, a package of constituent documents of the parent company (certificate of incorporation, articles of association, resolution on the establishment of a subsidiary).

The registration process in RKEZ Free Zone takes 3-7 business days, provided that the documents are correctly completed and no pre-approval is required. If preliminary approvals are required (e.g., for educational, medical or engineering services), the time frame may increase to 10-15 business days. RAKEZ also offers an expedited procedure for an additional fee, allowing you to obtain a licence within 1-2 days. All stages can be done remotely, without physical presence in the UAE.

Remote Registration Option

RAKEZ Free Zone offers a convenient option for fully remote company registration, which is particularly relevant for international entrepreneurs. The process begins with the handing in of documents in electronic form - either through an accredited registration agent or directly on the RAKEZ platform.

After preliminary verification of the documents, a video verification of the owner's identity is scheduled (usually via Zoom or a similar service). During the video call, the client confirms their identity, passport details and signatures. This replaces the need for personal presence in the emirate.

The next step is to prepare and sign a set of founding documents. Signing can be done electronically or on paper with subsequent courier delivery. RAKEZ also provides an electronic licence and a digital memorandum of association.

With the help of licensed agents, the client can additionally open a corporate bank account, rent a virtual office, and order visas - also without visiting the UAE.

Thus, the zone provides the most convenient registration format, allowing you to start a business in the RAKEZ Free Zone from anywhere in the world in the shortest possible time.

Want to learn more about UAE business setup services?

Types of Licenses and Costs in RAKEZ Free Zone

Licence types and associated costs are key considerations when choosing the optimal business model within the RAKEZ Free Zone. Each type of licence is determined by the nature of the company's activities (trade, manufacturing, consulting, etc.), and the cost depends on several factors: the type of office included (virtual or physical), the processing time (standard or expedited), the number of employees, and the necessary visas. Below is an overview of the main types of licences with approximate costs to help you make an informed choice.

Visa Packages and Pricing Breakdown

RAKEZ offers flexible packages tailored to different needs, from sole traders to companies with a large workforce. The annual service fee depends on the number of visas, office format (virtual, flexi-desk, standard office) and administrative fees. The main categories are placed below.

- Office type: virtual.

- Visa quotas: 0.

- Annual cost: from AED 11,000 to 14,500.

- Ideal for: companies without employees in the UAE or working remotely.

- Office type: flexi-desk (shared workspace).

- Visa quotas: 1-2.

- Annual cost: from AED 15,000 to 18,500.

- Includes: right to rent a desk, access to coworking space.

- Office type: dedicated office.

- Visa quotas: 3-6.

- Annual cost: from AED 22,000 to 30,000.

- Suitable for: companies with local operations.

- Office type: industrial facility.

- Annual cost: individual, from AED 45,000.

- Additional approvals and technical permits are required.

- E-channel (electronic visa portal) - one-time fee of ~AED 2,500 + annual service fee of ~AED 1,200.

- Residence visa processing - ~AED 3,500–5,000 per person (including medical examination and Emirates ID).

- Additional visas - require an increase in leased space or package.

RAKEZ Free Zone maintains a competitive pricing policy, providing convenient conditions even on a limited budget.

Abu Dhabi Global Market Free Zone Company Formation: Who Should (and Shouldn’t) Choose This Free Zone?

RAKEZ is a universal zone with a broad profile, but like any jurisdiction, it has its own characteristics. Below are brief selection criteria:

RAKEZ Free Zone is suitable for:

- individual entrepreneurs and freelancers;

- online projects and e-commerce;

- international trade;

- manufacturing and logistics companies;

- consulting, education, IT, marketing;

- startups with a limited budget;

RAKEZ Free Zone is not suitable for:

- companies requiring automatic VAT registration (RAKEZ does not provide it by default);

- businesses related to finance, investments, and cryptocurrencies (separate licences outside RAKEZ are required);

- residents from high-risk jurisdictions (Iran, Syria, Afghanistan, etc.) - restrictions on registration and visas may apply;

- organisations requiring representation in Dubai (RAKEZ is located in Ras Al Khaimah);

Thus, the RAKEZ licence is a perfect solution for lots of small and medium-sized businesses, especially those that value cost-effectiveness and flexibility. However, for narrow-profile financial projects or companies focused strictly on the Dubai market, it is better to consider alternative zones.

Conclusion

The RAKEZ Free Economic Zone is a balanced solution for entrepreneurs seeking a combination of favourable conditions, flexibility and a reliable jurisdiction for starting a business in the UAE. Key advantages include full foreign ownership, simple and quick registration, affordable licence fees, a variety of business activities, low taxes, and the option of complete remote processing without the need for a personal visit.

RAKEZ Free Zone company formation is particularly suitable for freelancers, start-ups, small trading and manufacturing companies, as well as international investors who value cost-effectiveness and ease of doing business. The zone offers both virtual offices for online projects and full-fledged warehouses and production facilities for industrial players.

Low entry barriers, an expedited licensing procedure, flexible visa quotas, and government support make RAKEZ Free Zone a competitive alternative to more expensive zones such as DMCC or Dubai South.

If you are considering starting a business in the UAE, the next logical step is to consult with a specialist. Experienced consultants will help you choose the right package, prepare documents and complete the registration process without errors. Expert support minimises risks and ensures legal accuracy at every stage. This is especially important in the context of rapidly changing legislation and growing compliance requirements.

Can I register a company in RAKEZ Free Zone without visiting the UAE?

Yes, RAKEZ provides full remote registration. All stages, from submitting documents to signing statutory papers and obtaining a licence, can be completed online. Video verification is used to confirm identity. The originals are delivered by courier to the client's location. This is convenient for non-residents and owners of remote businesses.

Does the RAKEZ Free Zone offer installment payment options?

Yes, RAKEZ offers the option of paying in instalments through accredited agents. This is usually divided into 2-4 payments per year. Terms and conditions may vary depending on the service package and licence type. This approach is particularly useful for start-ups and small businesses seeking to reduce initial start-up costs.

Can I use RAKEZ Free Zone for trading outside the UAE?

Yes, the RAKEZ Free Zone licence allows international trade, including export and import. Companies can work with foreign partners, conclude contracts and conduct foreign economic activities. However, the zone itself is not subject to VAT, which may require registration as an importer/exporter in another emirate or the opening of a warehouse.

What activities require pre-approval in RAKEZ Free Zone?

Pre-approval is required for areas such as educational and medical services, engineering and architectural consulting, activities related to security, pharmaceuticals and telecommunications. Permits from external agencies or regulatory bodies may also be required, depending on the field.

How does RAKEZ Free Zone compare to other zones like DMCC or IFZA?