Why Choose RAK Free Zone for Business Setup?

Looking for the most affordable free zone for company incorporation in the UAE? If you are considering UAE free zone business setup, RAK Free Zone may be your best choice. This zone offers one of the most favourable combinations of low cost, remote registration, flexible business conditions and a wide range of activities.

RAKEZ is ideal for aspiring entrepreneurs, freelancers, start-ups, international investors and those who plan to develop their business with minimal costs. The peculiarity of the zone is that you can register your company remotely, without travelling to the UAE, and the process takes 3 to 5 working days.

RAKEZ company formation is a strategic solution for those looking to minimize costs and maximize flexibility. Flexible visa packages, access to warehousing and production facilities, ready-made infrastructure and support at every stage make this zone one of the most attractive for small and medium-sized businesses.

About RAK Free Zone

RAK Free Zone appeared in 2000 by Emir's decree and has been operating as a single economic zone since 2017, bringing together RAK FTZ and RAKIA Investment Agency. It is a government project aimed at business and industry development and integration with regional and global markets. RAK is positioned as one of the UAE's largest industrial hubs with a variety of specialised parks: business, industrial, technology and education. Thanks to its advantageous location, proximity to ports, airport and major transport corridors, it is integrated into the emirate's major logistics centre. Today, the zone brings together more than 14,000 companies from 50 sectors, continuing to strengthen its position in the UAE territory.

Business Activities Allowed in RAK Free Zone

The registration of companies in the RAK Free Zone opens a wide range of activities:

- industry (manufacturing, food, chemical, pharmaceutical, etc.);

- trade (import-export, e-commerce, wholesale);

- services (consulting, IT, finance, healthcare, education);

- logistics and warehousing, media activities (publishing, broadcasting, PR).

Some types require prior approvals (No Objection Certificate) from third bodies - for example, clinics need authorisation from the Ministry of Health, legal and audit services are classified as DNFBP and require established approvals.

In addition, specialities such as the manufacture of specialised equipment (fastening structures, industrial cranes and others like that) are exclusively available here. Also, companies can combine up to two activities on one industrial or service licence.

Want to learn more about UAE business setup services?

Step-by-Step RAK Free Zone Company Formation and Registration

Opening a company in the RAK Free Zone is a simplified and affordable process that can be done remotely. The zone offers fast registration times, minimal requirements and flexible business conditions. The step-by-step procedure allows entrepreneurs to start operations in the UAE without unnecessary bureaucracy.

Required Documents and Timeline

To register a company in the RAK Free Zone, you need to prepare a basic package of documents. The standard list includes:

- Copy of the foreign passport of the founder, the director, and all participants.

- A passport-size photograph.

- Proof of residence address, for example, a copy of the last utility bill or bank statement (not older than three months).

- If the applicant is already in the UAE, a copy of an entry stamp or visa will be required.

- In some cases, prior authorisations (NOC) for regulated activities.

- If a company with a physical office is to be established, additional documents may be required to prove the lease of the premises.

The process of company registration in the RAK Free Zone is quite fast. It usually takes 3 to 5 working days from the moment of submission of the full set of documents to the receipt of the licence. If prior approval is required (for example, for medical, educational or legal services), the period may increase to 10-15 working days.

Importantly, many stages can be completed remotely, including the application and signing of documents, which makes registration as convenient as possible for foreign investors.

Remote Registration Option

RAK Free Zone company set up can be done remotely. This makes the registration procedure attractive for foreign entrepreneurs. Personal presence in the UAE is not required at the stage of filing documents and obtaining a licence. The entire process can be completed online with the help of accredited registration agents or directly through the RAKEZ portal.

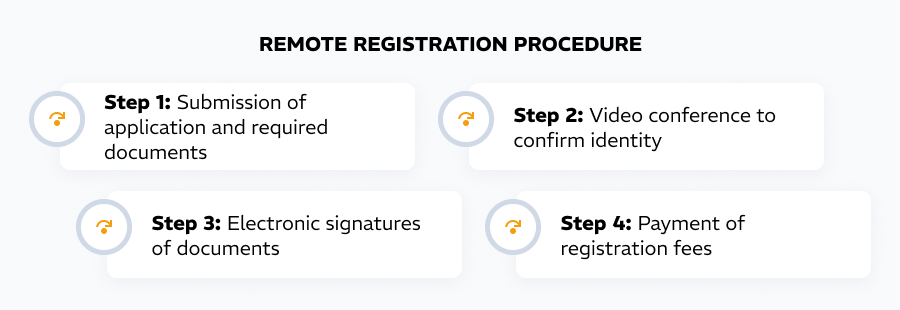

The first step is to submit the application and required documents electronically. After preliminary verification, a video conference is scheduled to confirm the identity. As part of this step, RAKEZ representatives conduct online verification of the applicant's passport and identity. This procedure replaces the need to submit documents in person and ensures the legal validity of remote registration.

After successful verification, the contract and the company's statutory documents are signed electronically. Payment of registration fees is also made remotely, via bank transfer or online payments.

The completed licence, incorporation documents and lease agreement (if an office or warehouse is selected) are sent digitally to the client's email. The originals, if necessary, can be sent by international courier service.

This format allows you to launch a business in the UAE as quickly as possible and without travelling to the country, which is especially valuable for start-ups and international investors.

Types of Licenses and Costs in RAK Free Zone

Various types of licences are available in the RAK Free Economic Zone, suitable for different types of businesses. Entrepreneurs can choose from: trade licence (for wholesale, retail and export-import trade), service licence (for professional and consulting services), industrial licence (for manufacturing and warehousing activities), as well as educational, media and freelance licences.

Each type of licence covers a certain range of business activities and has its own specific features. The cost of the licence depends on the chosen activity, the type of office and the number of visa quotas. RAKEZ offers some of the most affordable rates in the UAE, which makes the zone attractive for small and medium-sized businesses.

Visa Packages and Pricing Breakdown

RAK Free Zone (RAKEZ) has a variety of visa packages available, allowing you to choose the best variant depending on your business needs.

- The basic Zero Visa Package with Flexi-desk workstation costs approximately AED 6,000-7,000 per year and is suitable for entrepreneurs who do not plan to obtain a UAE resident visa.

- A Single-visa Flexi-desk Package costs an average of 12,000-13,000 AED per year, with immigration registration (e-channel), medical examinations and Emirates ID included.

- Dual-visa packages start from AED 18,000 per year, with the cost increasing for each additional visa thereafter.

For businesses with an extended team, packages with three to six visas are available. For example, a three-visa package costs around AED 22,000 and a six-visa package costs around AED 32,000 per year.

If the plan is to conduct trading activities under the General Trading Licence, the annual cost is from AED 37,000 with one visa.

In addition, the cost of e-channel deposit (about 5,000 AED, refundable on company closure) and annual costs for visa renewal, medical examination (about 1,500-2,000 AED per person) should be considered.

RAK Free Zone Company Formation: Who Should (and Shouldn’t) Choose This Free Zone?

RAK Free Zone is a great solution for many entrepreneurs, but it is not for everyone.

It is suitable for:

- Freelancers, consultants, and startups - due to low rates and the ability to work via a Flexi-desk without having to rent an office.

- Small and medium-sized trading companies - the zone offers affordable General Trading licences with the possibility of remote management.

- Manufacturing and warehousing companies - RAKEZ offers large industrial space and logistics opportunities with proximity to seaports.

- International investors are not planning an active physical presence in the UAE.

It is not suitable for:

- Companies operating in high-risk jurisdictions or owners from restricted countries (e.g. Syria, Iran, North Korea) as registration may be rejected.

- Businesses that need fast VAT registration - RAKEZ does not provide a simplified procedure for obtaining a VAT number, this is done separately through the federal tax office.

- Large companies with a mandatory physical office in Dubai or Abu Dhabi - logistics and business connections may be less convenient.

- Financial and insurance organisations - such licences are not supported in the RAK Free Zone.

The RAKEZ Free Zone business setup is ideal for those looking for an affordable, flexible, and fast start-up solution.

Conclusion

RAKEZ company formation is the best choice for entrepreneurs who want to start a business in the UAE quickly, remotely and cost-effectively. The zone offers some of the lowest prices for licences, flexible visa packages and a wide range of business activities. Freelancers, consultants, trading and manufacturing companies, as well as international investors who want to serve clients around the globe, are comfortable here. RAK remote company registration makes business setup accessible from anywhere in the world.

If you plan to work remotely, deliver goods abroad or use warehouse and production facilities in the UAE, RAKEZ provides all conditions for this. Company registration is maximally simplified and avoids complicated bureaucracy.

Ready to launch your business in RAKEZ? Contact our consultants right now. We will help you choose the right package, prepare documents and organise registration without mistakes. Professional support will save you time, ensure full compliance and allow you to focus on company development.

Can I register a company in RAK Free Zone without visiting the UAE?

Yes, remote company registration in the RAK Free Zone is possible. Personal presence is not required. The procedure includes online submission of documents, payment via bank transfer and a video conference to confirm identity. The licence and registration documents are provided electronically, which is convenient for foreign entrepreneurs.

Does RAK Free Zone offer installment payment options?

Yes, RAKEZ provides the option of instalment payments for the licence. This is usually available through accredited business consultants or when applying through official representatives. The annual cost of the licence can be divided into several instalments, which makes starting a business more financially affordable for small and medium-sized enterprises.

Can I use a RAK license for trading outside the UAE?

Yes, the licence obtained from RAK Free Zone allows international trade without restrictions. The company can import and export goods outside the UAE. However, it will require either a distributor or registration in the mainland with a local licence to deal with customers within the country.

What activities require pre-approval in the RAK Free Zone?

Some activities in the RAKEZ require prior approvals. This applies to medical, educational, legal, financial and some production areas. For example, clinics must obtain a permit from the Ministry of Health and educational centres must be accredited by the relevant authorities. Such approvals increase the registration period.

How does RAK compare to other zones like DMCC or IFZA?