Opening a personal bank account in Dubai is a convenient way to safely manage your finances in one of the largest financial centers of the world. In this article we will look at what types of accounts are available, what documents are required, and what advantages a personal account with a UAE bank offers.

What Is a Personal Bank Account?

A personal bank account is the most familiar and convenient tool for managing personal finances. Such an account is opened for an individual and is used for everyday needs: receiving salaries, keeping savings, paying for purchases, rent, utilities and other expenses.

There are two main types of personal accounts available in the UAE: for residents and for non-residents. A resident account is opened for people who have a UAE residence visa. This option is the simplest and gives full access to all banking products: debit and credit cards, online banking, the ability to take out loans and mortgages.

Non-resident account is available for foreign citizens who do not have a UAE visa. Conditions here are stricter, usually open only savings accounts with a minimum set of services, and banks require to maintain a higher balance on the account. But even such an account allows you to make international transfers, store funds in a reliable financial system and use multi-currency services.

It is important to realize that business and offshore accounts are a completely different format; they are designed for companies, not for personal use. A personal account is about you and your money, not about business.

Who Can Open a Personal Account in the UAE?

Both residents and non-residents can open a personal bank account in the UAE, but the requirements for different categories of clients differ significantly. First of all, banks take into account the legal status of the applicant, his citizenship, as well as the source of income and the purpose of opening an account.

UAE residents with a valid UAE residence visa and Emirates ID can open a personal account without special restrictions. Usually banks require proof of address, an income certificate or employment contract, and an initial deposit (minimum balance depends on the bank).

Image caption: Emirates ID

Non-residents, i.e., foreign citizens without a UAE visa, can also open an account, but with certain conditions. Most often, only a savings account with limited functionality is available. A non-resident will need to present a passport, proof of address abroad, and, in some cases, a letter of recommendation from another bank or a certificate of income. Some banks may request justification of the funds origin.

Citizens from countries under international sanctions or “high-risk” jurisdictions are usually rejected. There are no national restrictions for most countries, but banks always conduct thorough customer due diligence in accordance with AML/KYC policies.

Required Documents to Open Dubai Personal Bank Account

To open a personal bank account in Dubai, a client needs to prepare a standard package of documents. The specific list depends on the status - resident or non-resident - and the type of account.

For residents of the UAE are usually required:

- passport with a valid residence visa in UAE;

- Emirates ID (resident identification card);

- proof of address (e.g. rental agreement, utility bill not older than 3 months);

- employment contract or certificate of employment (in case of a salary account);

- bank statements for last 3-6 months (upon request).

For non-residents usually required:

- passport;

- proof of residence address abroad (utility bill or bank statement);

- letter of recommendation from the current servicing bank (not always);

- account statements for last 3-6 months;

- sometimes, requires a brief description of activities or source of income.

Banks may request additional documents, especially if the client opens an account with large amounts of money or plans to conduct international transactions. For corporate clients, the company's founding documents, licenses and ownership structure are required. It is better to check the full list with a particular bank, as requirements vary.

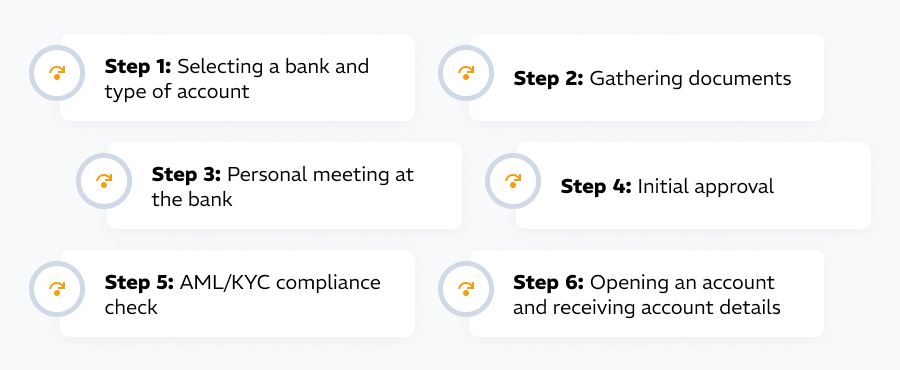

Step-by-Step Process to Open a Personal Account in Dubai

The process of opening a personal bank account in Dubai involves several consecutive steps. It is important to keep in mind, that most banks require the personal presence of the client, especially at the application and identity verification stage.

The main steps are:

- Selecting a bank and type of account. Determine whether you need a resident or non-resident account and select a bank with suitable terms and conditions.

- Gathering documents. Prepare the necessary package: passport, Emirates ID, proof of address, income certificates and bank statements.

- Personal meeting at the bank. It is necessary to visit the bank to submit the application and undergo identification. In some cases, it is possible to apply through an authorized agent, but banks increasingly require personal attendance.

- Initial approval. The bank checks the documents and conducts a preliminary assessment of the client. This stage takes from a few days to 2 weeks.

- AML/KYC compliance check. The bank conducts a comprehensive check of the origin of funds, business reputation and legal status.

- Opening an account and receiving account details. Once approved, you receive account details, access to online banking and, if necessary, bank cards.

The time to open an account is usually between 7 and 15 working days.

Personal Maintenance Cost and Minimum Balance

Opening and maintaining a personal bank account in Dubai involves certain financial obligations. The main ones are minimum balance requirements and possible service fees.

- Emirates NBD sets a minimum monthly balance of AED 3,000 to AED 5,000. For premium Executive Accounts, the minimum balance is AED 100,000

- FAB’s Super Saver account does not require a minimum balance. For standard current accounts is AED 3,000.

- Abu Dhabi Commercial Bank (ADCB) offers Super Saver accounts with no minimum balance. For other standard accounts, it starts from AED 10,000, depending on the account type.

- Citibank UAE requires a minimum balance of AED 35,000 for basic checking accounts.

If the account balance falls below the minimum balance, the bank charges a penalty. This is usually 25-100 AED per month (Emirates NBD, ADCB). Some banks provide a grace period with no penalty at the start (FAB).

Many banks do not charge a standard service fee if the minimum balance is met. Otherwise, a monthly fee of AED 25-50 may apply.

For non-residents the conditions are usually stricter, with a higher minimum balance and stricter financial monitoring. It is important to check the terms and conditions with the selected bank in advance, as they vary significantly.

Want to learn more about UAE business setup services?

Benefits and Limitations of a UAE Personal Account

Opening a personal bank account in the UAE gives the client a number of significant advantages, but it is important to take into account the existing restrictions, especially for non-residents.

Advantages:

- Multi-currency. Accounts in Dubai support several currencies, including AED, USD, EUR which is convenient for international transactions.

- International transfers. Fast and reliable SWIFT transfers worldwide.

- Bank Cards. Access to debit and, for residents, credit cards with flexible terms.

- Privacy. The UAE has a high level of banking secrecy and protection of personal data.

- Developed banking infrastructure. Convenient internet and mobile banking, wide range of banking products.

Restrictions:

- Non-residents generally cannot obtain checkbooks, credit cards or mortgages.

- Minimum balances are higher for non-residents, and source-of-income checks are stricter.

- Some banks refuse to open accounts for citizens of “high-risk” countries.

- Offshore accounts are subject to particularly strict financial controls and require additional supporting documents.

Terms and conditions vary depending on the selected bank, so it is recommended to compare them carefully before applying.

How We Help with Opening a Personal Bank Account

Opening a personal bank account in Dubai can be a complicated process without professional support. Banks in the UAE have strict document requirements and often impose internal restrictions that are difficult to know about in advance. This is where the help of an experienced consultant becomes a key success factor.

How we help:

- We analyze your situation and select a bank with suitable conditions and real probability of opening an account.

- We help optimize the application to meet the bank’s requirements.

- We help you to prepare a financial resume, proof of source of income and correctly prepare certificates.

- We organize meetings with bank representatives and accompany you at all stages. In some cases remote submission of documents through our representative is possible.

- We advise on AML/KYC requirements and help you pass internal checks.

- We provide post-opening support: assistance with internet banking, account setup and communication with the bank in case of difficulties.

We know the internal procedures of UAE banks and can save you time, reduce the likelihood of rejection and ensure full compliance with local requirements.

Conclusion

Opening a personal bank account in the UAE is a smart solution for those who value financial stability, international flexibility and privacy. Dubai's leading banks offer convenient tools for managing personal finances, access to multi-currency transactions, reliable online and mobile platforms and the ability to make international transfers with minimal fees.

The UAE's high degree of personal data protection and stable financial system make the country particularly attractive to both residents and expatriates. Even for non-residents with the right preparation, it is possible to open an account and gain access to quality banking services.

A personal account in the UAE is also useful for international business, investment diversification and comfortable personal wealth management. The process may seem complicated, but with professional support, it becomes much easier and safer.

If you want to open a personal account in the UAE quickly and without unnecessary complications, contact our consultants. We will help you go through all the steps confidently and efficiently.

Can I open a personal account in the UAE remotely?

Opening a personal bank account in the UAE remotely is challenging. Most banks require the applicant’s personal presence for identity verification and document submission. Some private banks may allow remote opening for high-net-worth individuals, but standard accounts typically require at least one in-person visit.

What is the minimum deposit to open a personal bank account?

The minimum deposit depends on the bank and account type. For residents, it usually starts from AED 3,000 to AED 5,000. For non-residents, banks often require a minimum balance between AED 25,000 and AED 100,000. Premium or private accounts may have significantly higher deposit requirements.

How long does it take to open a personal bank account in the UAE?

Opening a personal bank account in Dubai typically takes 7 to 15 working days for residents. For non-residents, the process may extend to several weeks due to stricter compliance checks. Timelines depend on the bank, completeness of documents, and the complexity of the applicant’s financial profile.

What banks work best for personal accounts?