If you want Dubai energy without Dubai chaos, Jumeirah Lakes Towers (JLT) Free Zone hits a sweet spot. Four lakes, walkable blocks, cafés you’ll actually use, and the tram humming outside—then upstairs, real companies doing real work. Managed by DMCC, it’s a government-backed ecosystem where JLT freezone company formation is fast, transparent, and built for scale.

You keep 100% ownership. You can start lean—flexi-desk today, private office when the team arrives—and complete most steps remotely with guided verification. Bank account? Easier with a JLT Free Zone business setup because banks know the address and the regulator. Activities span consulting, trading, tech, media, and more; add visas as your space allowance grows.

This isn’t a mailbox free zone. It’s a credible Dubai base with rules that are clear, fees that make sense, and a location your clients recognize. If you’re serious about Jumeirah Lakes Towers (JLT) Free Zone business setup, this is where the plan turns into a company.

Why Choose Jumeirah Lakes Towers (JLT) for Business Setup?

Starting a company in Dubai comes with choices—but Jumeirah Lakes Towers (JLT) Free Zone stands out for a reason. It gives you the Dubai address without the inflated downtown costs, the professional credibility without the bureaucracy, and the skyline view without the headache. Managed by Dubai Multi Commodities Centre (DMCC), JLT is one of the UAE’s most established and internationally recognized free zones. It sits right off Sheikh Zayed Road, minutes from Dubai Marina, surrounded by over 80 residential and commercial towers that double as office and living space.

The free zone is famous for its business-friendly formation process—clear timelines, digital documentation, and helpful account managers who actually answer emails. You can complete your JLT company setup remotely, including passport verification and e-signature submission. For many founders, it’s the perfect balance between prestige and practicality. Whether you’re testing the market or scaling globally, JLT gives you room to grow—start with a shared desk, move into a fitted office later, and expand your license as you add activities.

From tax advantages to solid governance, the JLT Free Zone business setup experience feels predictable, efficient, and modern—qualities not every jurisdiction can claim.

About Jumeirah Lakes Towers (JLT)

Created in 2002 under the Dubai Multi Commodities Centre Authority, JLT was originally designed as a hub for global trade—especially in gold, diamonds, and other commodities. Over time, it evolved into a full-spectrum business ecosystem attracting more than 20,000 registered companies. Its government backing gives it a layer of credibility that banks, investors, and partners recognize instantly.

Today, JLT is one of Dubai’s most active mixed-use developments, combining offices, residences, dining, and retail. It’s not just a zone on paper—it’s a real neighborhood. Entrepreneurs often choose JLT because it blends lifestyle and commerce in one address: you can walk from your office to a meeting, a gym, or a coffee shop in minutes.

Want to learn more about UAE business setup services?

Business Activities Allowed in Jumeirah Lakes Towers (JLT)

Think broad, then go broader. In Jumeirah Lakes Towers (JLT) you can set up to trade goods, advise clients, build software, run a marketing studio, manage logistics, or handle corporate support functions—without jumping between regulators. Because JLT is run by DMCC, it also caters to niche plays like precious metals and certain virtual-asset services that need tighter oversight.

Some lines of work—gold and diamonds, fintech, food import/export, regulated advisory—come with extra checks and pre-approvals. That’s normal here, and the steps are clear once you know the sequence.

The structure is flexible: pick a license that matches your core activity, then add related activities as you grow (within the permitted categories). Net result? You don’t just get a Dubai postcode—you get a serious platform to operate, scale, and be taken seriously.

Step-by-Step Jumeirah Lakes Towers (JLT) Freezone Company Formation and Registration

Setting up in Jumeirah Lakes Towers (JLT) Free Zone feels less like paperwork and more like a well-rehearsed routine. The system is built to be clear: apply online, submit your documents, get your initial approval, and you’re already halfway to a trade license. Everything runs through DMCC’s digital portal, which means you can form your company from anywhere—laptop, tablet, or phone.

The process starts with choosing a company type (usually an FZ-LLC or a branch), selecting your business activity, and confirming your office or flexi-desk package. Once your application is submitted, you receive a preliminary approval. The next step is signing the incorporation documents—either digitally or in person—after which DMCC issues your trade license, and your company becomes fully operational.

The entire timeline, if your documents are in order, typically takes seven to ten business days. For a Dubai free zone that hosts thousands of active businesses, that’s remarkably efficient.

Required Documents and Timeline

You don’t need to overthink the paperwork. DMCC asks only for what matters:

- A clear passport copy of each shareholder and manager

- Proof of residential address (usually a recent utility bill or tenancy contract)

- A passport-size photo in color

- Entry visa or UAE residence page, if you already have one

- Basic business plan or short description of intended activity

Corporate shareholders add a few extras, like a certificate of incorporation and a board resolution approving the new entity. Once submitted, the free zone reviews everything and may request a quick clarification or signature update.

From start to license, expect roughly one to two weeks, depending on response times and pre-approvals. You can open a bank account right after receiving your trade license—banks are familiar with JLT Free Zone companies, so the process is straightforward.

Remote Registration Option

One of JLT’s strongest draws is that you don’t have to be in Dubai to start. The remote registration route lets investors complete the full setup from abroad through digital channels. Identity verification happens via video call or authorized agent verification, and documents are e-signed through DMCC’s secure platform.

That means no embassy attestation, no courier shuffle, and no travel bills. You can form your JLT freezone company while sitting in your home office—then fly in only when you’re ready to activate visas or meet your bank manager. It’s fast, legitimate, and designed for the way business works today.

Types of Licenses and Costs in Jumeirah Lakes Towers (JLT) Freezone

The Jumeirah Lakes Towers (JLT) Free Zone works on a simple principle — one license, endless potential. You choose the license that reflects what you actually do, not a vague category you need to bend around later. The free zone issues four main types:

- Service License – for consulting, advisory, and professional services.

- Trading License – for import, export, distribution, or re-export of goods.

- Industrial License – for light manufacturing, packaging, or assembly.

- eCommerce License – for online retail and digital platform operations.

Each comes with the same backbone of benefits: 100% foreign ownership, zero customs duties inside the zone, and easy license upgrades when you expand.

The company setup cost in JLT starts at around AED 12,500–15,000 for a single-owner, flexi-desk package, including initial registration and license issuance. Costs rise with added visas, physical offices, or multiple business activities, but the pricing remains competitive for a central Dubai location. Annual renewals are usually in the same range, with minimal hidden fees — a refreshing difference from older free zones.

Visa Packages and Pricing Breakdown

Every office or flexi-desk in JLT Free Zone comes with a visa quota tied to workspace size. A flexi-desk setup typically includes one visa, while a small serviced office may grant two or three.

Here’s the general idea:

- 1 visa + flexi-desk: from AED 12,500–15,000/year

- 2 visas + shared office: from AED 18,000–22,000/year

- 3 visas + private office: from AED 25,000–30,000/year

Visa processing itself costs extra — roughly AED 3,500–5,000 per person, depending on medicals and Emirates ID. There’s also an e-channel registration fee (around AED 1,200) that covers your company’s immigration access.

All told, JLT freezone company formation stays transparent: you know what you’re paying for, and you can scale the setup without penalties when your team grows.

Jumeirah Lakes Towers (JLT) Corporate Tax, VAT, and Duties

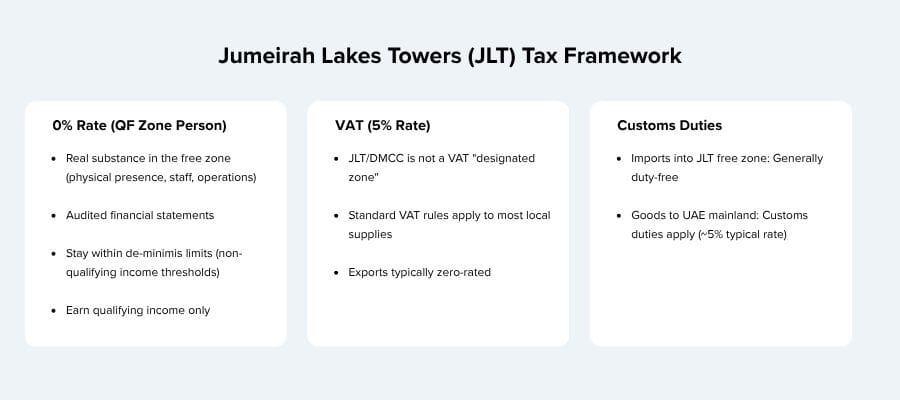

Here’s the tax picture in plain English. If your JLT company qualifies as a Qualifying Free Zone Person, your qualifying income can be taxed at 0%. To keep that status you need real substance in the free zone, proper books (audited), and to stay within the regime’s rules (including the de-minimis limits). Step outside those lines—or earn non-qualifying income—and the standard 9% UAE corporate tax kicks in. Trade directly with the mainland? Expect that revenue to be in the 9% bucket unless structured correctly.

VAT is 5% across the UAE. You must register once taxable supplies hit AED 375,000 in a 12-month period (voluntary registration is possible from AED 187,500). DMCC/JLT isn’t a VAT “designated zone,” so normal VAT rules apply to most local supplies.

On customs, imports into the free zone are generally duty-free. Move goods into the UAE mainland and customs duties (often ~5%) may apply.

This is where we help. Consulting.ae sets up your tax registrations, reviews your activity mix, aligns your ESR/audit timelines, and keeps your JLT freezone company fully compliant—while protecting every incentive you’re entitled to.

Jumeirah Lakes Towers (JLT) Company Formation: Who Should (and Shouldn’t) Choose This Free Zone?

Choose JLT if you want: a serious Dubai address, bankable credibility, and a setup that scales. It’s a sweet spot for consultants, boutique agencies, tech studios, traders, and freelancers who plan to grow. If you operate in commodities or certain virtual-asset activities (where licensed under DMCC rules), JLT’s ecosystem makes life easier. You’ll appreciate the workspace ladder too—flexi-desk now, private office later, visas added as your quota increases.

Think twice if you need: heavy manufacturing, large warehouses, or the absolute cheapest license on the market. Northern-emirate zones often win on bare price. Expect tighter compliance: proper bookkeeping, audits, ESR, and—where relevant—KYC/AML. Some high-risk nationalities may face longer approvals. If you don’t need Dubai credibility, JLT freezone company formation may be more than you need.

Conclusion

Setting up in Jumeirah Lakes Towers (JLT) Free Zone means choosing a place that blends Dubai’s prestige with practical business sense. You get real infrastructure, not a token office; credibility with banks and clients; and a setup process you can finish from anywhere. It’s built for consultants, traders, digital founders, and global entrepreneurs who want a stable, future-proof base.

If you value transparency, location, and long-term growth over bargain-basement packages, JLT delivers. Need help turning that idea into a registered company? Contact Consulting.ae — our team can handle the paperwork while you focus on building the business.

Yes. JLT freezone setup is fully remote via DMCC’s portal with video verification and e-signatures.

Often, yes. DMCC/JLT sometimes provides split or installment payments—package-dependent.

Yes. A JLT business license supports international trade; UAE mainland trading needs a local partner/structure.

Gold/diamonds, crypto/virtual assets, finance, and food import/export typically need DMCC or authority pre-approvals.