What Is an ICV Certificate in the UAE and Why Is It Important?

An ICV (In-Country Value) certificate is a document that assigns your company an ICV score based on how much of your business activity happens inside the UAE. It is not a license and it is not a marketing badge. It is a measurable profile that many buyers use when they compare suppliers, especially in structured procurement.

So, in a nutshell, what is an ICV certificate in UAE in practical terms? As a result, you can consolidate all of your company's data and financial statements into a single figure that accurately represents local contribution. That number can include areas such as UAE-based spending (with local suppliers), employment and payroll in the country, and other UAE-linked operational factors. The ICV certificate meaning is straightforward: it shows, in a format procurement teams can quickly assess, how “local” your business footprint really is.

Why does this matter? Obtaining an ICV certificate UAE is common practice in the bidding process, and it has an impact on evaluations beyond merely compliance in many instances. A higher ICV score can help you rank higher in the event that two bids are nearly identical in terms of price and technical scope. Even when a tender does not state “mandatory,” the reality is that companies with an ICV score are frequently easier to shortlist, especially for long-term frameworks and supplier rosters.

For manufacturers, contractors, service providers, and SMEs working in Abu Dhabi or ICV certificate Dubai procurement environments, the certificate becomes part of how your company is judged—alongside capability, experience, and cost.

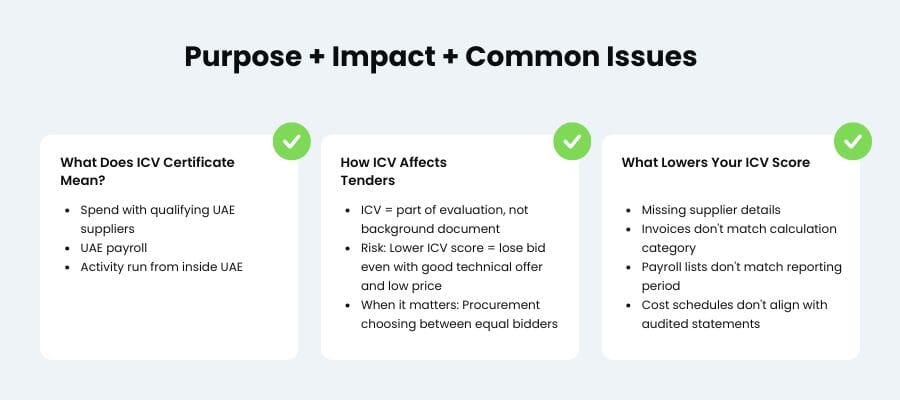

What Does an ICV Certificate Mean for Companies in the UAE?

An ICV certificate gives buyers a quick way to judge how “in-country” your company really is. Instead of reading pages about your business model, procurement teams get a score that comes from your audited figures and supporting records. It reflects things like your spend with qualifying UAE suppliers, your UAE payroll, and how much of your activity is actually run from inside the country.

This is where the effect becomes very real. In a lot of bids, ICV is not seen as a background document. It is part of the review. If another provider has a better ICV score, you could still lose even if you have a good technical offer and a low price. When procurement has a list of bidders who can all deliver, ICV is one of the best ways for them to decide who is the best.

You can also see the meaning of the In-Country Value certificate in your own actions. Among the deficiencies that are brought to light are supplier details that are missing, invoices that do not back up the calculation category, payroll lists that do not correspond with the reporting period, and cost schedules that do not neatly match up with the audited statements. These won't show up during verification, but they might not impact your day-to-day life. While these problems may not always halt issuance, they have the ability to subtly lower the score. Upon issuance of the certificate, purchasers utilize the printed score.

A ICV certificate UAE assists SMEs and startups in translating local efforts into something procurement can score. For established organizations, it becomes part of the planning process—supplier selection, employment plans, and how you structure UAE operations all have an impact on competition, not just internal efficiency.

Who Needs an ICV Certificate in the UAE?

When ICV scoring is part of the choice, you usually need an ICV certificate if your sales plan includes tenders or supplier lists. This happens a lot in the UAE, even with service businesses. You might need to show an ICV if you sell goods, do maintenance, offer professional services, handle projects, or act as a distributor and your customer has a formal procurement policy. Such a request may be made as soon as the policy is implemented. Additionally, it is important if you want to pre-qualify early, before a tender opens, and demonstrate to procurement teams that you are capable of being examined without delays within the organization.

The trigger is the buyer’s process, not your company size. A startup can be asked for ICV. A foreign-owned firm can be asked for ICV. The certificate is tied to a defined reporting period, so it must be kept current. Once you understand what an ICV certificate is in UAE, you see why “we’re small” or “we’re new” does not help in tendering.

ICV Certificate for Government and Semi-Government Tenders

In government and semi-government tenders, an ICV certificate UAE is often treated as a standard submission item. Some tenders state it as a requirement. Others incorporate it into the scoring model, thereby providing bidders with a certificate and higher score a competitive advantage during evaluation.

This matters when bids are close. If your technical offer meets the spec and your price is competitive, the ICV score can move your offer up or down the ranking. It can also affect shortlisting for framework agreements and approved vendor rosters.

The quality of the data is important. If your certificate is based on records that are missing or on spend and payroll that are labeled incorrectly, the score might be lower than it should be, which can cost you points.

Want to learn more about UAE business setup services?

ICV Certificate for Private Sector and ADNOC-Related Contracts

In private-sector procurement, ICV is not universal, but it is increasingly requested in sectors that mirror public procurement. ADNOC and many companies in its supply chain use ICV actively when they assess suppliers, contractors, and service providers.

If you aim for ADNOC-related work, expect ICV to appear in vendor registration, tender documentation, and sometimes in ongoing compliance checks. Many large groups also compare ICV scores even when they do not label it “mandatory,” especially when choosing between similar suppliers.

The ICV certificate is a sign of ready for companies that want to get more contracts. When a buyer asks for ICV as part of the business decision, you can protect your score, react quickly, and avoid making mistakes at the last minute.

How to Get ICV Certificate in the UAE: Step-by-Step Process

If you want to understand how to get an In-Country Value certificate in UAE, it helps to look at it as a controlled assessment rather than a registration form. The ICV certificate is issued based on verified financial data, not declarations. That is why preparation matters more than speed.

Picking the right financial period is the first step in the procedure. The audited financial statements for a whole fiscal year are used to figure out an ICV certificate. You can't use management accounts or draft numbers. Your numbers need to already be there, be closed, and be consistent with each other.

Next comes data structuring. Costs, payroll, and supplier spend need to be classified correctly between local and non-local elements. This step is where many companies lose ICV points without realizing it. If the UAE-based vendor does not meet the criteria set out by the ICV, then the purchase will not be considered local spend.

Once the financials are ready, the information is reviewed and formatted according to the ICV template. Only after this internal preparation should the file move forward. Rushing directly to submission is a common reason for weak scores.

A practical checklist for how to get ICV certificate in UAE:

- Close the books for the selected period and complete the audit

- Separate local vs non-local spend, payroll, and operating costs correctly

- Prepare the ICV calculation and supporting schedules

- Submit everything to an approved certifying body for verification

- Receive the certificate showing your ICV score and how long it’s valid

Less time spent fixing mistakes, waiting, and losing points is achieved with this methodical approach. Time is of the essence if you intend to submit a bid soon; in most cases, a certificate that is either out of date or contains wrong information is considered equivalent to none at all.

If you want to avoid score leakage or rework, Consulting.ae can review your eligibility, prepare the data correctly, and manage the ICV process end to end.

ICV Certificate Application and Approved Certifying Bodies

ICV is not a legal condition for all companies in the UAE. But as soon as you get into tenders, looking mainly at government, semi-government, or ADNOC-related ones, an ICV certificate is usually seen as part of the review. If you plan on buying, it's better to have it ready ahead of time than to try to rush it later.

The certification body checks your score, not your score. Their job is to make sure that the numbers are in line with the method and that there is proof to back them up. Before they get the certificate, they may ask for more information or explanation if data is missing or not clear.

MoIAT and ADNOC oversee the ICV structure, including the framework, calculation logic, and list of recognized certification bodies. In reality, this implies you should avoid "almost correct" paperwork because the issued score will not alter unless you repeat the process.

Understanding this structure will help you manage your goals. The award shows what your business has already accomplished. The process works best when people get ready to submit before they check their work.

ICV Certificate Requirements and Eligibility Criteria

The foundation of the ICV certificate requirements is proof. You won't receive a legitimate ICV certificate unless your employer can verify the figures.

A complete fiscal year's worth of audited financial documents is required to kick things off. "We can explain it later" files, management reports, and draft accounts are not compatible with ICV. The calculation is based on verified numbers and is backed up by schedules that show payroll, running costs, and supplier spending in a way that can be verified.

A lot of people can apply. Small and medium-sized businesses (SMEs) and firms owned by people from other countries can qualify. A newer company can still qualify if it has a closed year and a good audit. What counts is whether your records make it easy to tell the difference between things that are related to the UAE and everything else. If your file is missing invoices, has unclear supplier information, or has incomplete payroll information, it is hard to verify, which can lead to delays, questions, or an ICV score that doesn't show your true activities.

Also, being eligible is not the same as doing well. The paperwork is solely needed to issue the certificate. The score you get depends on what your business does now, such where you buy things, where you recruit people, and how you keep track of your costs.

Common Mistakes and ICV Certificate Rejection Risks

The formula itself is not usually the cause of problems with an ICV license. They come from the way the info is made ready and shown. One of the most common errors is turning in financial data that seems full but can't be linked to statements that have been audited. When the numbers don't match, certification groups stop or push the file back.

Misclassification is a very important issue. For ICV reasons, companies in the UAE usually label invoices as "local" without checking if the supplier is actually local. Payroll also has problems when lists of headcount, work locations, or contract information are not neat. You may still get the certificate, but the score generally goes down.

Timing is another risk. An expired certificate, or one issued for the wrong financial year, is usually treated as invalid during tender evaluation. In that case, the outcome is the same as not having an ICV at all.

The main point is clear: rejection and losing points frequently happen because of things that might have been avoided, not because of the ICV framework itself.

Want to learn more about UAE business setup services?

How Consulting.ae Helps You Obtain an ICV Certificate Correctly

Getting an ICV certificate right is mostly about preparation, not submission. That is where Consulting.ae comes in. We start by looking at your business as it actually operates, not as it is described in templates. This allows us to confirm early whether you are eligible and which financial period should be used.

Before any numbers are sent to be checked, our work starts. We go over your audited accounts, look at payroll and prices, and check supplier information to make sure that both local and non-local parts are properly classified according to ICV rules. Just doing this step usually stops you from losing points for no reason.

Consulting.ae also takes care of the process's hands-on part. We make the ICV calculation file, make sure it matches with the official way, and work with the approved certifying bodies directly. We answer verification questions with supporting reasons, not quick fixes.

The result is not just a certificate, but a defensible score. You avoid rework, delays, and surprises during tender evaluation. If your goal is to use the ICV certificate UAE in live bids, our role is to make sure it reflects your business accurately and stands up to scrutiny.

ICV is not necessary for all businesses in the UAE, however it is frequently requested in tenders and supplier evaluations. In many circumstances, not possessing an ICV certificate UAE has a direct impact on eligibility and scoring. If you intend to bid, it is safer to regard ICV as a practical condition.

Any company supplying goods or services to government, semi-government, or ADNOC-related entities may need an ICV certificate. This applies to manufacturers, service providers, contractors, and distributors. If structured procurement is part of your market, ICV usually follows.

To comprehend the process of obtaining an ICV certificate, begin with the audited financial statements for a completed fiscal year. Supporting schedules for payroll and supplier expenditure are also necessary. Accurate and verifiable records facilitate a more efficient process.

An ICV certificate is valid for 14 months from the date of issuance. A fresh certificate must thereafter be issued utilizing updated financial data. It is always advisable to plan for renewal prior to the issuance of tenders.