The UAE's Involuntary Loss of Employment (ILOE) insurance program is an important safety net that helps workers who suddenly lose their jobs.

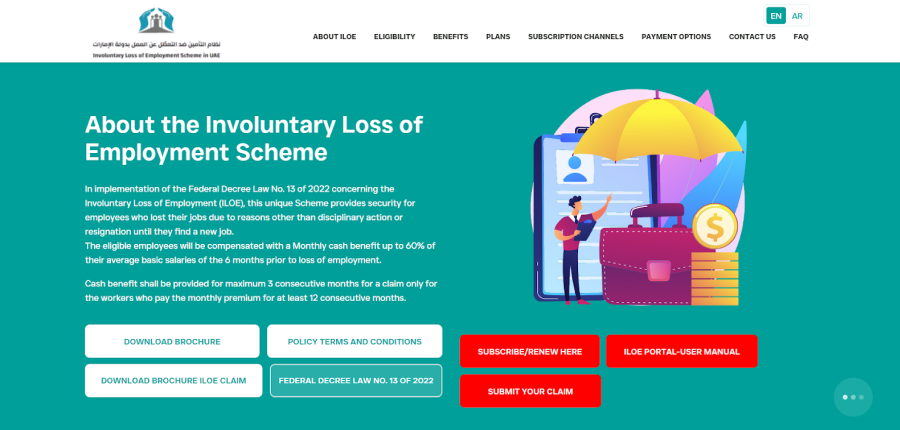

Federal Decree Law No. 13 of 2022 made this mandatory unemployment insurance scheme possible. Its goal is to protect workers' financial security and make the UAE job market more appealing.

This complete tutorial will teach you all you need to know how to pay ILOE insurance

in the UAE, from the basics of the scheme to how to use online payment gateways and solve typical problems.

What Is ILOE Insurance and Who Needs to Pay It

The ILOE insurance is an important part of the UAE's social security system that makes sure people who are looking for new jobs have a respectful transition period.

Overview of the ILOE Scheme

The ILOE system works on a simple idea: employees pay a modest amount each month, and in return, they get monthly cash payments if they lose their employment without their will and meet certain requirements.

This payment is usually 60% of their average basic wage from the last six months of work, and each claim can only be paid out for three months. The goal is to help pay for basic needs while the person looks for a new job.

The plan puts workers into two primary groups based on their base pay:

- Category A: For workers who make AED 16,000 or less a year. The monthly premium is AED 5 (plus VAT).

- Category B: For workers who make more than AED 16,000 a month. The monthly premium is AED 10 (plus VAT).

To get paid, a person must have been a member of the plan and paid their premiums on time for at least 12 months in a row before they lost their employment.

People who lose their jobs must file claims within 30 days, and the claims must not be based on false information or voluntary resignation or disciplinary dismissal.

Who Is Obligated to Make ILOE Payments in the UAE

The ILOE insurance plan is required by law for almost all private-sector and federal government workers in the UAE, whether they are Emirati or not. This covers workers in most free zones, but some, like the DIFC, may have their own rules. You probably have to sign up if you have a valid work permit and are paid in the UAE.

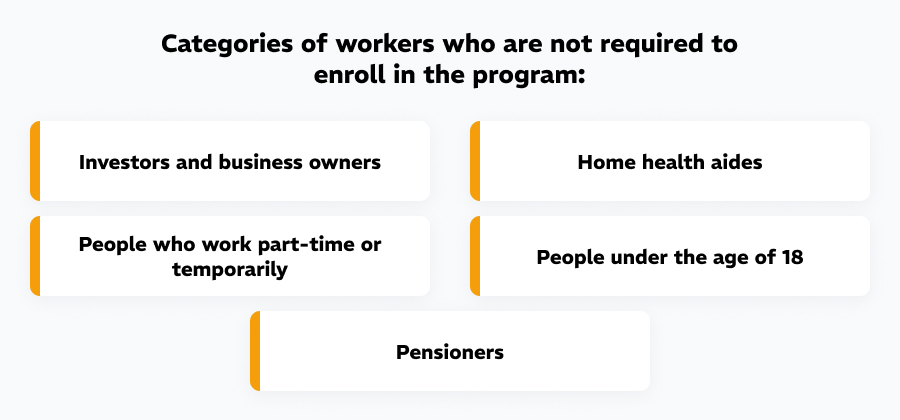

However, several types of workers don't have to sign up for the program:

- Investors and business owners who own and run their own businesses (i.e., partners or owners who don't work for someone else).

- Helpers around the house, such maids, nannies, and drivers.

- People who work part-time or on a temporary basis (those with short-term work permits).

- People who are less than 18 years old.

- Retirees who already get a pension and have started a new career.

You must subscribe to all other regular jobs, whether they are full-time or part-time, as long as you have an active employment visa or labor card (unless you are in one of the excluded categories).

Penalties for Non-Payment of ILOE Insurance

Not following the ILOE program might lead to big fines. The Ministry of Human Resources and Emiratisation (MOHRE) makes sure that everyone follows the rules by being very severe.

- Not subscribing: Employees who don't sign up for the ILOE policy before the deadline will have to pay a fee of AED 400.

- Late premium payments: If you don't pay your premiums within 90 days of when they are due, your insurance certificate will be canceled and you will have to pay a fine of AED 200.

These sanctions are meant to keep the scheme honest and make sure that as many people as possible take part. To avoid these penalties and stay eligible for future claims, it's very important to stay compliant.

When and How Often Do You Need to Pay ILOE Insurance

To prevent penalties and make sure you always have coverage, you need to know the payment cycles and deadlines.

ILOE Payment Cycles and Deadlines

The ILOE plan lets you choose how often you want to pay your premiums. You can pay your premiums:

- Every month.

- Every three months.

- Every six months.

- Every year.

The most important deadline to keep in mind is the 90-day grace period for late payments. If premiums are not paid within this time frame after they are due, the insurance policy will be canceled and a fee of AED 200 will be imposed.

ILOE Insurance Renewal and Payment Frequency

Most ILOE policies last for one or two years. As the end of your existing policy approaches, you will normally get a reminder message to renew. To avoid any gaps in coverage, it's best to start the renewal process at least a month before the end of the current policy.

You can choose how often you want to pay again when you renew (monthly, quarterly, semi-annually, or annually). Some platforms may let you pay once for a two-year renewal, which can make things easier and make sure you have coverage for a longer time.

To get paid in the future, you need to keep your subscription going and pay your premiums on schedule. If you've already filed a claim and gotten the full benefit (3 months of payments), your policy can be canceled. You would then have to re-subscribe, find a new job, and make another 12 months of contributions before you could make another claim.

How to Pay ILOE Insurance Online

The UAE government has made it very easy to pay ILOE insurance premiums online. This is usually the quickest and best way to do it.

Using the Official ILOE Portal for Insurance Payment

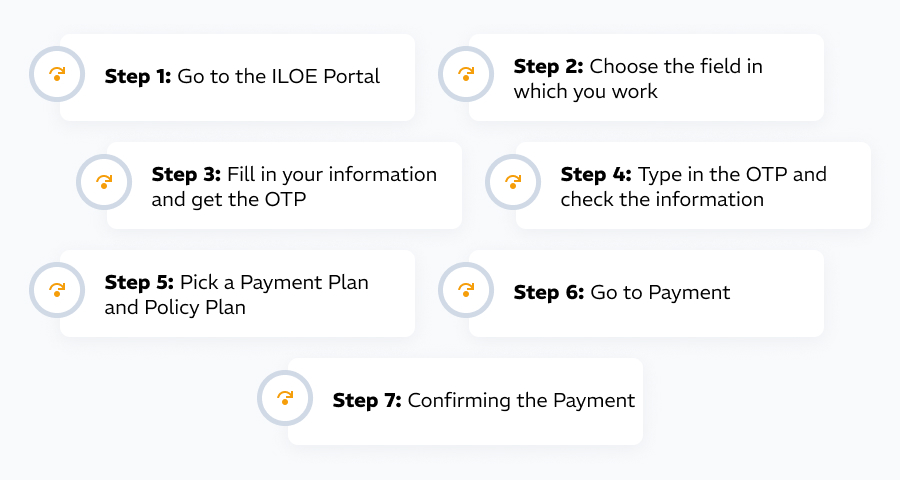

Instructions:

- Go to www.iloe.ae to see the official ILOE website.

- Choose your job category.

- Get and enter the OTP.

- Check your personal information.

- Choose how long your policy will last and how often you want to pay.

- Go to the payment page.

- Pay in full.

- Get a confirmation.

ILOE Insurance Quick Pay Option

The MOHRE ILOE Quick Pay facility is made just for quickly checking and paying fines that are connected to the ILOE system. Some platforms may also add quick pay alternatives for premiums, although most of the time it's only for fines.

This is how to utilize MOHRE ILOE Quick Pay to pay fines (the same steps may work for premiums if they are available):

- You can get to the MOHRE ILOE Quick Pay website by going to the MOHRE app or the website.

- Choose how to identify yourself: Emirates ID (EIDA), Unified Number (UID), Labor Card Number, or Person Code.

- Enter your ID number and the date that is relevant to you. Depending on how you want to do it, you may need to enter your birth date or the day it was issued.

- Click "Search" to see your ILOE compliance status and any fines that are still due.

- Check for fines: If there are any, the amount, due date, and reason for the fine will be given.

- Give your contact information: Type in your email address and mobile phone number.

- To pay, click the "Pay" button to go to the secure payment platform.

- Finish the payment: Use a credit or debit card, a mobile wallet, or one of the various payment alternatives that are available.

This quick pay option makes sure that your debts are paid on time, which helps you avoid more fines and keep your benefits.

Step-by-Step Instructions with Screenshots

-

Step 1: Go to the ILOE Portal

- Type www.iloe.ae into your web browser.

-

Step 2: Choose the field in which you work

- When you click "Subscribe/Renew Here," a new page or pop-up will open up and ask you to pick your sector.

-

Step 3: Fill in your information and get the OTP

- You will be asked to type in your Emirates ID number and the mobile number you used to sign up.

-

Step 4: Type in the OTP and check the information

- Look for a text message on your phone with a One-Time Password.

-

Step 5: Pick a Payment Plan and Policy Plan

- You will be able to choose how long the policy will last (for example, one year or two years) and how often you will have to pay (monthly, quarterly, semi-annually, or annually).

-

Step 6: Go to Payment

- Make sure your choice is correct and click "Proceed to Payment" or "Pay Now."

-

Step 7: Confirming the Payment

- When you pay successfully, a notification will appear on the screen to let you know.

How to Pay ILOE Insurance Fines

If you have been fined for not subscribing or paying your premiums on time, you need to pay them right away to avoid more problems and stay in compliance.

ILOE Insurance Fine Pay Methods and Platforms

Fines may mostly be paid through official online channels, which makes the process easy:

- Official ILOE Portal: This portal is mostly for subscriptions and renewals, although it may also link to or redirect to ways to pay fines.

- ILOE Quick Pay on the MOHRE website: This is a special service for checking and paying ILOE fines.

- MOHRE Smart App: The Ministry of Human Resources and Emiratisation (MOHRE) has a smart app that features a special section for paying fines.

- Authorized Service facilities: Some service facilities that the government has approved, such Tasheel and Tawjeeh, also let people pay their fines.

- Exchange facilities: Some authorized exchange facilities, like Al Ansari Exchange, could help you pay your ILOE penalties.

How to Pay ILOE Insurance Fine via Smart App or ICP

How to pay ILOE fines is a prevalent question we encounter in our consultancy practice.

You may easily manage a number of labor-related services using the MOHRE Smart App, such as paying ILOE fines. The ICP (Identity and Citizenship Portal) is mostly for fines relating to immigration and residence. However, sometimes services that are linked to one other may let you verify or pay fines related to personal identifying documents. The MOHRE channels are the most direct way to pay ILOE fines.

- You may get the MOHRE UAE app from the iOS and Android app stores.

- Log in: Use your UAE Pass or Emirates ID information to go in safely.

- Go to "Services" or "Insurance Services" and look for a section about ILOE or unemployment insurance.

- Choose either "ILOE Quick Pay" or "Pay Violations." The names may be a little different.

- Put in your identifying information, which is usually your Emirates ID number.

- Look for fines: The app will show you any fines that are still outstanding on your ID.

- Choose which fine(s) you want to pay: Pick the fine(s) you want to pay.

- Go ahead and pay: Use a credit or debit card to pay safely.

- Paying using the MOHRE website (ILOE Quick Pay—this is usually the same method as what was said before):

- Go to the MOHRE website at www.mohre.gov.ae.

- Click on "Services" and then "ILOE Quick Pay."

- You can use your Emirates ID, Unified Number, Labor Card Number, or Personal Code to identify yourself.

- Fill all the relevant information and click "Search."

- Look at the fines and choose the ones you want.

- Go to the payment gateway and finish the deal.

What to Do If You Missed the Deadline

If you've missed the deadline for paying for a membership or premium and have been fined, you need to act quickly:

- Check the fine.

- Pay the fine right away.

- Re-subscribe or start paying again.

- Installment plans.

- Get in touch with support.

Where to Pay ILOE Insurance Offline

We strongly advocate online payment methods because they are so easy, but there are also offline choices for individuals who want or need them.

- Al Ansari Exchange branches.

- Kiosk Machines.

- Business Service facilities.

- ATMs at banks.

- Banking Apps (even though they are commonly thought of as online).

These offline choices make it easier for people who may not have simple access to online payment methods or who prefer to do business in person.

Common Issues with ILOE Insurance Payment

The ILOE payment system is mostly easy to use, however some people may have problems with it. Knowing how to deal with issues can save you time and money.

Transaction Failure or Payment Not Reflected

There are several things that can cause payments to fail or not show up:

- Your credit or debit card number, expiration date, and CVV may be wrong.

- Not enough money

- Bank security blocks

- Problems with Internet connectivity

- System clitches

- Not updating your passport or work permit information

What to do:

- Check your bank statement to see if the money was taken out of your account.

- Wait and check again.

- Get in touch with your bank.

- Update your personal information.

Incomplete Registration Causing Payment Errors

Mistakes in payments might also happen if the first registration is not complete or is wrong. For example, if the government system doesn't correctly link or update your Emirates ID, unified ID, or labor card number, it can make it hard to make a payment.

What you should do:

- Check your registration status.

- Make sure the data is consistent.

- Go to a typing facility.

- Get in touch with ILOE/MOHRE support and tell them about the problem.

How to Contact Support for Payment Disputes

If you have problems with payments, conflicts, or need more information, you should contact the appropriate support channels:

- ILOE Call Center

- Contact Support: if you have a question or a problem that needs proof, you can contact claims@iloe.ae.

- MOHRE Customer Happiness Centers

- Official ILOE Portal/App

When you call assistance, be ready to provide them your Emirates ID, policy number, transaction details, and any error messages or screenshots that will help them fix your problem quickly.

Conclusion

The ILOE insurance plan is an important part of employee well-being in the UAE since it helps people financially when they lose their jobs unexpectedly.

Employees can make sure they follow the rules and keep this important safety net by knowing who needs to pay, when and how frequently payments are due, and the several ways to pay online and offline.

Online payments are really convenient, but it's just as vital to be aware of any problems like failed transactions or data errors and know how to get help from established support channels. By carefully keeping track of your ILOE payments, you help protect your financial stability and follow the spirit of the UAE's progressive labor laws.