Planning to obtain a DUNS number in the UAE? Start with the basics. D-U-N-S is a nine-digit identifier issued by Dun & Bradstreet that pins a company to a single, verified record. It doesn’t replace your trade licence or VAT, but it gives buyers, banks, and platforms a clean way to recognise you across borders.

In practice, the number shows up at moments that matter: supplier onboarding, government tender portals, enterprise procurement, marketplace registrations, and Apple’s organisation verification for developer accounts. Free zones and banks also use D-U-N-S data during KYC checks because it’s structured, consistent, and widely recognised.

Why would a UAE business bother? Credibility and speed. A verified profile means fewer back-and-forth emails about who owns what, whether the address is current, or if the entity is active. Your legal name, ownership, and contact details sit in one place and can be checked in minutes.

The process to apply for DUNS in the UAE is straightforward: submit core company details, respond to a brief verification call or email, then receive the number once D&B confirms the record. Keep it updated and it keeps paying you back — smoother onboarding, cleaner due diligence, and a profile that travels well globally.

DUNS Number in the UAE and Its Significance

In today’s global economy, recognition matters as much as registration. A trade licence shows that your company exists — a D-U-N-S number shows that the world can trust it. For UAE-based businesses, this nine-digit identifier has become an invisible credential that travels across borders faster than any document could.

It’s not mandatory by law, but it’s becoming unavoidable in practice. Tech giants like Apple, Amazon, and Google require a valid D-U-N-S for marketplace sellers, app developers, and global vendors. Banks, procurement departments, and government portals also use it as part of their verification chain. If your company has ambitions beyond the Emirates, obtaining a DUNS number for business in Dubai is more than an administrative formality — it’s a credibility marker that tells the world you’re real, active, and verified.

A Global Language of Business

Globally, the D-U-N-S system acts as a shared language between corporations, financial institutions, and regulators. A business in Dubai that holds an active profile can be cross-checked instantly by a partner in Singapore, a supplier in Germany, or an investor in the U.S. Each lookup shows ownership details, address history, and financial standing drawn from Dun & Bradstreet’s database.

That’s why the DUNS number for UAE companies isn’t simply another record — it’s a universal handshake. It helps foreign partners confirm who they’re dealing with, speeding up agreements, reducing fraud risk, and building trust without extra paperwork.

Want to learn more about UAE business setup services?

Legal and Investment Perspective

From an investment standpoint, a DUNS registration in the UAE adds a layer of global transparency that the local trade licence alone cannot provide. It aggregates verified data — such as corporate structure, directors, and branch affiliations — into a single internationally recognised file. This is critical for investors, compliance officers, and government procurement units.

UAE free zones and federal authorities use the D-U-N-S system for due diligence and DUNS number verification during new company approvals or expansions. It aligns with the Emirates’ push toward transparency, AML (anti-money laundering) standards, and data-driven compliance.

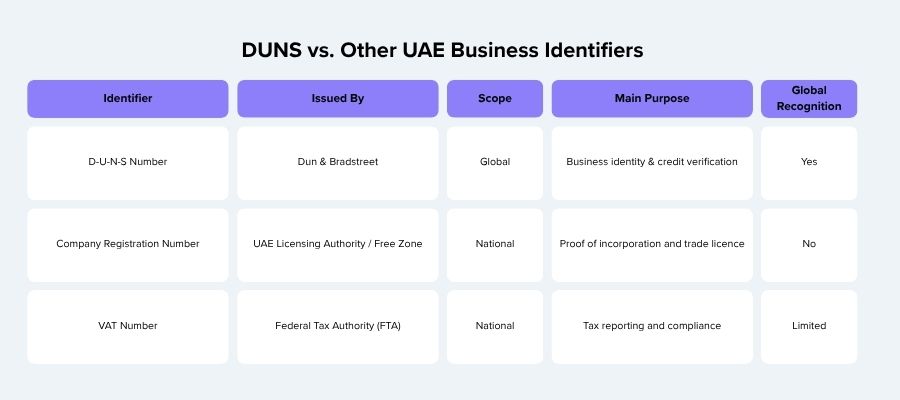

DUNS vs. Other UAE Business Identifiers

In essence, a D-U-N-S number does what the others can’t — it makes your UAE company visible, verifiable, and trusted worldwide.

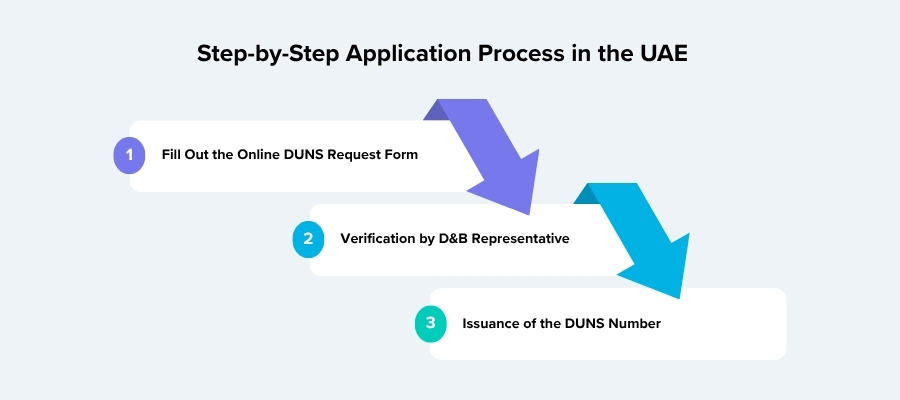

Step-by-Step Application Process in the UAE

Getting a DUNS number in the UAE isn’t complicated, but it does reward accuracy and patience. The process is standard across most Emirates, yet the route you choose — direct or through a consultant — can change how quickly your application moves. Businesses can apply through the official Dun & Bradstreet (D&B) portal, via select UAE free zone authorities that integrate D-U-N-S requests, or through authorised corporate service providers familiar with the system.

Get the important things together before you start: a valid business licence, contact information for the company, information on who owns the business, and the actual office address. The data you give will be used to make or check your global record, which is D&B's digital identity for your business.

Step 1. Fill Out the Online DUNS Request Form

Visit the D&B website or your free zone’s digital services platform. Choose the option to apply for DUNS UAE and complete the online form. You’ll need to enter legal company details exactly as they appear on your trade licence. Errors or spelling inconsistencies can delay processing. Attach supporting documents if requested — most often a copy of the licence or establishment card.

Step 2. Verification by D&B Representative

After submission, your file goes into the D-U-N-S registration process. A Dun & Bradstreet representative will contact you, usually by phone or email, to confirm the data and verify key points such as ownership, address, and business activity. This step ensures that your entity’s record doesn’t duplicate an existing one. If you already have a D-U-N-S file under a previous name or location, D&B may update it instead of creating a new profile.

Step 3. Issuance of the DUNS Number

Once verification is complete, D&B assigns your unique nine-digit identifier. You’ll receive a confirmation email containing your official number and instructions for accessing your DUNS file UAE online. From that point, your company becomes searchable in the global database and can use the number in tenders, supplier applications, or developer registrations.

Typical Time and Assistance Options

The average timeframe for DUNS registration in the UAE is around 20 to 30 business days. However, using a licensed intermediary or business setup consultant can shorten the process, as they communicate directly with D&B and ensure all documents meet the required standards. For larger groups or foreign investors handling multiple entities, this support can save weeks and prevent rejections due to mismatched details.

In short, the application is simple, but precision matters — one clear form, one accurate record, and your UAE company is globally recognised.

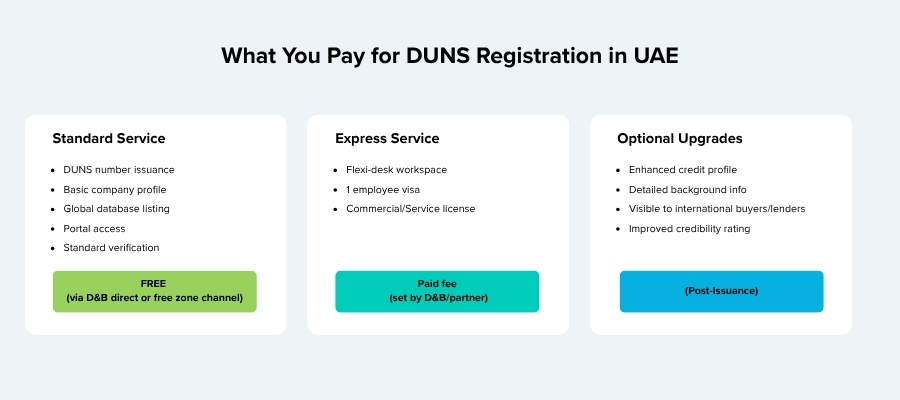

Timelines, Fees, and Additional Services

Getting a DUNS number in the UAE is not an overnight process, but it’s predictable. The standard timeline sits at around 30 business days from submission to approval. That period includes D&B’s internal verification, cross-checking existing records, and confirming ownership. If your company already exists in their global system, the process can be shorter — they simply update the data and reissue confirmation. New entities or complex ownership chains take longer.

Standard vs Expedited Processing

The cost of DUNS registration in the UAE depends on how fast you want it delivered. The standard service is typically free when applying directly through D&B or a free zone channel, though processing follows the normal timeline. If you need the number sooner — for example, to complete a tender application or verify an Apple Developer account — you can request an Express service, which prioritises your file for faster handling. This option usually carries a paid fee, set individually by Dun & Bradstreet or their local partner.

Optional Upgrades and Business Tools

Once your company’s profile is active, D&B offers additional tools that go beyond the basic identifier. The D-U-N-SFile™ service lets you maintain a detailed credit and background profile visible to international buyers and lenders. The Credit Builder package allows you to add financial statements, payment history, and references to strengthen your credibility rating. These upgrades are optional but useful if your UAE company works with banks, suppliers, or government clients that rely on D&B scoring.

In short, the timeline for DUNS registration UAE is fixed, but the value can scale with the extras. Whether you wait the full month or opt for express handling, the result — a verified global business identity — remains the same.

Want to learn more about UAE business setup services?

After Issuance — Managing and Updating DUNS Information

Receiving your DUNS number in the UAE isn’t the final step — it’s the start of an ongoing record that lives alongside your business. Once Dun & Bradstreet approves your registration, your company becomes part of its international database. That means you can be found, checked, and evaluated by potential partners, banks, and procurement teams worldwide. To make that visibility work in your favour, your profile needs to stay accurate and up to date.

Accessing and Managing Your DUNS Profile

After issuance, D&B sends login details to access your company’s record through their online portal. Inside, you’ll find your DUNS file UAE, which lists your registered name, address, ownership, business activities, and credit summary. You can view how your business appears to others and request updates or corrections if something looks off. It’s a living record, not a one-time certificate.

Updating Data and Linking Entities

If your company moves offices, changes trade names, or shifts ownership, update those details through the D&B portal or your local representative. The system allows you to request edits, upload new licences, and verify new information. For larger corporate groups, it’s also possible to link multiple entities — for example, connecting your mainland company with its Dubai free zone subsidiary under the same DUNS number for UAE companies. This linkage builds a transparent ownership tree and strengthens your overall credit profile.

Why Keeping It Current Matters

Accurate data helps more than compliance — it impacts your reputation. Many banks, free zones, and tender committees rely on D-U-N-S records to verify a company’s standing before signing contracts. A stale or inconsistent profile can delay approvals or raise red flags during due diligence. Keeping your DUNS record current ensures your company is seen as active, transparent, and financially reliable.

Everyday Uses of a D-U-N-S Number

Businesses use their D-U-N-S across everyday operations — to join government tenders, pass supplier verifications, undergo credit checks, or register for the Apple Developer ID. Whether your goal is international trade or smoother procurement within the UAE, maintaining your D-U-N-S data is what keeps those doors open — and keeps your company visible where it counts.

Conclusion

If you work with serious partners, they’ll ask for proof, not promises. Obtaining a DUNS number in the UAE gives you that proof in one clean ID. Banks, marketplaces, and tender portals know it and trust it. You show the number; they can verify your company in minutes.

The flow is simple, but details matter. DUNS registration UAE moves fast when names, addresses, and ownership line up. If you’re busy or have branches and past name changes, let a pro apply for DUNS UAE and keep the file tight from the start.

Contact our specialists to obtain your DUNS number in the UAE quickly and without errors. We handle the full process — from document preparation to profile activation.

It’s your global ID. Partners, banks, marketplaces, and tender portals use it to verify a company’s identity and basic credit profile. That’s why many buyers ask for a DUNS number for UAE companies up front.

No. It isn’t a legal must for every licence. But it’s often required in practice—think large supplier onboarding, some free zone procedures, and platforms like Apple or Amazon.

Plan on roughly 30 business days from a clean submission. Updates to an existing record can be quicker; complex ownership or mismatched data can take longer.

Yes. With your authorisation, a consultant can apply for DUNS UAE, prepare the file, handle queries, and reduce back-and-forth.

VAT is for taxation inside the UAE. A DUNS number for business in Dubai is for global identification and risk/compliance checks—used by banks, corporates, and procurement teams.