Imagine retiring in the warm sunshine, in a country with a high level of security, no income tax and modern comforts for living. A retirement visa in the UAE gives you access to high-quality healthcare, prestigious real estate, and world-class infrastructure. It's an opportunity not just to move, but to start a new chapter in your life in one of the most stable and developed regions in the world. Find out how much it costs and how to go through the application process.

Why Apply for a Retirement Visa in Dubai?

A retirement visa in Dubai is a unique opportunity to spend your well-deserved retirement years in one of the safest and most comfortable regions in the world, maintaining your accustomed standard of living and obtaining official residency rights. This status allows you not only to enjoy the mild climate and modern infrastructure, but also to take advantage of the country's zero personal income tax.

Retirement visa keepers have access to a high-quality healthcare system, prestigious residential complexes and a wide selection of properties to buy or rent. At the same time, Dubai offers a developed social and cultural setting, with many opportunities for an active lifestyle, travel and leisure.

Resident legal status opens the door to banking services, long-term contracts and the opportunity to engage in investment activities, for example, in real estate or financial instruments. A flexible visa policy allows you to invite family members to join you, creating comfortable conditions for living together.

Thus, a retirement visa in Dubai is not just the right to live in the UAE, but a strategic choice in favour of stability, high quality of life and financial independence against the backdrop of a favourable economic and tax environment.

Step-by-Step Guide to Getting a Retirement Visa

The step-by-step guide to obtaining a retirement visa in Dubai begins with checking that you meet the basic requirements: age 55 or older, proven income or savings, and ownership of real estate (when selecting the appropriate category).

- Prepare your documents. You will need to submit your passport, photographs, proof of income or assets, property documents, and medical insurance. All papers must be translated into English or Arabic and certified.

- Submitting an application. The application is submitted through government platforms such as ICP (Federal Authority for Identity, Citizenship, Customs and Port Security) or GDRFA (General Directorate of Residency and Foreigners Affairs - Dubai). It is possible to apply online through the e-channel or through licensed service centres.

- Medical examination. After preliminary approval, you must undergo a medical examination at accredited clinics in Dubai.

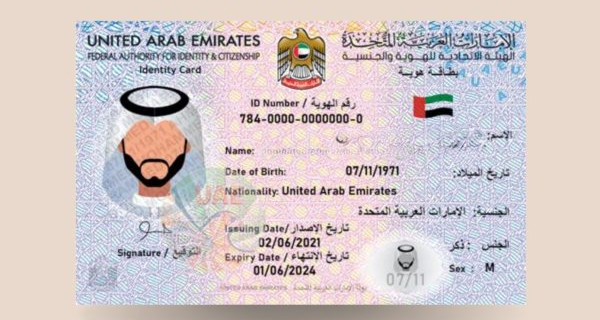

- Obtaining an Emirates ID. After the visa is approved, a resident identity card is issued at ICP or GDRFA offices.

- Completion of the process. Payment of government fees, activation of the visa in the passport and registration with the e-channel for subsequent renewal.

If necessary, you can engage specialised companies that will take care of the preparation and submission of documents, which is especially convenient when applying for the first time.

Eligibility Criteria for Dubai Retirement Work Visa

The criteria for obtaining a retirement visa in Dubai are designed to ensure the applicant's financial stability and ability to independently cover the costs of living in the UAE. The main requirement is that the applicant must be at least 55 years old at the time of application. Also, if the person has working experience for at least 15 years inside or outside the UAE, they can apply for the visa.

There are several categories that can be used to confirm eligibility for a visa:

- Having savings in a bank account in the required amount (usually AED 1 million or more).

- Proof of a solid income not lower than the established threshold (usually from AED 15,000 per month) from a pension, investments, property rental or other legal sources.

- Valid medical insurance covering services in the UAE is required.

Employment, freelancing, remote business or active entrepreneurial activity are not mandatory but are permitted if they comply with the country's legislation. The main thing is to confirm financial independence and compliance with all the conditions of the migration authorities.

Want to learn more about UAE business setup services?

UAE Retirement Visa: Required Documents

You need to prepare a set of documents confirming your identity, financial solvency, and compliance with the established criteria if you want to apply for a retirement visa in the UAE. The following materials are usually requested:

- A copy of the applicant's passport.

- A copy of your current visa page or entry stamp.

- A passport-sized photo on a white background.

- Proof of income - pension statements, rental agreements, investment reports or other documents confirming your monthly income.

- Bank statement for the last 6 - 12 months confirming the movement of funds and the availability of savings.

- Real estate documents (when applying under the property ownership category).

- Medical insurance valid in the UAE and covering basic medical services.

- Emirates ID application.

- NOC - if necessary, if the applicant previously had a sponsor in the UAE.

Depending on the emirate and the method of application (through ICP, GDRFA or an agency), the list may vary slightly. But still, these are the list of docs that you’ll definitely need. All documents must be in English or Arabic and, if necessary, notarised.

Retirement Visa Cost and Validity

The cost of a retirement visa in the UAE depends on the emirate, the method of application (independently or through an agency) and the selected category of processing. On average, the costs include:

- State fee for submitting an application - from AED 3,000 to AED 3,500.

- Fees for consideration by the ICP or GDRFA - approximately AED 500 - 800.

- Medical examination at an accredited clinic - from AED 700 to AED 1,000.

- Emirates ID registration - approximately AED 500 - 1,000 depending on the visa validity term.

- Typing centre services (form completion and submission) - approximately AED 100 - 200.

- Insurance policy - the cost varies from AED 2,000 per year depending on the coverage and age of the applicant.

The validity period of a retirement visa is usually 5 or 10 years (depending on the programme), with the possibility of renewal if all conditions are met, including age, income level or asset value, as well as valid medical insurance.

Renewal is carried out using a similar procedure with resubmission of papers and payment of fees. Failure to comply with the conditions may result in the restriction of visa renewal.

Renewal and Cancellation of a Retirement Visa

Renewal of a retirement visa in the UAE is possible provided that the applicant still meets the established criteria, such as age, confirmed income or asset value, and valid medical insurance. Usually, applications for renewal are accepted 1–6 months before the visa expires.

The renewal process includes:

- Collecting the relevant documents.

- Submitting an application through ICP or GDRFA (online or through a typing centre).

- Undergoing a medical examination at an accredited clinic.

- Payment of fees for visa and Emirates ID renewal.

Visa cancellation can be:

- Voluntary. Upon departure from the UAE or change of residency type.

- Automatic. In case of non-compliance with the conditions or expiry without renewal.

In case of cancellation or expiry, a grace period (usually 30 days) is provided to exit the country or make a new application for a visa. Exceeding this period will result in fines for each day of delay.

Timely renewal or correct cancellation of a visa helps to avoid fines and problems when entering the UAE in the future.

Who Should Apply for a Retirement Visa?

The ideal candidates for a retirement visa in the UAE are people who want to live in the country for a long time, remaining independent from local employers and supporting themselves with their own funds. These may include:

- Retirees who want to spend their retirement years in a safe and comfortable country.

- Property owners with assets above a certain threshold (e.g. AED 1,000,000) who plan to live in their own homes.

- Investors managing assets in a safe economic and tax environment.

- Freelancers and remote workers who earn income from abroad.

- Individuals with continuous income from rent, dividends, interest or other investments.

When such a visa may not be the best option:

- In case the applicant plans to work for a company in the UAE, a work visa is required.

- If active business activities are planned that require company registration in the country and physical presence.

- If there is no stable income or assets that meet the requirements of the immigration authorities.

Thus, a retirement visa in the UAE is suitable for those who value freedom of choice of residence, financial independence and a high level of comfort, but do not plan to build a career in the local labour market.

Conclusion

A retirement visa in Dubai is not just a formality for living abroad, but a real tool that opens the door to a comfortable and safe life in one of the world's most dynamic megacities. Here, a high level of service, modern infrastructure, advanced medicine and no personal income tax are harmoniously combined.

By choosing Dubai, you get not only a mild climate and year-round sunshine, but also access to a stable financial system, ample investment opportunities, and a diverse cultural life. If you are a property owner, investor, freelancer or someone with passive income, a retirement visa allows you to maintain your usual lifestyle while broadening your horizons.

The application process is fairly straightforward, despite its formal rigour. By turning to professionals, you can avoid bureaucratic delays, prepare your documents correctly and obtain a visa with a twinkling of an eye. Competent support is especially important if you are applying for residency in the UAE for the first time and want to be sure of the end result.

Today, Dubai is a city where you can not only enjoy a well-deserved rest, but also continue to be active: do business at the international level, develop personal projects, travel and meet people from everywhere in the world.

If you are considering relocating and want to spend the next few years in a place where comfort and safety are the norm, you should consider a retirement visa as your next step towards a new, more free life.

Can I apply for a Retirement Visa without visiting the UAE?

Yes, of course. You can apply remotely via the ICP or GDRFA online services, or through an accredited agency. However, medical examinations and Emirates ID registration require you to be physically present in the UAE, so a visit to the country at some stage is still unavoidable.

How much does a Retirement Visa cost?

The total cost is usually between AED 8,000 and AED 12,000, including government fees, medical examination, Emirates ID, insurance and typing centre services. When applying through an agency, a consultation fee is added, which may vary depending on the fullness and urgency of the application.

How long is a Retirement Visa valid?

The validity period depends on the programme, most often 5 or 10 years. Renewal is possible if all conditions are met: confirmed income or asset value, age and medical insurance. Applications for renewal are usually open several months before the visa expires.

Can I work in the UAE with a Retirement Visa?

A retirement visa is not intended for employment with a company in the UAE. Remote work for a foreign employer or management of your own investments is permitted. For official work within the country, you must apply for a work visa or obtain the appropriate permission from the immigration authorities.

What documents are required to renew a Retirement Visa?

Passport, Emirates ID, current bank statements, proof of income or ownership, medical insurance, recent photograph, and medical examination results. Sometimes an NOC is requested if there was a previous sponsor. Documents are submitted through ICP, GDRFA, or a licensed agency.

Can I sponsor family members with a Retirement Visa?