A UAE investor visa is your key to living and doing business in one of the world's most stable and fastest growing economies. This type of visa gives you access to residency status, international business opportunities and a favourable tax system. An investor visa allows you not only to invest safely, but also to gain a secure base for your company's development and life in the UAE.

Why Apply for an Investor Visa in Dubai?

The UAE Investor Visa is a strategic tool for those seeking to not only preserve but also grow their capital in a safe, favourable and stable jurisdiction. This type of visa grants legal residency status, allowing you to reside freely in Dubai, open corporate and personal bank accounts, and take full advantage of the local infrastructure.

One of the key factors of attractiveness is the tax policy: the UAE has no personal income tax and in some cases no corporate tax, which allows for a significantly reduced tax burden and efficient planning of international investments.

The investor visa also opens up access to the favourable purchase of property in prestigious areas of Dubai, with the right of full ownership. This is not only an investment, but also an opportunity to set up a comfortable place for life or business.

An important advantage is the right to family relocation: the investor can issue visas for spouse, children and even service personnel.

Thus, an investor visa in Dubai is not just a status, but a set of opportunities for financial growth, personal security and quality of life.

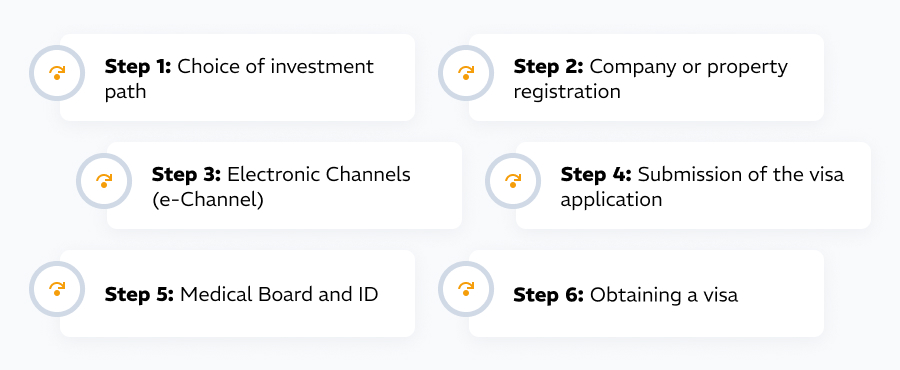

Step-by-Step Guide to Getting an Investor Visa in the UAE

Getting an investor visa to the UAE is not as difficult as it may seem at first glance, if you understand the sequence of actions and requirements at each stage. In this section, we will look in detail at where to start, what documents to prepare and how to go through the visa application process step by step.

- Choice of investment path. First of all, it is necessary to determine the basis for obtaining a visa: starting a company, buying a share in an existing business or purchasing real estate for a minimum amount.

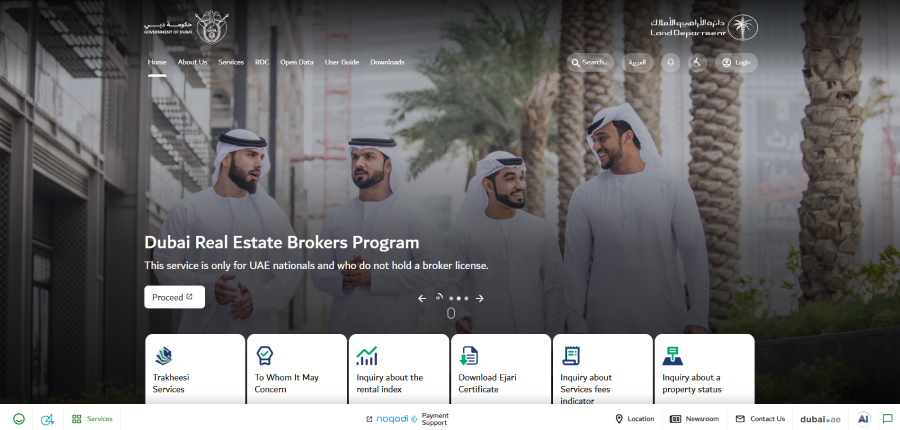

- Company or property registration. If the corporate route is chosen, it is required to register the company in one of the free economic zones or on the mainland. If buying a property - titling through the Dubai Land Department (DLD).

- Electronic Channels (e-Channel). The application requires e-Channel registration through the ICP migration portal or through a specialised agency within the chosen Free Zone.

- Submission of the visa application. The application is submitted through the ICP (Federal Authority for Identity, Citizenship, Customs & Port Security) or GDRFA (General Directorate of Residency and Foreigners Affairs) platform depending on the Emirate.

- Medical Board and ID. You must undergo a medical examination at an accredited clinic and obtain an Emirates ID.

- Obtaining a visa. After successful verification, the documents are certified and a resident visa is issued for a period of 2 to 10 years.

With proper preparation and support, the investor visa process becomes clear, structured and allows you to quickly obtain residency status in the UAE.

Image caption: Dubai Land Department (DLD)

Eligibility Criteria for Dubai Investor Visa

In the UAE, an investor visa can be obtained in a number of ways and the conditions vary considerably from emirate to emirate.

- Investment in property - AED 750,000 in Dubai for a 2-year visa, or AED 2,000,000 for a 10-year visa. For other emirates, it’s AED 2,000,000 for 5 years.

- Investment in the company - AED 500,000 for 5 years and AED 2,000,000 for 10 years

In Dubai, there are options:

- The entrepreneur must have a pilot project with a registered income of $500,000 with the Ministry of Economy or the appropriate local authorities (AED 1,000,000 annually).

- The entrepreneur has received approval for a pilot project from a business incubator or the Ministry of Economy to launch an enterprise that will generate income for the country (AED 2,000,000).

- To be the founder of a pioneering project sold for at least AED 7,000,000.

- Paying a non-refundable annual investment of AED 250,000 for 10 years.

- Have a deposit in a bank AED 2,000,000 for 10 years.

These schemes differ in terms of visa validity period and formal requirements. The choice of the appropriate option depends on financial capacity, source of funds and purpose of stay in the UAE.

Want to learn more about UAE business setup services?

UAE Investor Visa: Required Documents

To apply for a UAE investor visa, you need to prepare a full package of documents to prove your identity, financial solvency and the legality of your investment. It is important to submit all papers up to date, as overdue or incorrect documents may result in rejection. Here is a list of basic requirements:

- Copy of passport (valid for at least 6 months).

- Passport size photo on a white background.

- Copy of your valid visa (if you are already in the UAE).

- Proof of investment: certificate of incorporation of a company, shareholding or property ownership certificate.

- Bank statement (usually for 6 months) confirming availability of funds or stable income.

- Medical insurance valid in the UAE.

- Application for Emirates ID.

- Certificate of medical examination.

- NOC (No Objection Certificate) - authorisation if required under the chosen scheme.

- For family visa: copies of family members' passports, marriage and birth certificates.

Some documents may vary depending on the type of investment and the Emirate of application. It is recommended to consult with specialists in advance for correct preparation of the package.

Image caption: Emirates ID

Investor Visa Cost and Validity

Processing an investor visa in Dubai requires not only careful preparation of documents, but also an understanding of all the associated costs. The total cost of the visa comprises several mandatory steps and fees.

On average, processing an investor visa for two years costs AED 6,000-12,000. This amount includes:

- government application fees - from AED 4,000;

- medical examination - from AED 700-1,000;

- Emirates ID processing - from AED 500 to AED 1,150;

- administrative and typing fees - approximately AED 500 to AED 1,500;

- printing centre services - approximately AED 150-300;

- optional advisory and mediation services - from AED 1,000 to AED 5,000 depending on the level of support.

The validity of a standard investor visa is 2 years. After this period it is necessary to undergo a renewal procedure, which includes a second medical examination, renewal of the Emirates ID and payment of the visa fee, which is usually AED 1,500-1,750.

It is important to bear in mind that the exact cost may vary depending on the Emirati jurisdiction chosen, the type of investment and the use of third-party assistance. To speed up the process and minimise errors, many investors choose to be accompanied by professional advisors.

Renewal and Cancellation of an Investor Visa

UAE investor visa is usually issued for a period of 2 years with the right of subsequent extension. It is recommended to start the extension procedure 30-45 days before the visa expiry date to avoid penalties, and possible interruptions in residency status.

To extend your visa, you must:

- reattend a medical examination at an accredited clinic;

- issue a new Emirates ID;

- apply through ICP or GDRFA;

- provide up-to-date company documents or proof of property ownership;

- pay government fees and administrative fees.

Image caption: ICP

If the visa is cancelled voluntarily (e.g. company closure or change of Emirate), the migration office must be notified and all related corporate and bank accounts must be closed. After cancellation or expiry of the visa, a grace period of 30 days is granted, during which the resident must leave the country or apply for a new status (e.g. tourist visa or change of sponsor).

In case of violation of the terms of stay after the expiry of the visa, fines are charged for each day of delay. A responsible approach to extensions allows the resident status to be maintained without interruption or legal risks.

Who Should Apply for an Investor Visa?

The UAE investor visa is not suitable for everyone, so it requires a strategic approach. Foremost, this solution is ideal for:

- Foreign investors looking to start or acquire a company in the UAE with the ability to manage the business remotely or locally.

- Property owners of AED 750,000 and above seeking residency status without mandatory operations.

- Remote professionals and freelancers who want to reside legally in the UAE, run international projects and take advantage of the local banking system.

- Retirees, planning to relocate to a country with a favourable climate and a high level of security.

- Investors interested in tax optimisation, buying assets in the UAE or international diversification.

However, this visa is not suitable:

- If your goal is to be officially employed by a local company (in which case a work visa from your employer is required).

- If you do not plan to start a business, invest or purchase property.

- If you want to reside in the UAE on a temporary or short-term basis (in this case it is better to consider a tourist, freelancer or remote work visa).

The choice of investor visa should be justified by your long-term goals and real investment interests in the region.

Conclusion

The UAE investor visa is a practical and favourable tool for those seeking legal residency, safe capital allocation and the benefits of one of the world's most stable economies. This visa opens up access to international business, personal and corporate banking, favourable taxation and high standards of living.

Dubai remains one of the most attractive destinations for investors due to its developed infrastructure, stable legal system, flexible corporate opportunities and favourable visa policy. The ability to acquire property, open wholly foreign-owned companies and freely manage assets makes the emirate a strategic choice for international entrepreneurs and investors.

The process of obtaining an investor visa may seem complicated, but with professional support it becomes simple and predictable. Experienced consultants will help you choose the best investment route, prepare documents and go through all the steps without mistakes.

If you are considering the UAE as a new business location or a place to live, an investor visa is a sensible and long-term move. Contact our experts for a personalised consultation and start the process today.

Can I apply for an Investor visa without visiting the UAE?

Yes, you can start your UAE investor visa application remotely. Most free economic zones provide the option of applying online. However, in order to undergo a medical examination and obtain an Emirates ID, a personal visit to the UAE at the final stage is mandatory.

How much does an Investor visa cost?

The average cost of an investor visa ranges from AED 6,000 to AED 12,000 for a two-year period. The amount includes government fees, medical examination, Emirates ID and administrative services. Additional fees include the opening of a corporate bank account and, if necessary, consultancy support.

How long is an Investor visa valid?

The standard validity period of the UAE investor visa is two years. At the end of the term, the visa is subject to renewal, provided that the investment grounds remain intact: an existing company or property. Renewal is possible an unlimited number of times if all visa and corporate requirements are met.

Can I work in the UAE with Investor visa?

An investor visa allows you to manage your own company and conduct business activities in the UAE. However, you cannot be employed by another company with this type of visa - a separate work visa issued by your employer is required.

What documents are required to renew an Investor visa?

To extend the investor visa, you will need: a valid passport, a recent medical certificate, an updated Emirates ID, up-to-date corporate documents (company licence, registration papers) and proof of continued investment activity. The relevant government fees must also be paid.

Can I sponsor family members with an Investor visa?