Looking for a place in Dubai where your business can actually breathe and grow? Economic Zones World (EZW) isn’t just another free zone on the list — it’s the engine room behind some of the UAE’s biggest success stories. Born under the DP World umbrella, it connects you straight to Jebel Ali Port, one of the busiest trade gateways on the planet. Think of it as a bridge between your idea and the world market — minus the red tape. Whether you’re building, trading, or scaling up, setting up a company in the EZW free zone means you’re choosing smart infrastructure, global reach, and the kind of ecosystem that quietly gets things done.

Why Choose Economic Zones World for Business Setup?

If your plan is to plant a flag in Dubai and actually move goods, win contracts, and scale, Economic Zones World (EZW) gives you a head start. You sit on the doorstep of Jebel Ali Port and a short drive from Al Maktoum International Airport. That means fewer handoffs, fewer delays, and a supply chain that feels responsive instead of rigid. Popular with traders, logistics firms, manufacturers, and regional HQs, the appeal is simple: real infrastructure, serious connectivity, and a regulator that understands business tempo.

Cost-wise, you choose what fits. Need a flexi-desk to get started? It’s there. Need a warehouse with easy truck access or a plot for the light industry? Also on the table. Processes are streamlined and increasingly digital, so EZW free zone business setup doesn’t drown you in forms.

Many founders complete the core steps remotely through authorized representatives; you handle signatures, verifications, and payments online, then deal with visas and bank onboarding when you’re ready to fly in. Flexibility first, bureaucracy second.

About Economic Zones World

Economic Zones World grew under the DP World umbrella—the same ecosystem that turned Jebel Ali into a global trade hub. EZW’s portfolio has included heavy hitters like Jebel Ali Free Zone (JAFZA), Dubai Auto Zone, and TechnoPark, which positioned it at the intersection of shipping, manufacturing, and technology.

For anyone eyeing Economic Zones World free zone business setup, government backing matters: EZW’s association with DP World signals stability, policy clarity, and long-term planning. In plain terms: you’re not experimenting with an untested jurisdiction; you’re plugging into a mature logistics platform with a track record.

Business Activities Allowed in Economic Zones World

The activity map is broad: general trading, specialized trading, logistics and distribution, manufacturing and assembly, automotive trade and services, technology and professional services. If you handle regulated lines—medical devices, energy equipment, chemicals, or anything safety-sensitive—expect pre-approvals and technical documentation. It’s not a hurdle; it’s a checklist.

With EZW freezone company formation, clusters do the heavy lifting: traders get port proximity, manufacturers get utilities and land options, and service firms get credible addresses with visa allocation. Pick the license that fits your model, then scale without changing your postcode.

Step-by-Step Economic Zones World Freezone Company Formation and Registration

Starting a company in Economic Zones World (EZW) should feel like switching on a well-tuned engine, not wrestling paperwork. The playbook is simple: pick what you’ll do, choose where you’ll sit, prove who you are, and get licensed. Because EZW sits within the broader DP World ecosystem, the path is structured and predictable—good news if you’re juggling timelines, suppliers, or investors.

Trading, services, or industrial? Your activity list drives the license, so get it right first. If you’re unsure, a quick scoping call with a consultant saves days later.

Free Zone Establishment (single shareholder) or Free Zone Company (multiple). Facilities scale with ambition: flexi-desk to keep costs lean, offices for teams, warehouses or plots for production and logistics. This is where EZW free zone business setup shows its range.

Submit a few name options, confirm activities, and clear basic compliance checks. No drama—just sequence.

File the pack, pay the fees, and receive incorporation documents and your EZW license. Bank account and visas follow.

Most clean files move from submission to license in about 5–10 working days. Add time if your activity needs third-party clearance (for example, technical or safety-sensitive lines). The point is momentum—EZW company formation is built for it.

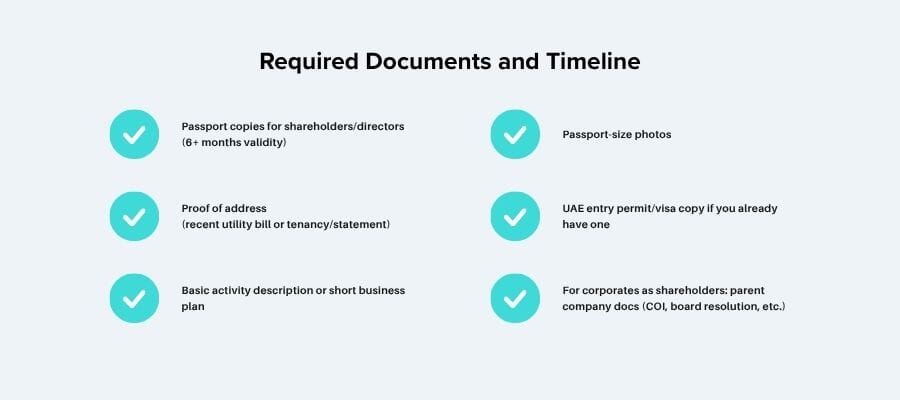

Required Documents and Timeline

Keep it tidy and you’ll move fast. Typical Economic Zones World free zone requirements include:

- Passport copies for shareholders/directors (6+ months validity)

- Passport-size photos

- Proof of address (recent utility bill or tenancy/statement)

- UAE entry permit/visa copy if you already have one

- Basic activity description or short business plan

- For corporates as shareholders: parent company docs (COI, board resolution, etc.)

Once approved and paid, you receive the incorporation certificate, license, and establishment card. From there, you can open the bank account and start the visa quota and individual visas. A realistic, clean timeline: one week for straightforward files; two if pre-approvals or inspections apply. No false promises—just what teams actually see on the ground.

Want to learn more about UAE business setup services?

Remote Registration Option

Not in Dubai yet? You don’t have to be. EZW freezone company setup supports remote formation through authorized agents. You share verified scans, e-sign the forms, and complete a short video-call verification to confirm identity and intent. Your consultant coordinates name reservation, initial approval, and license issuance while you keep running your day job in another time zone.

When the license goes live, you can fly in later for residency steps—medical, Emirates ID, bank KYC—on your schedule. It’s a calm, low-friction route that’s made EZW company registration popular with founders who manage multi-country operations and can’t afford long on-site setup.

Types of Licenses and Costs in Economic Zones World Freezone

In Economic Zones World (EZW), licenses aren’t just pieces of paper — they’re the starting point of how your business lives and grows. You don’t buy a license here; you build around it. EZW understands that a trader, a consultant, and a manufacturer play by different rules, so it gives each the room to move.

You’ve got three main options. The Commercial License opens the door for import, export, and distribution — ideal for anyone moving products through Dubai’s trade corridors. The Service License fits consultants, tech providers, and management firms — people selling expertise rather than inventory. And then there’s the Industrial License, tailored for light manufacturing, packaging, or assembly work that needs a mix of workspace and storage. Each one connects to the infrastructure that makes Dubai hum — warehouses near Jebel Ali Port, easy access to customs, and supply-chain links that just work.

The starting costs depend on your setup, but EZW free zone business setup is known for being flexible. A flexi-desk package — basically your legal seat with minimal overhead — usually starts around AED 12,000 to 15,000 a year. Step up to a private office or warehouse and your annual spend rises, but so does your visa quota and credibility with banks and clients. The difference isn’t in red tape, it’s in scale.

Visa Packages and Pricing Breakdown

Your license decides your right to operate, but your visa package decides how big your team can be. A 1-visa package with a flexi-desk keeps things lean, roughly in the AED 15,000–18,000 range. A 3-visa setup fits a small team, usually around AED 22,000–26,000, while a 5-visa package tied to a larger facility can reach AED 35,000–40,000 annually.

Then there are the extras — the things that make your company official on paper. E-channel registration for immigration access runs about AED 2,000–2,500, and each employee visa adds around AED 3,000–3,500 once you factor in medicals, Emirates ID, and stamping.

In short, EZW freezone company setup gives you the freedom to start small, spend smart, and scale without friction — paying only for what your business truly needs.

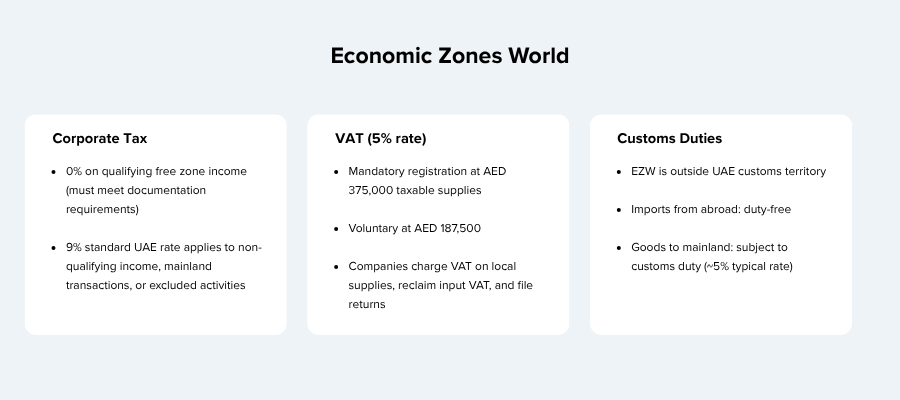

Economic Zones World Corporate Tax, VAT, and Duties

In Economic Zones World (EZW), tax works on a simple rule: qualify, document, and you can keep the 0% corporate tax on qualifying free zone income. If activity or transactions fall outside those rules, the standard 9% UAE corporate tax applies. That line matters for EZW companies trading with the UAE mainland, earning non-qualifying income, or carrying out excluded activities.

VAT is separate. The UAE rate is 5%, and registration is mandatory at AED 375,000 in taxable supplies (voluntary at AED 187,500). EZW businesses bill VAT on local supplies, claim input VAT where eligible, and file returns on schedule.

On customs, free zones sit outside the UAE customs territory. Imports into the EZW free zone from abroad are typically duty-free; moving goods from EZW to the UAE mainland triggers customs duty under the tariff (often around 5% for many goods).

Consulting.ae helps EZW clients map activities to “qualifying” status, register for corporate tax and VAT, set up proper books, and structure supply chains to use the free zone’s incentives without slipping out of compliance.

Economic Zones World Company Formation: Who Should (and Shouldn’t) Choose This Free Zone?

Economic Zones World (EZW) is built for companies that move, make, or manage things — not just exist on paper. It’s a perfect match for traders, logistics firms, manufacturers, and industrial service providers that depend on Dubai’s infrastructure. If your business needs warehouses, land, customs links, or access to Jebel Ali Port, this zone feels like home. It also works well for consultants and engineering or tech firms that serve regional supply chains.

Where EZW free zone business setup might not fit is for freelancers or one-person service providers chasing the cheapest license. Office requirements and visa-linked facilities make it more structured than small creative or remote-work zones. It’s also less flexible for retail, food service, or activities that demand constant mainland interaction. Some nationalities may require extra background screening or security clearance — not rejection, just one more form to clear before launch.

Conclusion

If your business needs real-world muscle—ports, warehouses, fast customs—not just a pretty trade license, Economic Zones World (EZW) makes sense. It’s built for traders, manufacturers, and logistics-led teams that want scale without chaos, plus clear rules on tax and visas. You can start lean (flexi-desk), grow into space, and keep momentum the whole way. If you’re ready to move product, not just paperwork, EZW free zone company formation is a solid launchpad. Need a clean, low-stress setup? Contact Consulting.ae and we’ll map the steps, costs, and timelines with you.

Yes—EZW free zone company setup supports full remote formation with verified docs and a short video check.

Often, yes. EZW accepts staged payments via approved partners; terms depend on your package.

Yes. An EZW license is built for regional and global trade.

Think regulated lines: medical devices, chemicals, energy equipment, automotive modification—submit specs first.