Dreaming of a business in Dubai with full control, flexibility and real growth opportunities? Then mainland company formation in Dubai is exactly what you should consider first. Unlike companies in free zones, a Dubai mainland business allows you to operate without geographical restrictions. You can work with clients across the UAE, participate in government tenders and contract with major local players.

What Is Mainland Company Formation in Dubai?

Mainland сompany formation in Dubai is the process of registering a company that is licensed by DET ( Department of Economy and Tourism). Such companies are authorized to do business within the UAE without geographical restrictions. Unlike companies in Free Zones, a Mainland Company is free to work with both residents and other companies throughout the Emirates, including participation in government tenders and servicing the B2B segment.

Mainland vs Free Zone: Key Differences

Choosing between Dubai mainland company registration and a free zone, an entrepreneur should consider the goals, market and scale of future activities. Both formats have their advantages, but differ significantly in terms of legal status, opportunities and restrictions.

|

Mainland |

Free Zone |

|

|

Geography of operations |

The company is free to do business throughout the UAE, including working with residents and government organizations. |

The activity is limited to its own zone and foreign markets. |

|

Business Ownership |

100% foreign ownership is allowed in most sectors, without the need for a local sponsor. |

Foreign investors initially have full ownership, no restrictions. |

|

Participation in tenders and B2G projects |

A company can participate in public tenders and enter into contracts with government agencies. |

Such access is directly closed. |

|

Type of office and lease |

It is necessary to lease a physical office in Dubai (outside the Free Zones) |

Flexi-desk or virtual office rental is allowed |

|

Taxation |

Standard corporate tax rate of 9% applies to companies with profits over AED 375,000. |

Free zone companies may benefit from a 0% tax rate only if they qualify as a QFZP, otherwise, the standard 9%tax appli |

Who Should Choose Mainland Setup?

A Mainland company in Dubai is the optimal choice for entrepreneurs who plan to work actively in the domestic market of the UAE, rather than limiting themselves to exports or online services. This form of registration is necessary if you want to serve residents, rent an office in any part of the city, participate in government tenders and have complete freedom in choosing business partners. It is especially relevant for businesses in retail, construction, logistics, education, medicine and professional services.

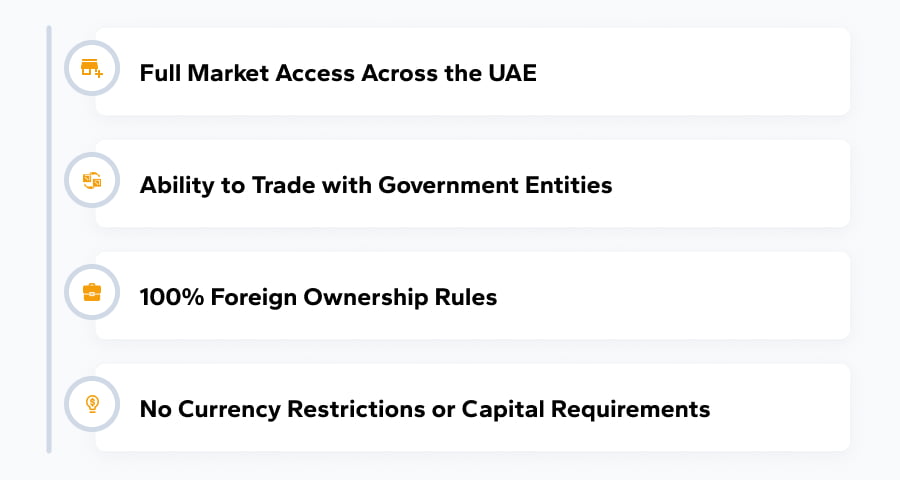

Benefits of Dubai Mainland Business Setup

Dubai mainland company setup offers entrepreneurs a wide range of strategic advantages. Unlike free economic zones, this form allows to operate without territorial restrictions, directly interact with the local market and build long-term partnerships at the level of the state and the private sector. Below are the key benefits that make company setup in Dubai mainland an attractive solution for serious business.

Full Market Access Across the UAE

Full Market Access Across the UAE is one of the key advantages of a Mainland company in Dubai. Unlike companies in free zones, whose activities are limited to the boundaries of a particular zone or require intermediaries to work with residents, a Mainland company can freely sell goods and provide services throughout the UAE, including Dubai, Abu Dhabi and other emirates.

Ability to Trade with Government Entities

Ability to Trade with Government Entities is an important strategic advantage for a mainland company in Dubai. Only organizations registered in the mainland jurisdiction are eligible to participate in government tenders, bid for major infrastructure projects and enter into contracts with ministries, municipalities and parastatal corporations. This opens up access to stable and long-term sources of income, especially in areas such as construction, technology, education, medicine, consulting and procurement.

100% Foreign Ownership Rules

The 100% Foreign Ownership Rules have been a game changer for entrepreneurs opting for mainland incorporation in Dubai. With the 2021 reforms, foreign investors are now able to own a mainland company without the need for a regional sponsor.

This means full control over the business, assets, revenues and strategic decisions. Unlike the previous model, where mandatory shareholding (usually 51% to the local partner) limited real independence, the new system gives international investors a level playing field with local investors.

No Currency Restrictions or Capital Requirements

There are no currency restrictions for mainland companies in the UAE. Businesses can freely repatriate profits and hold accounts in multiple currencies. As for capital requirements, Limited Liability Companies (LLCs) are not subject to a mandatory minimum capital in practice, although the share capital must be declared in the Articles of Association. No actual deposit or proof is required unless specified by the licensing authority.

By contrast, Public and Private Joint Stock Companies must meet statutory capital thresholds, typically AED 30 million and AED 5 million respectively, depending on their structure and regulatory obligations.

Mainland Company Formation Process in Dubai

The Mainland Company Formation Process in Dubai includes several key steps and can be completed within 1-2 weeks with proper preparation:

- Selection of the type of business - determines the type of license (trade, professional, industrial).

- Selection and approval of the company name - submitted to the Department of Economy and Tourism (DET) for approval.

- Renting an office and concluding a lease - a physical address confirmed by an agreement is required.

- Drawing up incorporation documents and registration with the DET - obtaining a license.

- Filing documents and obtaining initial authorization - includes passport data of founders and business plan (if required).

- Opening a bank account and arranging visas - the final stage to launch the business.

This process can be done remotely through a licensed business provider.

Mainland Business Licenses Types

Choosing the right type of business license is a key step when opening a mainland company in Dubai. It determines what types of activities you can officially carry out, office, personnel and regulatory requirements. In Dubai's mainland jurisdiction, licenses are issued by the Department of Economy and Tourism (DET) and cover a wide range of industries, from trade and services to manufacturing and specialized activities.

Below we look at the main types of mainland licenses, their features and conditions for obtaining them, so you can choose the best format for your business model.

Commercial License

Issued to companies engaged in trade - import, export, distribution, wholesale and retail. Suitable for stores, online retail and trading companies operating both in the UAE and abroad. Requires an office in the mainland and prior DET approval by activity.

Professional License

Designed for individual professionals and service companies whose business is based on knowledge and qualifications. Suitable for consultants, lawyers, designers, IT specialists and educational projects. Allows 100% foreign ownership and requires proof of experience or education.

Industrial License

Required for companies involved in manufacturing, assembly or processing. Requires a manufacturing facility that meets technical and environmental standards, as well as approvals from regulatory bodies including MoIAT.

Tourism & E-Commerce Licenses

Tourism License is suitable for travel agencies, tour operators and hospitality companies. DET approval and fulfillment of profile conditions are required.

E-Commerce License is issued to online businesses that sell through websites, marketplaces and social media. Does not require a physical store, but does require a registered address in the mainland.

Dubai Mainland Company Formation Cost

The main cost is the license, which ranges from AED 12,000 - AED 35,000 depending on the type of business and license. An equally significant part of the budget is office space, a mandatory element for obtaining a license. Rent can range from AED 30,000 to AED 80,000-100,000 per year. You should also consider the annual cost of a local partner (if one is required), which is usually AED 10,000-25,000, and for certain areas even higher.

Additional costs include:

- visas and their processing - AED 3,500-7,500 per visa, including health checks and Emirates ID

- legal and administrative fees - notary, registration, MOA, translation of documents: around AED 2,000-5,000

- customs and municipal fees - e.g. registration with the Ministry of Economy (AED 3,000), and “market fees” 5% of the rental rate for stores and 20% for warehouses.

Best Locations for Dubai Mainland Company Setup

Choosing the right location for a Mainland company in Dubai is critical not only in terms of logistics, but also image, customer flow, rental costs and future scalability. Below is an overview of the best points to incorporate a Mainland company in Dubai from a practical perspective:

Business Bay, Sheikh Zayed Road & Other Hotspots

Business Bay is a central business district adjacent to Downtown and Burj Khalifa. It is ideal for financial, legal, consulting companies, developers and start-ups focused on the premium segment. Location advantages are prestige, infrastructure, transportation accessibility. Rents are from AED 70,000-100,000 per year.

Sheikh Zayed Road is the main thoroughfare of Dubai, along which many commercial buildings are located. It is good for sales offices, brokers, logistics companies, IT and educational projects. Location advantages are central location, proximity to the metro. Rent is from AED 50,000 per year.

Al Qusais, Al Nahda or Deira are old but well developed neighborhoods with affordable infrastructure and reasonable prices. It is good enough for small businesses, service companies, retail, warehouses and transportation. Advantages of the locations are low rent (from AED 25,000-35,000), access to labor. The disadvantages are that these are less prestigious locations.

Location Choice by Activity Type

The location of a mainland company in Dubai should directly correspond to the type of business. For consulting, IT and legal services, business districts like Business Bay or Sheikh Zayed Road are suitable. It provide prestige and access to corporate clients.

Retail and salons should choose Deira, Al Barsha or Jumeirah for their high client traffic. Logistics and warehouses will find industrial zones like Al Quoz and Ras Al Khor, while e-commerce can be conveniently located in Silicon Oasis or Al Barsha South.

Construction and service companies choose Dubai Investment Park and Al Qusais, and educational centers choose Oud Metha, Al Nahda or Mirdif.

Choosing the right neighborhood reduces costs, increases access to customers and makes it easier to scale your business.

Transitioning from Free Zone to Mainland

The transition from Free Zone to mainland jurisdiction in Dubai is an important step, but not always an easy one. It is relevant for companies that have grown beyond the Free Zone and want to access the local market, contract with public and private clients in the UAE, rent an office in any neighborhood, or scale their workforce without restrictions.

Steps to Switch Your Business Jurisdiction

Moving from the Free Zone to the mainland jurisdiction is not a technical transfer, but a full-fledged re-registration of the business. First you register a new company in the mainland through the DET, rent an office and obtain a license. Then the Free Zone license is revoked, contracts, assets and, if necessary, employees are transferred - with visas re-issued. Bank accounts and tax registration are also updated. Although the process requires cost and preparation, it gives the business full access to the UAE market and more flexibility to scale.

Why and When It Makes Sense

A move from Free Zone to mainland jurisdiction is worth considering when your business has grown beyond the limitations of the Free Zone and you need full access to the UAE market. This is specially relevant in the following cases:

- you want to sell goods or provide services within the UAE directly;

- you plan to participate in tenders and work with government agencies;

- you need an office in any neighborhood of Dubai;

- you need to expand your staff. Free Zone often limits the number of visas;

- you are seeking a high reputation and a transparent corporate structure for banks, investors and large clients.

The transition makes sense when Free Zone no longer matches the scale and ambition of the business. It's a step towards greater control, legality and operational flexibility.

Visas and Sponsorship Under Mainland License

Visas and Sponsorship Under Mainland License in Dubai is one of the key factors that distinguish a mainland structure from Free Zone.

After obtaining a mainland license, the company is entitled to apply for resident visas for founders, employees and their family members. The number of visas directly depends on the size of the leased office (usually 1 visa per 9-10 m²), which gives the flexibility to scale the team.

A business owner with a mainland license can obtain an investor visa for up to 2 years and then sponsor family members. Mainland employers also officially sponsor employees, including Emirates ID, health insurance and work visas.

Unlike the Free Zone, there are no hard caps on the number of visas and the process is coordinated through the government (GDRFA), which provides greater control and flexibility as the business grows.

Why Work with a Business Setup Consultant

Dubai mainland business setup is more than just filing paperwork. It is a legally and administratively complex process where mistakes can cost time, money and even denial of a license. That is why working with a professional business consultant is not a luxury, but a strategically wise decision.

Navigating Legal Requirements

A business consultant helps you accurately interpret UAE law, avoid legal pitfalls and choose the right type of license, zoning, ownership structure and relevant permits. This is especially important for expatriates who may find it difficult to navigate local rules, ever-evolving regulations and inter-agency procedures.

Speed, Accuracy, and Cost Efficiency

Consultants know how to avoid bureaucratic delays, prepare a complete set of documents in advance, and reduce the number of resubmissions. This not only speeds up the launch of your business, but also reduces your bottom line costs by eliminating fines, unnecessary fees, and redundant actions. The consultant works for results: so that you can focus on the business, not on the intricacies of the administrative system.

Conclusion

Opening a mainland company in Dubai is a reliable way to enter the UAE market with full control over the business and no restrictions on operations. This format is suitable for those who aim for growth, local contracts and long-term presence.

The support of a business consultant allows you to avoid mistakes, save time and resources, and most importantly - to launch the company correctly the first time.