Ready to build an automotive trading business in Dubai? Dubai Cars and Automotive Zone (DUCAMZ) is where car deals actually move. Built for the fast-moving world of car trading, import, and re-export, DUCAMZ gives automotive entrepreneurs what most zones can’t — direct access to Dubai’s transport arteries, on-site customs, and a community made up entirely of vehicle professionals.

Launched by Dubai Auto City, this automotive free zone is purpose-built for car dealers, spare parts traders, and exporters connecting Dubai to markets across the Middle East, Africa, and Asia. It’s the one zone in the UAE where everything — trade, storage, clearance, and delivery — happens under one roof.

For entrepreneurs, investors, and global traders, DUCAMZ company formation means a clean, fast, and scalable setup with 100% foreign ownership, low administrative friction, and ready-made credibility in one of the region’s largest automotive trade hubs. If your business moves on wheels, DUCAMZ is where it belongs.

Why Choose Dubai Cars and Automotive Zone (DUCAMZ) for Business Setup

If your business lives on wheels, DUCAMZ feels familiar from day one. It sits inside Dubai’s logistics web, with fast road links to the ports and airports, so cars don’t linger—they move. The zone was built around the way traders actually work: straightforward licensing, yards that make sense for inventory, and processes that keep vehicles flowing in and out without ceremony. For founders and investors, that translates into a DUCAMZ business setup that’s practical, cost-aware, and built to scale.

Prefer to start from abroad? Company formation can be handled through approved agents with digital verification, so you can open your file before you book a flight.

What sets the zone apart is focus. Everyone around you—exporters, parts dealers, logistics crews—speaks the same language of turnover, condition reports, and shipping windows. Fees are transparent, renewals are routine, and you can adjust footprint and visa quotas as your pipeline grows. It’s a specialist environment, not a generalist address.

About Dubai Cars and Automotive Zone (DUCAMZ)

DUCAMZ was created by the Government of Dubai to anchor the city’s role as a regional hub for vehicle trade and re-export. It’s a specialized automotive free zone, positioned within Dubai’s wider ecosystem of customs and logistics, so traders can consolidate, clear, and ship with fewer moving parts. Over the years, it has grown into a known marketplace for used and new vehicles bound for the Middle East, Africa, and South Asia, giving small operators and large exporters the same core advantage: speed with paperwork that matches the industry.

Business Activities Allowed in Dubai Cars and Automotive Zone (DUCAMZ)

Licensing maps to the real automotive chain. Typical activities include vehicle trading (new/used), re-export of cars and heavy vehicles, spare parts and accessories trading, storage and logistics support, inspection and detailing, auction/brokerage, and fleet management. Work that alters a vehicle’s condition or identity—modification, testing, re-registration steps—can require pre-approval from the relevant authorities (e.g., customs or road/transport regulators). Standard trading and re-export pathways are streamlined.

The result is simple: a DUCAMZ company formation gives you permission sets that match how auto businesses actually operate, so you can spend less time nudging forms and more time turning inventory.

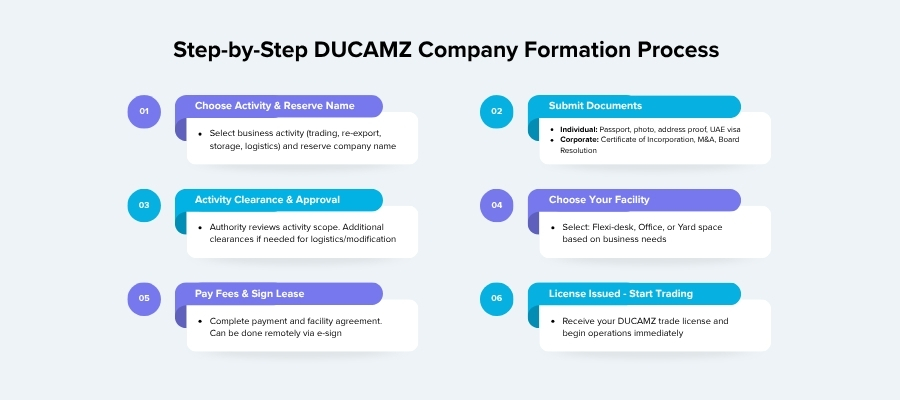

Step-by-Step Dubai Cars and Automotive Zone (DUCAMZ) Freezone Company Formation and Registration

Here’s how a DUCAMZ company setup actually plays out. You decide what you’ll do—trade cars, re-export, store, or a blend—then reserve a name and file the application. The authority checks that your activity fits the zone’s scope, you choose a footprint (flexi-desk, office, or yard), and you get an initial nod. Pay fees, sign the lease, and the license lands. When files are clean and the activity is standard trading, it moves fast. If you’re adding logistics, testing, or anything that touches vehicle modification, expect an extra lap for the relevant clearances. Most files wrap in 7–14 working days; your speed on documents decides where you land in that range.

Required Documents and Timeline

The paperwork is short, not soft. For an individual shareholder, you’ll typically provide:

- Passport copy (6+ months validity)

- Passport-style photo (plain background)

- Proof of address (recent utility bill or tenancy/statement)

- UAE entry stamp/visa copy (if you have one)

If a company is the shareholder, add:

- Certificate of Incorporation

- Memorandum & Articles

- Board Resolution authorizing the setup

The steps are: submission, name/activity clearance, initial approval, fees and facility agreement, and then the license is issued. Straight trading files usually take less than a week to finish. If they need to be looked over by Dubai Customs or the RTA, they can take up to a second. That's not red tape for fun; it's the due diligence that keeps things moving once you're live.

Remote Registration Option

You can start without flying to Dubai. An approved agent handles filings while you complete secure uploads and e-sign where accepted. Identity is confirmed via a brief video-call verification or equivalent KYC step; originals can be couriered later if requested. Payments run through approved online channels, and the facility agreement is aligned in parallel, so you’re not waiting on a desk to chase a license.

The effect is simple: you launch from your laptop, let the clearances tick over, and arrive when plates, storage, and paperwork are ready. Less back-and-forth. More turnover.

Want to learn more about UAE business setup services?

Types of Licenses and Costs in Dubai Cars and Automotive Zone (DUCAMZ) Freezone

DUCAMZ doesn’t drown you in endless license variations. It’s lean, practical, and built for people whose businesses depend on vehicles changing hands quickly. The authority offers a few core license types — each crafted around the real operations of traders, exporters, and logistics providers.

The Commercial License in Dubai Cars and Automotive Zone is the main ticket for anyone trading, importing, or re-exporting cars, trucks, and spare parts. It also covers related activities like brokerage, auction, or automotive consultancy. The Service License works for businesses that support the trade chain — car testing, detailing, repairs, inspection, or freight handling. The Industrial License is for light work: packaging, accessory assembly, and vehicle modification, provided you’re not building from scratch.

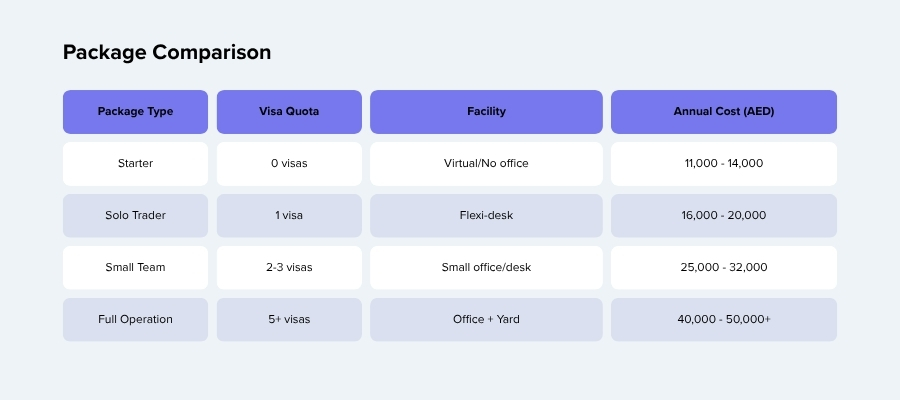

What you pay depends on how big your operation is and how many visas you need. A small startup might take a flexi-desk package and a single visa; larger traders often lease an office or yard with multiple visa quotas. Most setups fall into one of a few clear bands.

A no-visa DUCAM license starts around AED 11,000–14,000 per year. The 1-visa package, often with a flexi-desk, averages AED 16,000–20,000 annually. If you add space and staff, a 2–3 visa package usually sits between AED 25,000–32,000, while operations needing five or more visas and a full yard climb into the AED 40,000–50,000 range.

Renewals tend to mirror initial pricing, and costs are broken down clearly — license fee, facility rent, and government charges. That transparency is what most traders appreciate; no surprise fees halfway through the year.

Visa Packages and Pricing Breakdown

Beyond the base license, there are a few extras to plan for. E-channel registration (a UAE immigration system requirement) costs about AED 2,000–2,500, paid once per company. Each visa adds AED 3,500–5,000, depending on medical insurance and applicant status.

For traders moving vehicles in and out daily, DUCAMZ’s value isn’t just in the price tag — it’s in the structure. The license matches the business you actually run, and every cost, from the visa to the yard rent, is predictable. That clarity keeps you focused on what matters: turning inventory, not chasing paperwork.

Dubai Cars and Automotive Zone (DUCAMZ) Corporate Tax, VAT, and Duties

Here’s the tax picture the way traders in Dubai Cars and Automotive Zone (DUCAMZ) see it: what do I keep, what do I file, and when do I pay.

The UAE corporate tax is 9%. Free-zone entities, including those in DUCAMZ, can keep a 0% rate on qualifying income—the profit you earn from permitted free-zone activities and overseas business, provided you meet the official conditions and keep the right separations. Sell into the UAE mainland, and the non-qualifying slice can be taxed at 9%. Many auto firms structure contracts, invoicing, and flows so re-export remains squarely in the qualifying lane.

VAT runs alongside this. The federal rate is 5%. Cross AED 375,000 in taxable turnover in a rolling 12-month period and you register. Re-exports are often zero-rated; domestic supplies are usually standard-rated. The practical rule: split your books cleanly—local vs. export—so return filings are defensible and audits are uneventful.

On customs and duties, vehicles or parts brought into the DUCAMZ free zone for re-export sit in a duty-suspended environment. Move those goods into the UAE market, and the standard 5% customs tariff applies. That’s the margin many exporters rely on: duty-free in, quick turnaround out.

As for the compliance, free-zone benefits don’t run on autopilot. Keep proper accounts, document transfer paths, and prepare audited financials when required. If you want 0% on qualifying income, maintain policies that prove you meet the free-zone conditions and keep related-party or mainland deals ring-fenced.

This is where Consulting.ae earns its fee. We map your operating model—what stays in the free zone, what counts as qualifying, when VAT registration triggers, and how customs flows are documented. The goal is simple: capture incentives you’re entitled to, stay compliant, and avoid tax you don’t owe. Less time decoding rules. More time turning inventory.

Dubai Cars and Automotive Zone (DUCAMZ) Company Formation: Who Should (and Shouldn’t) Choose This Free Zone

DUCAMZ is for people who make a living from vehicles — not just selling them, but moving, storing, and exporting them. If your business revolves around automotive trading, re-export, spare parts, or vehicle logistics, this zone fits like a glove. It’s built for traders who need yards instead of boardrooms, customs access instead of fancy addresses. Small operators and global exporters alike find the place wired for movement — roads, yards, and paperwork all tuned to the same rhythm. That’s why many of those who do research on a company setup in Dubai Cars and Automotive Zone (DUCAMZ) end up here for the operations alone.

Where DUCAMZ shines: re-export traders, spare-parts suppliers, logistics operators, and inspection or detailing services. The zone is equally friendly to brokers and vehicle auction operators, as long as they stay within the automotive scope.

Where it doesn’t: freelancers, digital consultants, IT or marketing companies — DUCAMZ simply isn’t built for them. It also doesn’t suit heavy manufacturers or anyone needing large-scale industrial facilities; light modification and prep work are fine, full assembly lines are not. Companies dealing in restricted or high-value vehicles may face extra due diligence and approval from Dubai Customs or RTA, depending on origin and use.

So, if your world runs on horsepower, logistics, and trade routes, DUCAMZ gives you infrastructure that works with you, not against you. If your business is digital, creative, or industrial, look elsewhere — this zone speaks one language, and it’s automotive.

Conclusion

Setting up in Dubai Cars and Automotive Zone (DUCAMZ) isn’t about chasing the lowest license cost — it’s about operating in a space built for your kind of business. Every process, from customs to storage, is designed around vehicles. You get 0% corporate tax on qualifying income, fast licensing, and a clear link to ports, airports, and buyers across three continents.

It’s the ideal zone for car traders, re-exporters, spare-parts dealers, and logistics operators who value efficiency over flash. Everything here — location, pricing, infrastructure — favors turnover and scale.

If your business lives on wheels, DUCAMZ gives it a base that runs just as smoothly. To start, connect with a consultant who understands both the automotive trade and UAE regulations. They’ll handle activity mapping, approvals, and structure — so you can focus on what you do best: trading, shipping, and growing.

Yes. DUCAMZ company formation can be completed remotely through an approved agent with digital document uploads and a brief video-ID check.

The authority expects fees up front. Some business setup consultants, however, let you split their service charges—ask before you sign.

Yes. A DUCAMZ free zone license is built for automotive import and re-export, so international trading sits squarely in scope.

Anything that changes a vehicle’s condition or status—modification, testing/inspection, re-registration—may require clearance from Dubai Customs or the RTA.