Looking for the most cost-effective free zone to register your UAE company? Dubai Auto Zone (DAZ) might be your best choice. This is Dubai’s purpose-built ecosystem for people who live and breathe vehicles: traders, parts distributors, exporters, and the logistics teams that keep wheels turning. You get what matters—straightforward licensing, on-site customs, warehousing options, and a location stitched into the port, airport, and highway network. No fluff, just a clean runway for growth.

If Dubai Auto Zone company formation is on your radar, think practical wins: 100% foreign ownership, fast setup, and a community that speaks automotive. Need to re-export cars? Store parts? Run inspections or value-added services? DAZ makes those moving pieces click together. For entrepreneurs, freelancers, and international investors planning company setup in the UAE, this free zone feels like a pit lane: pull in, refuel, and get back to business—quicker, leaner, and safer, ready to scale today.

Why Choose Dubai Auto Zone (DAZ) for Business Setup?

If your business smells like motor oil and moves on wheels, Dubai Auto Zone (DAZ) just makes sense. For entrepreneurs considering Dubai Auto Zone company formation, the zone sits on Dubai’s main arteries, with quick runs to the port, airport, and the wider GCC—so stock doesn’t sit, it rotates. Importantly, it is built around real trade: easy licensing, useful facilities, and support teams who know the difference between a one-time sale and a rolling re-export model. The fees and due dates are clear, and the paperwork for forming a company won't take up your whole week.

Prefer to set up from abroad? DAZ is remote-setup friendly via authorized agents and secure digital checks, so you can get moving before you even land.

About Dubai Auto Zone (DAZ)

DAZ was created to anchor Dubai’s position as the region’s automotive marketplace. It’s a government-affiliated, specialized free zone focused on vehicles and everything that keeps them moving. If you’re weighing Dubai Auto Zone license cost against practical value, the zone’s edge is its location and purpose: close to logistics corridors, stitched into Dubai’s trade ecosystem, and calibrated for high-volume turnover. That positioning has made DAZ a known name with traders serving the Middle East, Africa, and South Asia—a serious reach for businesses that live on velocity and margins.

Business Activities Allowed in Dubai Auto Zone

DAZ keeps the scope tight and useful. Core activities include vehicle trading (new and used), re-export, spare parts trading, warehousing, and logistics services. Many service-style activities pair well here, too: leasing, brokerage, remarketing, and value-added prep (think storage, light conditioning, or cataloging). Some operations—especially those touching safety, testing, or regulated services—can require pre-approvals from the relevant authorities, which your setup agent will flag early. The upside of this specialization is focus: licensing paths are designed around automotive reality, not generic checklists.

Step-by-Step Dubai Auto Zone (DAZ) Freezone Company Formation and Registration

Here’s the honest version of Dubai Auto Zone company formation: it’s a checklist, not a maze. You decide what you’ll actually do (trade vehicles, re-export, parts, logistics), pick a license, and reserve a name. From there, it’s document upload, fee payment, and compliance checks. When your papers are clean and your activity doesn’t need extra approvals, the DAZ freezone company registration can move quickly—often a few working days, sometimes a little longer if inspections or special clearances enter the chat. Think of it as momentum you control: the faster you provide what’s needed, the faster the license lands.

Required Documents and Timeline

You won’t be asked for your life story, just the essentials. For an individual shareholder, expect to provide:

- Passport copy (valid six months+)

- Passport-style photo (plain background)

- Proof of address (recent utility bill or tenancy/statement)

- UAE entry stamp or visa copy (if you have one)

- Basic application forms that the authority supplies

If a company owns the shares, add the usual corporate kit: Certificate of Incorporation, Memorandum/Articles, and a Board Resolution naming the new entity and manager. Not glamorous, but straightforward.

How long from “submit” to “licensed”? With standard activities and tidy documents, it’s typically several business days to around two weeks. If your activity touches testing, regulated services, or customs-facing work, plan for extra review time. No drama—just an extra lap.

Remote Registration Option

Can you handle the Dubai Auto Zone company setup from abroad? Yes—this is where DAZ is friendly. Applications can be processed remotely through authorized representatives, with documents shared digitally and originals couriered if the authority requests them. Identity checks are done in a safe way. In many cases, a short video verification or something similar is enough to prove that you are who you say you are. You don't have to fly in to get started.

Agent support helps with the small-but-critical moves—name reservation, activity mapping, signing sequences, and chasing any pre-approvals—so you’re not learning procedures on the clock. The result is the same whether you’re in Dubai or dialing in from abroad: a licensed, compliant DAZ free zone company ready to trade. Show up later for visas, banking, and facilities—after the paperwork is already working for you.

Types of Licenses and Costs in Dubai Auto Zone (DAZ) Freezone

When people talk about Dubai Auto Zone licenses, they’re really talking about how much freedom you want and how much space you need. The zone was designed for movement — vehicles coming in, out, and through — so every license here links back to that. There are three core types: Commercial, Service, and Industrial.

The Commercial License covers car import, export, and re-export, plus spare parts and accessories — the bread and butter of DAZ. Service Licenses fit support operations like vehicle inspection, brokerage, and logistics. If you modify, wrap, or lightly assemble cars, the Industrial License is your lane. All three come with 100 % foreign ownership and easy renewals, and none of them require a local partner.

What makes DAZ attractive is the cost logic. You’re not paying for a flashy address you never visit; you’re paying for access — to warehouses, customs, and a community that understands your margins. Fees scale by how many visas you need and what kind of workspace you pick: flexi-desk, office, or warehouse.

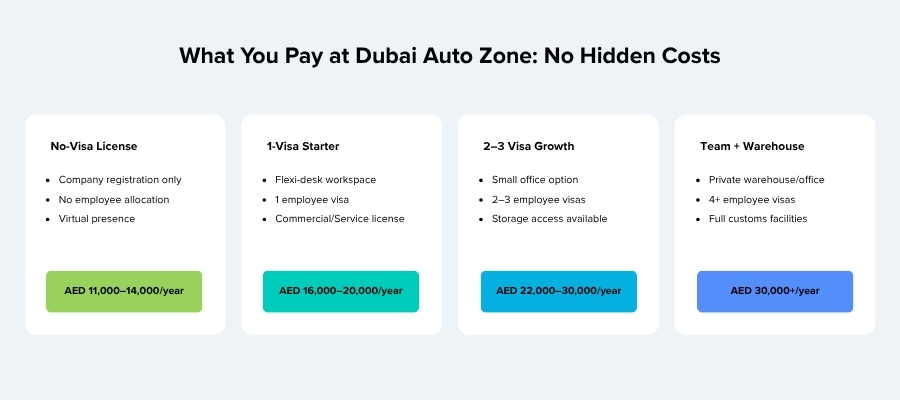

Visa Packages and Pricing Breakdown

DAZ packages are structured for clarity, not surprise. A no-visa license typically starts around AED 11,000–14,000 per year. Add one visa and the total moves to AED 16,000–20,000, including the flexi-desk option. Two- to three-visa setups usually run between AED 22,000–30,000, and full teams with storage or warehouse facilities step beyond that range.

There are a few extras you’ll want to budget for:

- E-Channel registration (federal immigration access) — roughly AED 2,000–2,500 one-time.

- Visa stamping and Emirates ID — around AED 3,500–5,000 per person, depending on insurance and status.

What you get in return is not just a license number on paper, but a space built for trade — trucks rolling in, paperwork processed fast, and a setup you can actually run, not just frame.

Dubai Auto Zone (DAZ) Corporate Tax, VAT, and Duties

Let’s talk about the part that keeps every entrepreneur up at night — taxes. The good news? Dubai Auto Zone (DAZ) sits under the UAE’s free zone framework, which means businesses registered and operating strictly within the zone generally enjoy a 0% corporate tax rate on qualifying income. That’s the headline benefit: you keep your profits, provided your transactions align with free zone-to-free zone or overseas trade. Once your company earns income inside the UAE mainland, though, the standard 9% corporate tax may kick in — depending on how your business is structured and where your invoices land.

VAT is simpler but unavoidable. Most goods and services in the UAE are subject to a 5% federal Value Added Tax (VAT). Companies that make more than AED 375,000 a year must register. Businesses in DAZ that sell cars or parts locally must charge VAT and file quarterly returns through the Federal Tax Authority portal. Companies focused solely on re-exports can often stay VAT-neutral, since transactions leaving the UAE are zero-rated — still, proper bookkeeping is what keeps those numbers clean during audits.

When it comes to customs duties, DAZ’s design as an automotive hub pays off. Imports entering DAZ for re-export are duty-free, while goods entering the UAE market pay the standard 5% customs tariff. Having on-site Dubai Customs facilities speeds up this entire cycle — no running around to external offices.

Following the rules is where things get complicated. Businesses in free zones still have to keep audited financial statements, file tax returns, and make sure they are eligible for the corporate tax regime based on their activities. That’s where partners like Consulting.ae step in. Their advisors help map out whether your DAZ company qualifies for free zone tax exemptions, when VAT registration makes sense, and how to stay compliant with the UAE’s 2023 Corporate Tax Law without paying a dirham more than required.

Dubai Auto Zone (DAZ) Company Formation: Who Should (and Shouldn’t) Choose This Free Zone?

DAZ is built for people who trade in metal and movement, not slides and slogans. If your day is about cars, parts, containers, and deadlines, you’ll feel at home here — especially if you’re considering Dubai Auto Zone company formation.

A good fit

- Vehicle traders and re-exporters. Fast customs, storage options, and routes to the GCC, Africa, and South Asia make turnover easier to plan.

- Spare-parts distributors and logistics operators. Warehousing, consolidation, and value-add prep (cataloging, light conditioning) slot neatly into the zone’s workflow.

- Leasing, brokerage, testing/inspection services. Service-style activities that sit around the automotive trade can be licensed with the right approvals.

- Small teams and owner-operators. 100% foreign ownership, visa flexibility, and straightforward renewals keep admin light.

Not a good fit

- Freelancers and non-automotive consultants. DAZ is specialized. If you sell time, code, design, or media, choose a generalist free zone.

- Heavy manufacturers. Light assembly and wrap/fit-out work are fine; large-scale production is not the game here.

- Retail, F&B, and lifestyle brands. This isn’t a consumer footfall location; it’s a trade corridor.

- Applicants expecting instant approvals in regulated niches. Testing, safety, or other controlled services can trigger extra vetting and longer timelines.

Practical caveats

- Banking. High-value, fast-moving auto trade gets extra scrutiny. Clean invoices and clear provenance matter.

- VAT and corporate tax. Zero-rated exports help margins, but VAT registration can still apply once you cross the AED 375,000 taxable-turnover threshold; keep books tight. Free-zone corporate tax relief depends on qualifying income and how/where you sell.

- Pre-approvals and nationalities. Some activities need prior sign-off; certain passports face enhanced due diligence.

If your business lives on wheels, DAZ gives you the infrastructure and neighbors you need. If it doesn’t, pick a zone that speaks your language.

Conclusion

Setting up in Dubai Auto Zone (DAZ) isn’t about chasing the cheapest license — it’s about landing where your business can actually move. The zone was built for one thing: the automotive trade in all its forms. If you deal with vehicles, spare parts, or related logistics, you’re not just getting an office here; you’re plugging into a ready-made ecosystem with customs on site, warehousing next door, and trade routes at your doorstep.

The appeal lies in its clarity. Licenses are specialized but flexible, costs are transparent, and registration is fast — often done remotely. You get full ownership, zero import duties on re-exports, and a 0% corporate tax environment on qualifying income. For traders, brokers, or logistics operators who want a low-friction base in Dubai, that combination is hard to beat.

If you’re serious about building a UAE foothold in the automotive sector, start the conversation early. Speak with experienced setup advisors who understand DAZ’s procedures and can guide you through compliance, VAT, and banking — so you spend less time in paperwork and more time doing business.

Yes. Most DAZ company formations can be completed remotely. Identity checks and document signing are handled online, often through a short video verification with the authority or your appointed agent. Original documents may be couriered later for record purposes, but physical presence isn’t required to get licensed.

In some cases, yes. DAZ itself expects full payment for the license, but several authorized agents and consulting firms provide structured installment or deferred payment plans. These are arranged privately between the client and the intermediary.

Absolutely. DAZ is designed for re-exports. You can buy, store, and ship vehicles or parts to global markets without import duties, as long as goods leave the UAE.

Anything involving vehicle inspection, testing, customs facilitation, or environmental controls may need clearance from Dubai Customs or other regulatory bodies before licensing.