Launching a company in the United Arab Emirates is not a romantic notion of palm trees and glass towers; it is a disciplined process rooted in regulation, clarity, and economic intent. A commercial license is not just a permit to trade — it is the state’s way of telling you: you may operate here, you may generate revenue here, and your business is formally part of the Emirati economy. And the country takes that commitment seriously.

The UAE built its growth on a simple philosophy: make it easy to establish a business, but keep the system clean, compliant, and well-regulated. Entrepreneurs often imagine the license as a formality that comes after the real work. In the Emirates, it is the real work. It determines who you can sell to, where you can operate, how your company will be structured, and even which banks will agree to work with you. Choosing the wrong structure doesn’t just complicate your life — it can block entire lines of business later.

At first glance, the process looks almost too smooth: online applications, fast approvals, simple fee structures. But beneath that speed sits a dense framework of economic rules, free zone regulations, federal oversight, and increasingly strict compliance requirements. Understanding this framework is what separates companies that operate comfortably from those that spend their first year fixing avoidable mistakes.

The material here covers everything from selecting mainland or free zone jurisdictions to regulatory agencies to banking, compliance, and post-licensing duties for UAE commercial licenses. No theory, no embellishment. Only current system operation.

The DNA of Doing Business in the UAE

A Country Where Licenses Aren’t Paperwork: They’re Economic Infrastructure

The UAE didn’t stumble into becoming a global business hub; it engineered the environment deliberately. Licensing is part of that architecture. In many countries, a business license is little more than a dusty formality. In the Emirates, it is a strategic instrument. The government uses licensing categories to shape sectors, attract investment, and maintain a clean, internationally compliant ecosystem.

The intensity of regulation is not meant to slow you down but to set standards. When you apply for a commercial license, you’re stepping into an economic system designed to protect trade partners, ensure tax transparency, combat money laundering, and maintain the UAE’s credibility with global financial institutions. That’s why every license — from a micro-trading company to a regional distributor — is tied to a set of predefined activities, controlled by specific authorities and often aligned with international reporting standards.

This framework also explains why the UAE can approve thousands of new companies each week without collapsing under bureaucracy. Because every license sits inside a predefined structure, the system scales. Entrepreneurs often describe the UAE process as “efficient,” but the more accurate word is engineered. Everything is intentional.

What a “Commercial License” Actually Means in Practice

A commercial license authorizes you to trade goods or provide certain types of services. It covers activities such as retail, wholesale, import–export, logistics, e-commerce, and general trading. But the UAE doesn’t treat “commercial activity” as a vague umbrella. It runs on a detailed list of economic activities — thousands of them — each with its own requirements.

This is where many newcomers get tripped up. Choosing the wrong activity category can restrict what your company is legally allowed to do. Importing a product? You need an activity that explicitly allows import–export. Selling both physical goods and digital subscriptions? You may need a combination of commercial and service activities. Want to operate across all Emirates? That’s a mainland decision, not a free zone one.

And unlike some countries, the UAE doesn’t grant blanket permission to operate outside the scope of your licensed activities. Banks also use your listed activities as part of their risk assessment. The process is forgiving if done correctly, but unforgiving if you try to improvise.

Free Zone, Mainland, and Offshore: Three Models, Three Very Different Realities

Mainland: The Model Built for Real, Local Business

A mainland license gives you full access to the UAE economy. If your plan involves serving customers in Dubai, Abu Dhabi, Sharjah, or anywhere across the seven emirates, this is the only model that makes sense. Retail, hospitality, construction, healthcare, professional services with in-person delivery — all of these require a mainland presence.

The major reform allowing 100% foreign ownership in most sectors removed the old sponsor dependency. Today, only a narrow group of strategic activities requires a local partner. Everything else is open and transparent.

Mainland operations do come with obligations: a physical office, municipality approvals, advertising regulations, tenancy registration, and compliance with local labour rules. But for companies that actually want to operate “on the ground,” nothing is more stable or respected by banks and institutions.

Free Zones: Efficient Corporate Engines for Global Operators

A Free Zone company is designed for entrepreneurs whose market is international rather than local. These jurisdictions function like economic micro-ecosystems — fast licensing, simplified compliance, modern infrastructure, and industry-specific clusters that reduce friction for startups and SMEs.

You get 100% foreign ownership, straightforward visa allocation, and the freedom to trade globally. What you do not get is direct access to mainland customers without legal structuring. Selling onshore requires a local distributor or specific approvals.

For tech companies, marketing agencies, consultancies, digital service providers, traders importing and exporting through ports, and companies with a remote-first model, Free Zones provide speed and clarity unmatched by traditional systems.

Want to learn more about UAE business setup services?

Offshore: Corporate Architecture, Not Commercial Activity

Offshore companies in the UAE (RAK ICC, JAFZA Offshore, Ajman Offshore) are built for asset protection, holding structures, and cross-border corporate planning. They don’t issue visas, don’t have offices, and don’t operate commercially inside the Emirates.

Think of them as the skeleton supporting more complex structures: ownership of Free Zone or mainland companies, management of international subsidiaries, or custody of intellectual property.

These entities follow strict compliance rules: beneficial ownership reporting, AML checks, and record-keeping requirements. They are fully legitimate — but only when used for their intended purpose.

Who Regulates What: The UAE’s Regulatory Architecture in Practice

Mainland Regulators: The DED and Its Connected Authorities

Mainland entities fall under the jurisdiction of the DED of the relevant emirate. The DED exercises authority over activity classifications, license issuance, amendments, renewals, and compliance enforcement. It also coordinates with municipal authorities for tenancy registration, civil defense for safety approvals, and sector-specific bodies for activities requiring specialized clearance.

While the federal framework is harmonized, procedural differences between emirates can influence timelines and requirements. Understanding these nuances is essential to avoid delays.

Free Zone Authorities: Autonomous Commercial Regulators

Free Zones operate as independent commercial jurisdictions within the UAE. They issue their own licenses, maintain their own regulatory rulebooks, and often provide semi-integrated corporate services, including visas and workspace allocation.

DMCC, DIFC, ADGM, RAKEZ, SHAMS, DAFZA, and others maintain activity lists that may diverge from mainland DED classifications. These authorities enforce compliance within their zones and are the sole regulatory body for Free Zone entities, except where federal approvals are mandated by law.

Federal Oversight: Cross-Emirate Regulation for Sensitive Sectors

Several federal institutions regulate activities that carry systemic or national importance. The Ministry of Economy oversees auditors, commercial agencies, and foreign branch registration. The Central Bank regulates all financial services and payment-related activities. The Ministry of Health supervises medical services, pharmaceuticals, and medical devices. The Telecommunications and Digital Government Authority regulates ICT and digital infrastructure. The Ministry of Human Resources manages labour compliance for mainland companies.

This federal layer ensures that industries with national or international exposure maintain consistent standards across the UAE.

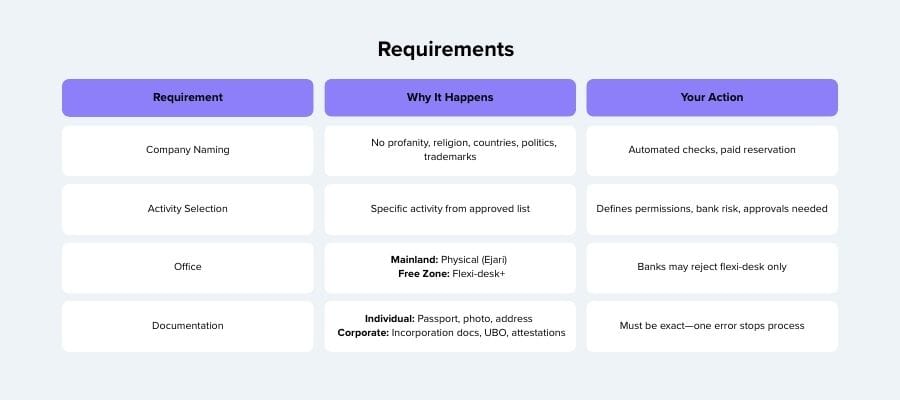

Real Requirements: What They Actually Ask For

Company Naming: A Compliance Filter, Not a Creative Playground

In the UAE, a company name is treated like an entry in a government registry — not a branding stunt. Regulators enforce clear, non-negotiable rules: no profanity, no religious terms, no country names, no political language, no claims of government affiliation. If you want to use a person’s name, it must be a shareholder’s full name. And anything that resembles an existing trademark usually gets rejected immediately.

Every authority, from mainland DEDs to Free Zones, runs automated checks. If the name is too generic, misleading, or similar to an existing entity, it doesn’t pass. The reservation process is formal and paid, and every emirate follows its own timeline.

Activity Selection: The Single Most Important Decision Most Entrepreneurs Underestimate

The UAE doesn’t issue broad, catch-all licenses. Instead, it uses highly specific activity lists: thousands of them, each tied to precise permissions. Your activity defines what you can legally sell, where you can operate, which ministries might regulate you, and even how banks view your risk profile.

Pick a vague or overly broad activity, and you risk higher scrutiny, higher costs, and future roadblocks. Pick an activity that doesn’t match what you plan to do, and you’ll be forced into amendments — each one costing time and money. If your sector is regulated (fitness, education, healthcare, HR recruitment, food trading, logistics, finance), you will need additional approvals.

Office Requirements: What’s Actually Mandatory

Mainland companies generally need a real, physical office space registered through Ejari. Even if you don’t expect daily visitors, regulators want a verifiable operational base. Some activities require site inspections before approval — especially anything involving food, medical services, warehouses, or construction.

Free Zones, on the other hand, offer multiple workspace tiers: flexi-desk, shared office, virtual desk, dedicated office, storage, and industrial units. A flexi-desk is enough for most service businesses, including consulting, software, marketing, design, and global trading.

But banks have their own criteria. Many want evidence of a physical presence, not just a flexi-desk your company never uses. This is where entrepreneurs get unpleasant surprises. The regulator says yes; the bank says no.

Want to learn more about UAE business setup services?

Documentation: Simple in Quantity, Strict in Execution

Individual shareholders need only a passport, a photo, and sometimes proof of address. Corporate shareholders require a full stack: incorporation documents, shareholder resolutions, UBO declarations, and in many cases, notarized and attested records.

Authorities aren’t asking for much — but what they ask must be exact. One wrong date, an expired passport, a missing attestation, or an unresolved UBO form can stop the process cold.

The UAE prefers clarity. If the ownership structure is clean, the paperwork moves quickly. If it’s messy, every regulator slows down.

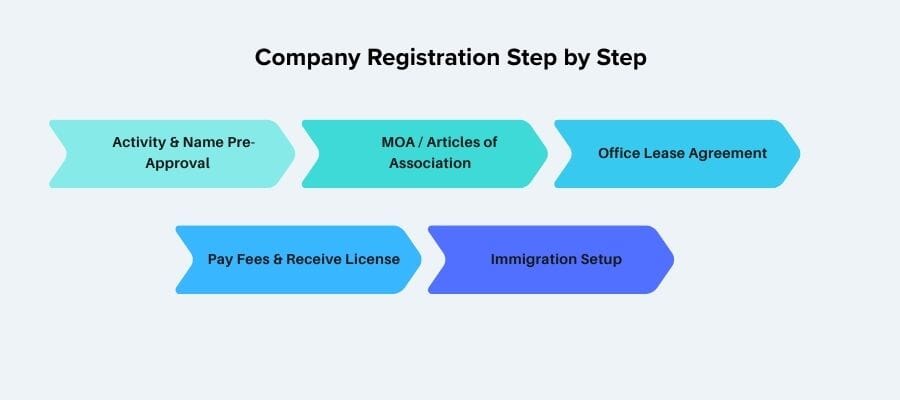

The Process, Step by Step, Without the Fairy Tale

Activity Selection and Name Pre-Approval

This stage sets the direction of your entire company. You choose your business activity from the official list and propose your trade name. The authority checks both elements and flags anything that requires external approvals or violates naming rules.

At this step, you mainly:Confirm what you’re legally allowed to do and what you’ll be called. If the activity is wrong or the name is non-compliant, you’ll have to amend the file later, which costs time and money.

Issuing the Memorandum of Association / Articles of Association

Once your activity and name are approved, the regulator prepares your company’s legal backbone. Mainland companies sign a notarized Memorandum of Association; Free Zone companies sign standardized Articles of Association. Corporate shareholders bring extra resolutions into the process.

These documents aren’t creative — they’re structural. They define who owns the company, how it’s managed, and how shares are held.

Office Lease Agreement (Ejari or Free Zone Contract)

Every business in the UAE needs to have a physical or mostly physical base. Companies on the mainland have to sign an office lease through Ejari or a similar service. In Free Zones, on the other hand, most service activities can be done from flexi-desks or shared offices.

Your workspace influences:

- Visa availability

- Banking comfort

- Whether your activity is permitted

Even if the regulator accepts a flexi-desk, your bank may expect something more substantial.

Paying Fees and Receiving the License

After the documents are signed and the workspace is confirmed, the authority calculates your final fees. When you pay, the commercial license is issued — often within hours in Free Zones, and typically within a few days for mainland setups.

What Happens Next: Echannel, Establishment Card, Visas

A company is not truly operational until it is registered in the immigration system. You activate your file, obtain your Establishment Card, and then process visas.

The sequence is:

- eChannel/ICP registration

- Establishment Card

- Owner’s visa

- Employee and dependent visas (as needed)

Once this layer is complete, the company can fully operate.

Banks, Compliance, and the Decisive Factor: “Source of Funds”

Opening a Bank Account: Realistic Expectations

Setting up the company is the easy part. Opening a bank account is where the UAE quietly separates serious businesses from improvised ventures. Banks don’t operate on enthusiasm — they operate on risk. And the moment you apply, they start evaluating you: your activity, your background, the company’s structure, your residency status, and whether your business model makes economic sense.

Most banks prefer that the owner becomes a UAE resident. Not because it’s legally required, but because it shows commitment, simplifies compliance, and allows the bank to run full KYC checks. Companies whose owners stay entirely abroad often face longer onboarding or outright denial.

Banks also look closely at your activity. Mainstream sectors — consulting, trading, e-commerce, logistics, technical services — get processed smoothly. High-risk sectors — crypto-related activities, recruitment agencies, real estate brokerage, food trading, financial services — face more scrutiny.

What banks want is clarity:

- Who owns the company

- What the business will actually do

- Where the money will come from

- Who the clients will be

- What the expected volumes look like

If that picture is coherent, accounts open quickly. If it’s vague, contradictory or over-promised, the file dies quietly.

The Less Glamorous Side: AML, KYC, and Background Screening

The UAE has invested heavily in compliance infrastructure. The country is integrated with global financial networks, which means banks follow international AML (anti-money-laundering) and KYC (know-your-customer) standards. This isn’t a country where you “just open an account” — this is a country where compliance is a serious part of banking.

During onboarding, expect the bank to examine:

- Your professional background

- Your source of wealth

- Your country of residence

- Whether your industry is regulated

- Whether your business model raises red flags

The scrutiny is not personal. It’s structural. The UAE’s reputation in global finance depends on eliminating weak compliance cases. The stronger and clearer your documentation is, the smoother your experience becomes.

Banks can also request:

- Contracts or letters of intent from clients

- A simple business plan

- Proof of previous business activity

- Personal bank statements

- In some cases, a real office rather than a flexi-desk

Nothing dramatic — but you must be ready to explain your business in simple, solid terms.

Why “Source of Funds” Is the Decisive Factor

This is the one concept entrepreneurs underestimate. Banks don’t care about your dreams, your website, or your pitch deck. They care about where the money comes from. Source of funds is the core of UAE banking compliance.

Banks need to verify three things:

- How you earned your initial capital

- Where future company revenue will originate

- Whether those flows match your actividad y perfil

If you are investing your own savings, you must prove their origin. If the money comes from another company, banks want to see that company’s background. If you plan to trade internationally, they want clarity about suppliers and buyers. The entire concept is built on transparency. Vague answers create suspicion; precise answers build confidence.

There is no trick to passing this stage. Clean documentation and honest explanations are all the bank needs. But if you can’t justify your capital, no structure — mainland or Free Zone — will make the account open faster.

Conclusion — A License Is Not a Document; It Is a Launchpad

A commercial license in the UAE is much more than a certificate on a government portal. It is the moment your business becomes part of an economic system built on clarity, regulation, and deliberate design. Mainland, Free Zone, and offshore structures each serve a different purpose, and choosing the right one shapes everything that follows — banking, visas, client access, regulatory obligations, and long-term stability.

The strength of the UAE’s business environment comes from its predictability. The rules are strict, but they are published. The procedures are fast, but they are not careless. Authorities ask for clear documentation, transparent ownership, and a credible business model because the system is engineered to protect itself, its reputation, and, ultimately, the companies that enter it.

Once the license is issued and the immigration layer is complete, a company in the UAE enjoys an operating environment that is difficult to match: low taxation, modern infrastructure, easy access to global markets, and a regulatory framework that rewards businesses that play straight. For entrepreneurs who take the process seriously, the setup is not a hurdle — it is the first strategic decision in the life of the company.

In the end, a UAE license is not paperwork. It is permission to step onto a larger stage, backed by a system that expects clarity and rewards ambition.