Every business looks smooth on the outside. Inside, it’s numbers, invoices, and late-night reconciliations. That’s where bookkeeping services in the UAE matter. They keep the chaos in order. They make sure what’s on paper matches what’s in the bank. Miss a few weeks, and VAT or corporate tax deadlines start creeping up fast. Keep it clean, and you’ll always know where you stand. Real bookkeeping isn’t just data entry — it’s control, insight, and a bit of sanity for anyone building something real in Dubai or beyond.

Who Needs Bookkeeping Services in Dubai?

Not every company needs a full finance department — but every company needs order. That’s where a bookkeeping service in Dubai steps in. Most of our clients are small and mid-sized businesses, startups that have outgrown spreadsheets, or fast-scaling teams juggling new investors and multiple bank accounts. Free zone entities come too, usually after the first VAT return turns messy or an auditor asks for a document they can’t find.

The signs are easy to spot. Bank statements don’t match invoices. Payments go missing. You’re not sure how much cash is actually available — or if you’ve already crossed a filing deadline. It’s not neglect; it’s growth catching up faster than the books.

Outsourcing bookkeeping solves that. Instead of hiring a full-time accountant, you get a steady hand that manages the numbers month after month — clean, reconciled, VAT-ready, and corporate tax–ready. It’s not just compliance; it’s visibility. Banks trust you more. Investors take you seriously. And you finally have reports that show where your money goes, not where it got lost.

That’s what bookkeeping UAE is really about — peace of mind that your numbers make sense before someone else checks them.

What’s the Difference Between Accounting and Bookkeeping?

People often mix them up, but they serve different purposes. Bookkeeping is the day-to-day work — tracking every sale, expense, and bank movement so your numbers stay real. Accounting steps in later, turning those records into insights, reports, and tax filings. You can’t do one well without the other, but bookkeeping always comes first.

Here’s the simple split:

- Bookkeeping records what happens.

- Accounting explains why it happened.

- Bookkeeping keeps your data organized.

- Accounting turns that data into strategy and compliance.

- Bookkeeping runs monthly.

- Accounting looks at the bigger picture — quarterly or yearly.

Bookkeeping Services We Provide in the UAE

No two companies earn or spend the same way. Some move fast and deal with hundreds of small transactions; others handle fewer, bigger ones that really matter. The point of good bookkeeping is to make sure every number — big or small — actually adds up. That’s what we do at Consulting.ae. We keep your financial records straight, ready for a quick check or a full audit. It’s not paperwork for paperwork’s sake. It’s about knowing your position before someone else asks. Whether you’re running a startup, scaling across the Emirates, or keeping a free zone entity compliant, our bookkeeping and accounting services adjust to your pace and your business style.

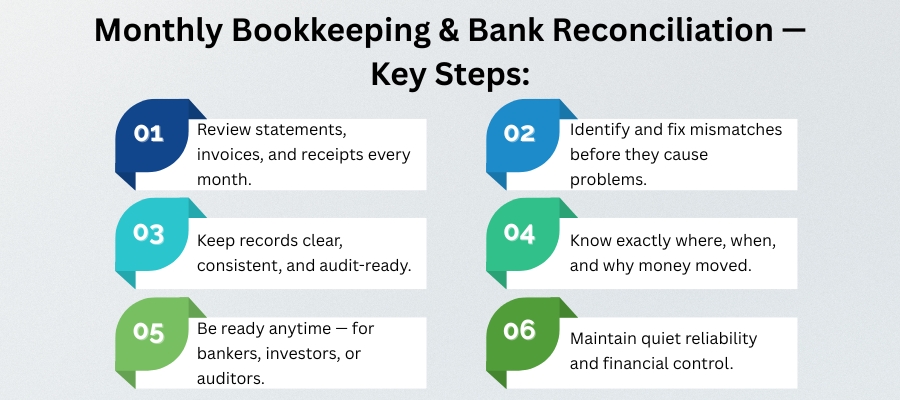

Monthly Bookkeeping and Bank Reconciliations

This is the base layer — the part that keeps everything honest. Each month, we go through your statements, invoices, and receipts and make sure they all tell the same story. When the books don't add up, we figure out why and fix the problem before it gets worse. Not only do the records look better, they are also clearer. You will know what went where, when, and why. So if a banker, investor, or auditor calls tomorrow, your numbers are already ready — not something you scramble to explain. That’s the quiet kind of reliability you only notice when it’s missing.

Want to learn more about UAE business setup services?

Accounts Payable and Accounts Receivable Support

Cash flow lives or dies by timing. We track what you owe and what others owe you, flag overdue payments, and organize statements so nothing gets lost in email threads. If your business handles dozens of invoices a week, this part keeps it running without chaos. We also set up reminders and approval flows so bills are paid on time — no surprises, no double payments, no missed receipts. With this in place, you finally know where your money is supposed to be and when it’s coming back.

VAT-Ready Record-Keeping (Codes, Evidence, Returns Support)

VAT in the UAE isn’t complicated — until your documentation is. We tag every transaction with the right VAT code, collect evidence for input and output tax, and prepare all supporting files for your quarterly return. That way, if the FTA ever asks for backup, everything is already in order. You don’t chase invoices or scramble for receipts — they’re already organized and ready to go. Proper VAT tracking also protects your refund claims and keeps penalties off your back.

Corporate Tax–Ready Books and Year-End Assistance

Corporate tax has changed how UAE companies manage their books. We make sure your records align with UAE Ministry of Finance requirements and are ready for corporate tax filings at year-end. That includes adjustments for deductible expenses, accruals, and profit calculations that match official tax formats. When your books are clean, your tax filing becomes a simple next step, not a stressful overhaul.

Management Reports (P&L, Cash Flow, KPIs)

Numbers alone don’t help much — context does. Each month, we prepare management reports that tell you how your business is performing: profit and loss, cash flow trends, and key performance indicators that actually matter. It’s a full snapshot of where you stand and where you’re heading. Real bookkeeping UAE work doesn’t stop at record-keeping — it turns data into insight you can act on.

What Affects the Cost of Bookkeeping Services in the UAE

No two businesses generate the same kind of data, and that’s why bookkeeping prices vary. The cost of bookkeeping services in the UAE depends on how much work your numbers actually need — not on a flat rate or package size.

Several factors shape the final quote. The biggest ones are your monthly transaction volume and how many bank accounts or legal entities we manage. Add to that the workload from accounts payable and receivable, how often you need management reports, and whether we’re using your software or ours. Some clients come to us for a historical clean-up, which takes extra time. Others need quick, ongoing support because of a pending audit or investor request.

After we review your setup, we map out exactly what’s needed and agree on a scope that fits your pace and level of support. Every business is different, and so is every bookkeeping plan — that’s why we only finalize costs after the first consultation.

Why Choose Consulting.ae for Bookkeeping Services in the UAE

Good bookkeeping isn’t about fancy spreadsheets — it’s about peace of mind. When numbers line up, you stop guessing and start making decisions. That’s what we aim for at Consulting.ae. Our bookkeeping services in the UAE are built for real companies with real pressure — tight deadlines, VAT checks, investor questions, and zero room for error.

End-to-End Financial Handling

We don’t do half the job. From day-to-day entries to reconciliations and monthly summaries, we handle the full circle. You send the data; we turn it into order. No chasing, no “who’s got that file?” moments.

Ready for VAT and Corporate Tax

We follow the same playbook the Federal Tax Authority (FTA) and Ministry of Finance expect — proper coding, proper evidence, proper storage. When tax season hits, you won’t be digging through folders.

Leaner, Faster, Smarter

You don’t need an accounting department to stay organized. Outsourcing to us keeps things light — predictable cost, no payroll overhead, and your books always up to date.

People Who Actually Care

We’ve done this long enough to know what a mismatch in figures feels like at 11 p.m. before a deadline. That’s why we double-check everything. We use smart, secure tools — but it’s our people who make the difference.

Accuracy With Accountability

You’ll know what we deliver, when, and how. We don’t hide behind jargon or vague promises. You get clear numbers, delivered on time, every time — the kind you can make real decisions with.

Yes, we handle both — invoices in, payments out. Our bookkeeping service in Dubai keeps your cash flow clear and your numbers organized so you always know who owes you and who you owe.

Of course. Every entry is coded correctly, matched with valid proof, and ready for Federal Tax Authority (FTA) checks. By the time your accountant files the return, your books are already audit-proof.

Yes. We prepare and maintain records exactly as required by the Ministry of Finance and FTA. Our bookkeeping and accounting services are structured to make corporate tax reporting simple and stress-free.

Nothing complicated — just invoices, receipts, payroll, and bank statements. You can email them or upload them to the shared folder we set up for your account.

We use systems like QuickBooks, Zoho Books, and Xero — all widely used across bookkeeping in Dubai and the UAE. If you already have a platform, we can plug right into it.

We keep it fair and simple. Pricing depends on how many transactions, accounts, and reports you need. After a short consultation, we’ll quote what makes sense — no hidden extras.