Every company in Sharjah lives and dies by its numbers. If those numbers aren’t right, nothing else is. Accurate books aren’t a nice extra—they keep a business alive.

Accounting work in Sharjah isn’t just about balancing spreadsheets. It’s about staying legal, making smart choices, and proving to banks and partners that you’re worth trusting. The market has become tougher and more regulated. The Federal Tax Authority now wants detailed reports, and the Ministry of Finance expects every company to follow new corporate-tax rules. Miss a filing and you pay for it. Keep things in order and doors open.

Businesses that invest in professional accounting see the difference fast. They waste less money, understand their cash flow, and can show real numbers when they want a loan or new investors. That’s what proper accounting services in Sharjah do—they give your business a clean bill of financial health.

Why Businesses in Sharjah Need Professional Accounting Services

Running a company means dealing with customers, suppliers, and staff. There’s rarely time left to chase receipts or calculate tax returns. That’s why more owners are turning to professional accountants. They handle the figures so you can handle growth.

The Role of Accounting in Business Growth

Numbers tell you whether your business is healthy or in trouble. A good accountant spots problems before they turn serious—slow payments, rising costs, weak margins. With solid data you make better calls: when to hire, when to expand, when to cut back.

Legal and Financial Compliance in the UAE

Sharjah companies must follow UAE accounting standards, VAT regulations, and the corporate-tax law. The Federal Tax Authority requires digital records, correct invoices, and on-time returns. Miss one rule and fines arrive fast. Accountants keep everything compliant and ready for inspection, which protects both your license and your reputation.

Our Accounting Services in Sharjah

Not every business needs the same kind of accounting help. A small marketing firm might just need its books checked each month. A logistics company handling large contracts might need a full accounting team, regular reports, and year-end audits. Consulting.ae builds its service around that reality. The idea is simple: you get the level of support your company actually needs, no more, no less.

Bookkeeping and Financial Reporting

Bookkeeping is where it all starts. Every purchase, sale, and payment has to land in the right place on the ledger or nothing else works. Most business owners don’t have time to chase invoices or balance statements, and mistakes pile up fast when they try. That’s why Consulting.ae manages the entire flow — recording transactions, organizing documents, and preparing monthly and quarterly reports that make sense even if you’re not an accountant.

The reports show where your cash is going and whether your margins make sense. At the end of the quarter or year, you’ll have full financial statements: profit and loss, balance sheet, and cash-flow reports that you can actually use to make decisions, not just store in a folder.

VAT and Tax Compliance

Taxes used to be straightforward in the UAE. Now they’re not. You have VAT filings, corporate-tax requirements, and more documentation than most small teams can handle. The Federal Tax Authority wants accuracy and consistency, not excuses.Consulting.ae keeps your VAT registration, return filing, and reconciliations clean. They make sure invoices are formatted correctly and all records are ready in case the FTA asks questions. Their accountants also handle corporate-tax preparation so you don’t get caught off guard by the new laws.

Auditing and Financial Review

Audits matter because numbers on paper aren’t enough anymore. Banks, investors, and even clients ask for verified accounts before doing business. Consulting.ae connects you with certified auditors who know both local practice and international standards. They go through your statements, check compliance, and flag weak spots before they cause problems.

An audit isn’t just about compliance—it’s about trust. It proves that your business is transparent, reliable, and managed properly, which counts for a lot in Sharjah’s competitive market.

Benefits of Outsourcing Accounting Services in Sharjah

Hiring full-time accountants used to make sense when everything was done on paper. Today, most companies in Sharjah find outsourcing easier, cheaper, and far more reliable. You pay for skill, not for idle hours. When laws change — and they do, often — your outsourced team stays updated, while you stay focused on your business.

Outsourcing accounting isn’t about losing control. It’s about getting experts who already know the system, the local laws, and the technology that keeps books accurate and compliant. You still get full visibility, only now you don’t need to manage a payroll for it.

Cost Efficiency and Flexibility

Maintaining an internal accounting department means salaries, benefits, training, and software costs. For small and medium businesses, that’s money better used elsewhere. Outsourced accounting gives you professionals on call without paying for downtime. You can scale up or down depending on how busy you are — more help during audit season, less when things are quiet.

Consulting.ae structures its accounting services around your budget. You pay only for what you use, not for an office full of staff you don’t always need. That kind of flexibility is what keeps many Sharjah companies stable when the market shifts.

Want to learn more about UAE business setup services?

Access to Certified Accountants

When you outsource, you instantly gain access to certified accountants who know the UAE system inside out. They understand local accounting standards, VAT procedures, and the new corporate-tax framework. That level of expertise would cost a fortune to maintain in-house.

At Consulting.ae, every account is handled by trained professionals who stay updated with Federal Tax Authority (FTA) and Ministry of Finance guidelines. You don’t have to worry about errors or missed changes in regulations—they’ve already adjusted for them.

Focus on Core Business Operations

Owners often spend half their time firefighting—chasing payments, reviewing invoices, figuring out where the cash went. Outsourcing gives that time back. You handle customers and strategy; your accounting partner handles everything else.

You can really focus on making your product better, increasing sales, or planning your next step when you're not buried with paperwork. Your company should be informed by accounting, not tired out by it.

Guaranteed Accuracy and Timely Reporting

Deadlines don’t move. VAT filings, payroll reports, and audit submissions all have fixed dates. A professional accounting partner runs on those schedules automatically. They know how to prepare reports that meet FTA standards, reconcile every figure, and flag any inconsistencies before they turn into fines.

Accuracy isn’t just about numbers—it’s about credibility. When your reports are clean, your reputation with suppliers, clients, and banks strengthens. That alone is worth the outsourcing fee.

If you’ve been juggling the books on your own or relying on a part-time accountant, it’s probably time to switch. Consulting.ae can take over the accounting side of your business so you can focus on what actually moves the company forward.

Talk to Consulting.ae today about outsourcing your accounting services in Sharjah. They’ll review your current setup, identify gaps, and show you how to cut costs without losing control of your finances.

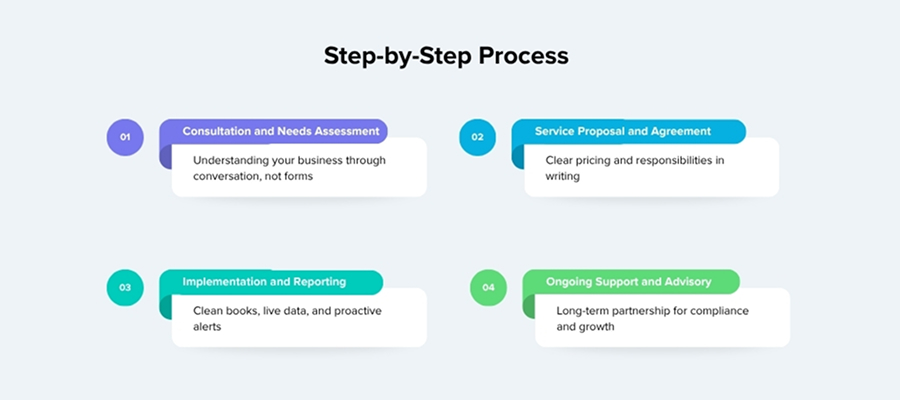

Step-by-Step Process of Working with Consulting.ae

Accounting doesn’t need to be complicated. What matters is that the work gets done correctly, on time, and with full visibility. Consulting.ae follows a process that clients actually understand — one that shows where every number comes from and what happens next.

The system wasn’t built by theory. It came from years of working with small traders, mid-sized manufacturers, family offices, and growing tech firms around Sharjah. Each business runs differently, but every one of them needs reliable books and reports that match reality. The Consulting.ae approach is the same each time: understand the business first, plan clearly, and keep the numbers straight.

Step 1. Consultation and Needs Assessment

Everything starts with a conversation. No forms, no “choose a package” gimmicks. The team wants to understand how your business really works — what you sell, how you get paid, where the money tends to get stuck. They look at your existing accounts, if you have them, and listen to what’s been going wrong.

From that talk, they identify what’s urgent and what can be improved gradually. Maybe you just need bookkeeping cleanup and VAT alignment. Maybe your accounting system is fine but your reporting lacks clarity. You’ll get a straight assessment, not a sales pitch, before any agreement is signed.

Step 2. Service Proposal and Agreement

Once they know your situation, Consulting.ae prepares a simple proposal that spells everything out: which services you’ll get, when reports will be delivered, how data will be exchanged, and what it will cost. The pricing is transparent; every item is listed.

If you agree, both parties sign a contract that spells out what they have to do and when. This paper isn't just red tape; it's a plan that makes sure everyone is responsible.

Step 3. Implementation and Reporting

Now it's time to do the hard work. The accountants bring in your data, examine the inputs, and begin making the initial reports. You’ll receive updates as they work — what’s missing, what’s been corrected, and when to expect your first full report.

Consulting.ae sets up regular financial statements, VAT filings, and performance summaries. They use secure, cloud-based tools, so you can view your accounts anytime without waiting for email updates. The numbers stay live and clean, and you stay informed.

If the team spots something unusual — like sudden cost jumps or missing payments — they alert you immediately. This proactive approach prevents end-of-year chaos and keeps your books ready for audit at any time.

Step 4. Ongoing Support and Advisory

Once your accounting runs smoothly, Consulting.ae shifts into a maintenance and advisory role. They monitor compliance deadlines, manage renewals, and prepare you early for corporate-tax obligations.

When new FTA guidelines appear, they translate them into plain terms so you can act fast. If your company starts growing or branching out, they’ll help redesign your reporting structure to match. It’s steady, long-term support that saves you from hiring a full-time finance department.

In the end, you get what every business owner wants — accurate numbers, zero surprises, and a partner who actually answers when you call.

Why Choose Consulting.ae for Accounting Services in Sharjah

When you let someone handle your accounts, you’re putting a lot of trust in them. You’re handing over the story of your company—every payment, every risk, every win. Consulting.ae treats that responsibility seriously. They’ve spent years working with Sharjah businesses that needed someone reliable to make sense of the numbers, not just record them.

Plenty of firms advertise accounting services in Sharjah, but most keep things generic. Consulting.ae doesn’t. Their team works inside the local system every day—small family stores, importers, tech startups, large manufacturers. They’ve seen the patterns, the tax changes, the surprise audits. They know what happens when records aren’t ready, and how to prevent it.

Licensed and Experienced Accountants

Every client file goes to trained accountants who know the UAE accounting standards and the Federal Tax Authority’s rules. They don’t just feed data into software; they read what it says about your business. If expenses jump or margins look thin, they catch it and tell you why. That’s what expert accounting services in Sharjah are supposed to do—protect you from small problems before they turn serious.

Consulting.ae’s accountants stay updated with Ministry of Finance and FTA announcements, so your filings always match the newest requirements. You don’t have to follow every change in tax law; they already have.

Transparent Pricing and Reliable Communication

Money talk should be simple. You’ll know the cost of every service before anything starts. No hidden extras, no vague wording. You get a clear quote, you agree, and they stick to it. Communication works the same way—straight answers, quick replies, and people who pick up the phone.

Clients who moved from in-house teams usually say the same thing: relief. Reports arrive when promised, questions get real answers, and mistakes stop eating up weekends.

Proven Results and Client Trust

Over time, Consulting.ae has become the steady financial partner behind many local firms. Their business accounting services Sharjah clients rely on every month keep operations smooth and audits uneventful. They’ve straightened messy ledgers, helped companies pass FTA inspections without penalties, and built trust where it mattered most—with banks, partners, and regulators.

That’s why businesses stay. With Consulting.ae, your books are in the hands of people who treat accuracy like reputation: something you earn, keep, and never gamble with.

Why is professional accounting important for businesses in Sharjah?

Because numbers don’t lie — but they can mislead you if no one’s watching them properly. Most fines in Sharjah come from small errors: wrong invoices, late VAT filings, missed entries. When your books are clean, you see what’s really happening in your business. That’s what keeps you safe and helps you grow.

How can outsourced accounting reduce business costs?

Keeping an in-house accountant sounds easy until you add up the salaries, visas, and training. Outsourcing skips all that. You pay for work done, not for time wasted. It’s cheaper, cleaner, and you still get people who know Sharjah’s tax rules by heart.

Is VAT compliance included in accounting services?

Of course. VAT sits in the middle of every transaction now. Consulting.ae handles all of it — returns, reconciliations, invoices — so you don’t spend half your week chasing paperwork.

How often are financial reports prepared?

As often as you need them. Most clients prefer monthly updates because business moves fast here. What matters more is that the reports are accurate and on your desk when you expect them, not weeks later.

If your accounts are messy, or you’re tired of fixing small errors that cost big money, let Consulting.ae take it off your plate. They know Sharjah, they know the laws, and they’ll keep your numbers straight.