Opening a bank account shouldn’t feel like decoding a puzzle, but many people find Abu Dhabi Bank account opening surprisingly confusing once they start. Different banks ask for different things, timelines vary, and rules for residents and non-residents aren’t always clear.

If you’re trying to open a bank account in Abu Dhabi for personal use or for your company, having someone walk you through the process saves a lot of stress. This guide breaks down what matters, what banks usually look for, and how to move through the process without guesswork.

Types of Bank Accounts to Open in Abu Dhabi

When you open a bank account in Abu Dhabi, you’re usually choosing between a few familiar options — but how they’re used in real life matters.

For everyday living, you’ve got current accounts (salary in, bills out, card payments, transfers) and savings accounts if you want to park money and grow a balance.

Running a business? Then you’ll need a corporate account to send invoices, pay staff, and keep company money separate from your personal life.

Some banks also offer options for non-residents, but those often come with stricter checks and higher minimum balances.

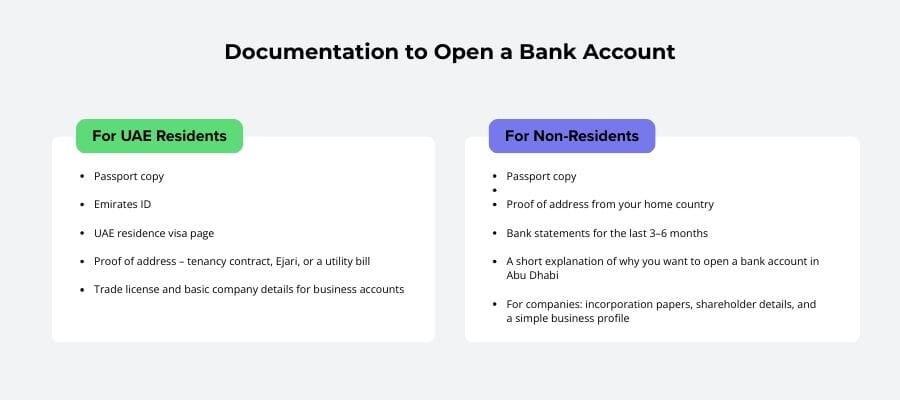

Documentation to Open a Bank Account

Banks in Abu Dhabi aren’t trying to trick you with documents. They just want to understand two basic things: who you are and where your money comes from. The list changes a bit depending on whether you already live in the UAE or you’re still based abroad.

For UAE Residents

If you’re a resident, life is easier. The system already “knows” you, so most banks follow a familiar pattern. Usually they ask for:

- Passport copy

- Emirates ID

- UAE residence visa page

- Proof of address – tenancy contract, Ejari, or a utility bill

- Trade license and basic company details for business accounts

Nothing here is exotic. As long as your story, income, and documents match, opening the account is mostly a matter of time, not drama.

For Non-Residents

For non-residents, Abu Dhabi Bank account opening is still possible, but banks look a bit closer. You don’t have local history yet, so they lean on home-country paperwork. Expect things like:

- Passport copy

- Proof of address from your home country

- Bank statements for the last 3–6 months

- A short explanation of why you want to open a bank account in Abu Dhabi

- For companies: incorporation papers, shareholder details, and a simple business profile

They’re not judging you; they’re just making sure the money and the story behind it are clean and logical. With honest paperwork, non-residents get accounts opened here every day.

Want to learn more about UAE business setup services?

How We Can Assist You

At Consulting.ae, we make the whole “banking maze” feel simple. You tell us why you need the account, and we guide you toward the banks that actually fit your situation — resident or non-resident, personal or corporate.

We help prepare the documents, explain what each bank expects, handle submissions, and keep you updated so nothing drags on quietly in the background. It’s practical, honest support that gets your account opened without stress or guessing.

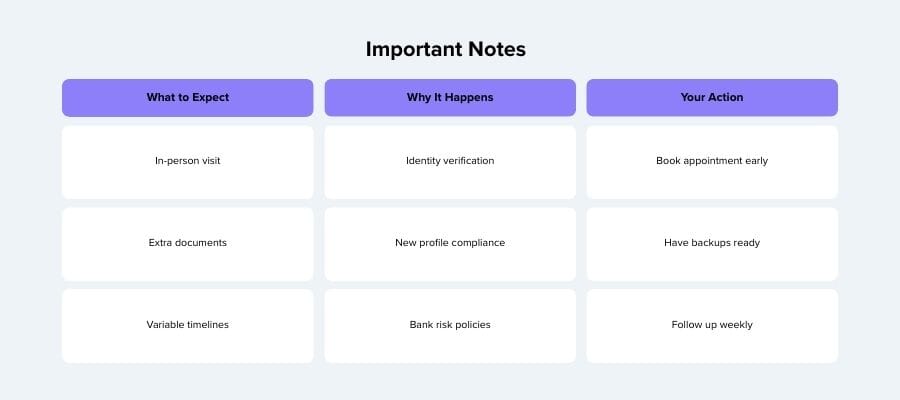

Important Notes

Before you get too deep into the process, it’s worth knowing a few things banks don’t always say upfront. Every bank has its own comfort level, its own risk filters, and its own pace. Some move fast, some take their time, and some will ask for extra documents simply because your profile is new to the UAE. None of this means something is “wrong” — it’s just how compliance works here.

Physical Presence

Most banks still want to meet you at least once. A quick in-person visit — even if you’re a non-resident — helps them verify identity, ask a few basic questions, and feel confident about opening the account. It’s usually a short appointment, but it matters.

Conclusion

Opening a bank account in the UAE, and particularly in Abu Dhabi, doesn’t need to feel like a test. Once you understand what banks look for — identity, clarity, and a clean financial story — the whole process becomes far more predictable. Whether you’re settling in the UAE or setting up a business, getting your banking sorted early makes everything else smoother. And if you’d rather not navigate the details alone, Consulting.ae can walk you through every step with clear, human guidance.

Yes. Foreigners open accounts here all the time, though non-residents usually need a bit more documentation.

Anywhere from a few days to a couple of weeks, depending on the bank and your documents.