Doing business in the UAE moves fast. New markets, new clients, and rules that keep you busy even after hours. Since VAT came into force back in 2018, every company has had to learn how to stay on the right side of the Federal Tax Authority. Getting registered isn’t just paperwork; it’s how you show the government, your partners, and your bank that your company is playing fair.

A lot of firms prefer using VAT registration services in Dubai instead of trying to figure it out alone. The process looks simple online, but the forms have to be filled just right, and one missing document can stall the whole thing. A clean registration means fewer problems later—no fines, no awkward FTA emails, no delays when you apply for contracts or financing.

For business owners coming from abroad, the rules can feel unfamiliar at first. This guide breaks it all down: who must register, what documents you’ll need, how the system works, and how Consulting.ae can take the load off your shoulders so you can get back to business.

Why Do You Need VAT Registration in the UAE?

If you plan to do business in the UAE, VAT registration isn’t optional—it’s part of the game. Since 2018, the Federal Tax Authority has treated it as a basic rule for companies that reach a certain level of activity. You can’t issue proper tax invoices or claim input VAT without it, and you definitely don’t want to be caught operating outside the system.

Once your business is registered, you get a Tax Registration Number, or TRN. That simple code shows banks, suppliers, and clients that you’re legitimate. Many larger companies won’t even process a payment if that number isn’t on your invoice. It’s also the only way to recover the VAT you pay on your own expenses, which makes a real difference when margins are tight.

Skipping registration or delaying it brings problems fast. The FTA can impose fines, freeze refund claims, or even suspend your tax account. And when that happens, fixing it takes time and money.

So yes, VAT registration keeps you compliant, but it also opens doors. It’s both protection and opportunity rolled into one.

Who Must Register for VAT and When?

In the UAE, VAT registration depends on how much business you actually do. The Federal Tax Authority looks mainly at your annual taxable turnover—that means all sales and imports that fall under VAT, not just profit.

If your total taxable supplies or imports reach AED 375,000 within the past 12 months, you must register for VAT. That’s written directly into Federal Decree-Law No. 8 of 2017, issued by the Federal Tax Authority (FTA), and still stands today. You’re also required to register if you expect to pass that figure soon. The FTA doesn’t wait until you’ve already gone over the limit; you’re supposed to apply ahead of time.

There’s also a voluntary registration window. Any business that earns more than AED 187,500 a year in taxable supplies can choose to register even before it’s mandatory. Many smaller firms do this because it allows them to recover VAT on expenses such as rent, equipment, or professional services.

If you own several companies under common control, you can apply for VAT group registration so that the entire group files under one Tax Registration Number (TRN). This option helps avoid VAT being charged between related entities—something that saves both time and paperwork.

It’s worth noting that certain operations—like importing goods from outside the GCC, signing new contracts that include VAT clauses, or beginning regular mainland sales—can trigger registration sooner. In short, once your activities start to look like a real ongoing business, the FTA expects you to be in the system.

Documents Required for VAT Registration

Before you open the FTA portal, get your documents ready. It saves hours later. The system rejects anything unclear, and resubmitting means waiting all over again.

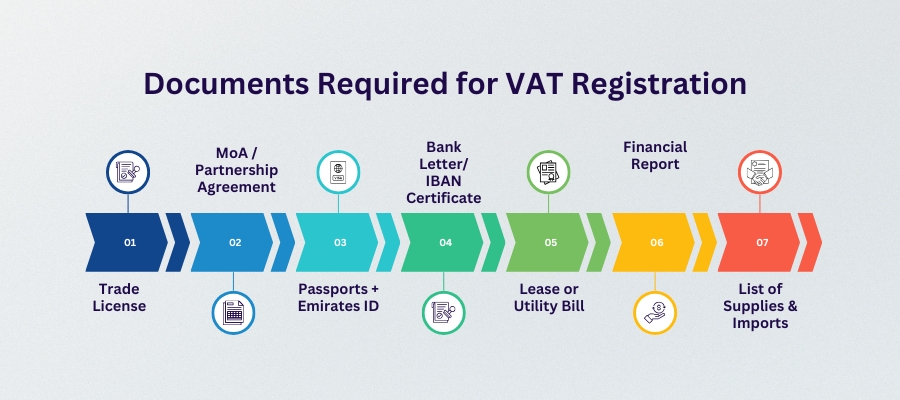

Here’s what you’ll need:

- Trade License – current and showing your activity exactly as you do it.

- Memorandum of Association (MoA) or partnership paper – so the FTA sees who owns the company and who signs on its behalf.

- Passport copies + Emirates IDs – for every owner or authorized person. No exceptions.

- Bank letter or IBAN certificate – from your UAE bank, confirming the account used for VAT refunds and payments.

- Lease agreement or utility bill – proof of where your office really is; not a P.O. box.

- Financial statement or sales summary – to prove turnover for the past 12 months, or forecast if you’re new.

- List of supplies and imports – short note describing what you sell, what you buy, and where it goes.

That’s the standard set. Consultants usually double-check everything because the FTA portal will reject a file if one number or name doesn’t match across documents. Better to spend half an hour reviewing now than lose a week later waiting for re-approval.

How to Register for VAT in the UAE: Step-by-Step

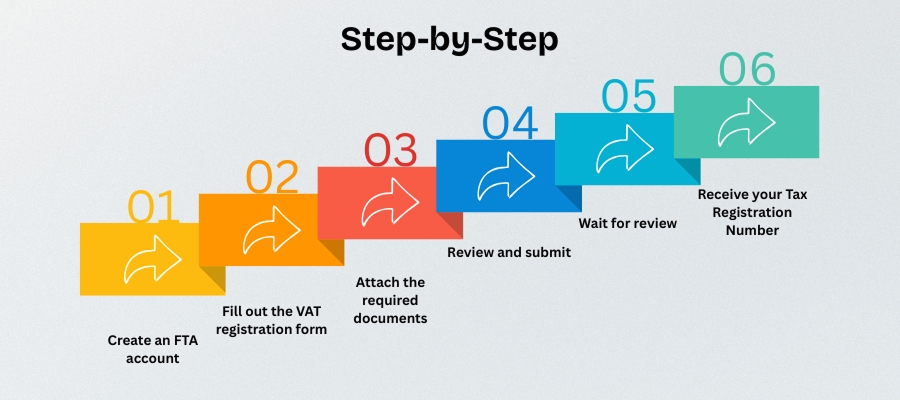

The Federal Tax Authority site is where everything occurs online. No paper forms and no submitting in person. If your papers are ready and the names are precisely the same, things normally go well. This is how it truly goes:

Go to the FTA website and open an e-Services account using a company email. You’ll confirm through a link. Keep the login details safe; that’s the same account you’ll use later for returns.

Inside the portal, choose “Register for VAT.” The form asks for basic information—trade license number, address, contact person, and your expected turnover. Write everything exactly as on your documents.

Upload the PDFs one by one. Each file has to be under the size limit and clearly readable. If something’s missing, the FTA system blocks submission.

Once everything’s attached, go through it again. Small mistakes like wrong activity codes or typos in passport numbers cause delays. When it looks clean, submit the application.

The FTA checks your details. If they need clarification, they’ll email you directly. Respond fast—it keeps your case from going back to the queue.

When approved, the FTA issues a TRN certificate. That’s your company’s tax ID. You’ll use it on invoices, contracts, and every future return.

Once this part is done, your business is officially in the VAT system. You can start issuing tax invoices, collecting VAT, and claiming input tax on eligible expenses.

VAT Registration in UAE: Timeline, Costs, and Penalties

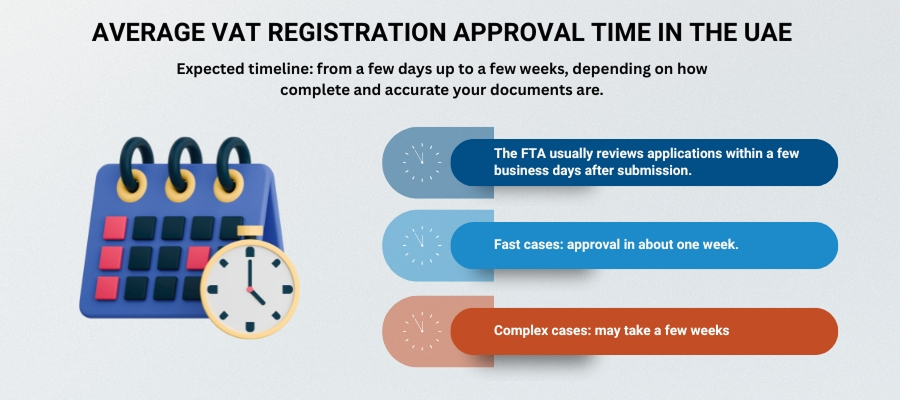

It doesn't take long to get a TRN, but it doesn't happen right away either. The most important thing is precision. Approval goes quicker if everything is in order. The FTA pauses the file and requests an explanation if the papers don't match. This restarts the clock.

Typical Timeline for UAE VAT Registration

The FTA normally looks into the application within a few business days after it is sent in. Some approvals get through in a week, but if there are many owners, overseas directors, or missing information, it may take longer. In real life, you might anticipate anything from a few days to a few weeks. That's normal. It's not random; it simply depends on how tidy the file is.

Consultants speed this up by catching errors before submission—simple things like mismatched addresses or license numbers can delay the TRN. Getting those right the first time saves a lot of back-and-forth later.

Want to learn more about UAE business setup services?

VAT Registration Costs in the UAE

When we talk about “costs,” we mean official or third-party expenses, not the consultant’s service fee. That includes any government-related charges that may apply, translation or attestation fees, notarization if needed, and sometimes courier services for document delivery.

The Federal Tax Authority itself doesn’t charge for basic registration, but there may be indirect costs. For example, if your documents are in another language, they must be translated and attested in Arabic. The same goes for power of attorney letters or shareholder authorizations—those often require notarization.

So, while the FTA’s portal doesn’t bill you directly for applying, the supporting paperwork can still carry some expense through these third-party processes.

Common VAT Penalties

Penalties are where the FTA has zero tolerance.

- Late registration brings a fixed fine as per the latest FTA schedule.

- Late VAT return filing or late payment adds daily penalties until settled.

- Submitting incorrect or incomplete data can also attract fines, especially if it affects the tax amount owed.

All penalty rates and conditions are public and listed on the FTA’s website, updated regularly. The point is simple—register early, file correctly, and you’ll avoid problems.

How Consulting.ae Helps With VAT Registration

VAT registration looks easy online, but it’s rarely that simple once you start uploading documents. The FTA portal is strict, and one mismatched name or expired file can freeze the whole application. That’s the point where most companies call in help.

Consulting.ae steps in early. They first check whether your business actually has to register or if it can do it voluntarily. Sometimes group registration makes more sense, especially if you run more than one license under the same ownership. Figuring that out first saves a lot of rework later.

Then they go through your papers. Trade license, MoA, Emirates IDs, bank letters—everything is checked for consistency. The team spots small issues before the FTA does, which is what keeps your file moving.

Once the documents are ready, they handle the portal. They fill out the form, upload attachments, and talk directly to the FTA if something needs clarification. You don’t chase emails; they do.

When the TRN arrives, they help you use it correctly—updating invoices, training staff, and making sure your accounting software shows VAT the right way. It’s practical, not just administrative.

If you want to stop worrying about forms and deadlines, get in touch with Consulting.ae. They’ll take the registration off your plate, manage the FTA process, and deliver the TRN cleanly and without the usual back-and-forth.

Why Choose Consulting.ae for VAT Registration in the UAE

There are plenty of firms that say they can handle VAT paperwork. The difference with Consulting.ae is that they actually do it day after day—and they do it fast, clean, and quietly. No guesswork, no hidden extras.

Their consultants know the FTA system inside out because they spend most of their time working in it. They’ve registered companies in manufacturing, trading, logistics, hospitality, and even small professional firms. Each one has its own quirks: a missing tenancy contract here, a joint-owner setup there. The team has seen it all, which means they spot problems early and fix them before the FTA even asks.

Another big reason clients stay with Consulting.ae is how direct they are. You don’t get vague promises; you get clear steps and real updates. If a document isn’t right, they’ll tell you immediately and show you how to fix it. Communication stays simple and confidential—no delays, no confusion.

The company also goes beyond registration itself. They set up clients for the long term, making sure the first VAT return is filed correctly, invoices meet format rules, and everything ties back to the TRN without errors. It’s not about filing a form—it’s about keeping your business compliant from day one.

If you’re serious about starting or expanding your business in the UAE, contact Consulting.ae. Their consultants will walk you through VAT registration from start to approval and keep your company ready for whatever the FTA asks next.

Do I really need to register for VAT in the UAE?

Yes. If your business makes taxable supplies or imports worth AED 375,000 or more in a year, VAT registration is mandatory. The law comes from Federal Decree-Law No. 8 of 2017. Staying unregistered when you qualify can lead to penalties, so it’s best to register early.

What is the VAT registration threshold here?

The mandatory threshold is AED 375,000, and the voluntary one is AED 187,500. These figures are official and still valid under current FTA regulations. If you’re unsure whether you meet them, a VAT registration consultant can calculate it for you.

How long does VAT registration take from start to TRN?

If your documents are accurate, the FTA often issues the TRN within a few working days. Complex setups or foreign ownership can take longer. Consulting.ae helps by keeping communication with the FTA clear and consistent.

Can I register for VAT voluntarily before I hit the threshold?

Yes, and many smaller companies do. Voluntary registration lets you reclaim VAT on business expenses, which helps with cash flow. It also gives your business more credibility with larger clients.

What happens if I delay or miss VAT registration?

The FTA imposes fines for late registration and may backdate your VAT obligations. That means you could owe taxes for past months plus penalties. Getting professional VAT registration services helps avoid this entirely.

Can you help me handle FTA questions during the application?

Absolutely. That’s part of what VAT registration services in Dubai cover. Consulting.ae manages communication, provides clarifications, and responds to FTA queries until your TRN is approved.

What’s the difference between VAT registration and VAT group registration?