Running a company in the UAE means living in a place that moves fast. New ideas, new markets, and plenty of rules to keep up with. Since VAT became part of the system in 2018, businesses have had to deal with paperwork that’s precise to the last detail. Missing a deadline or misunderstanding a rule can lead to real financial trouble.

That’s why many companies rely on VAT consultants in Dubai. They make sure registration, reporting, and refunds are handled correctly, and they keep an eye on every change coming from the Federal Tax Authority. Good consultants don’t just fill forms; they explain what those numbers mean for your cash flow and your long-term plans. With the right VAT partner, you can focus on growth instead of wrestling with regulations.

Why Do You Need VAT Consultants in the UAE?

Anyone who’s run a business in the UAE knows how fast the rules can change. You can be busy growing your company, and suddenly, there’s a new VAT clarification or a small update from the Federal Tax Authority that changes how you report something. Most people don’t have the time to keep up with that, let alone go line by line through tax notices.

That’s where a VAT consultant steps in. They live and breathe this stuff. Their job is to make sure you don’t overpay, underpay, or miss a deadline. It’s easy to think you can handle VAT yourself, but the system here has many small traps. Miss a filing date, issue an invoice with the wrong format, or forget to include an exempt transaction—and you’ll probably get a penalty. The FTA doesn’t overlook small mistakes.

A consultant’s value isn’t just in doing the math. It’s in seeing how VAT affects your business flow, your cash movement, and even your contracts. They’ll check that your numbers make sense before they ever reach the FTA portal. For a foreign-owned company, this support is priceless. Someone who understands both the rules and how they work in daily practice keeps you out of trouble and saves you a lot of stress.

Key VAT Rules and Regulations in the UAE

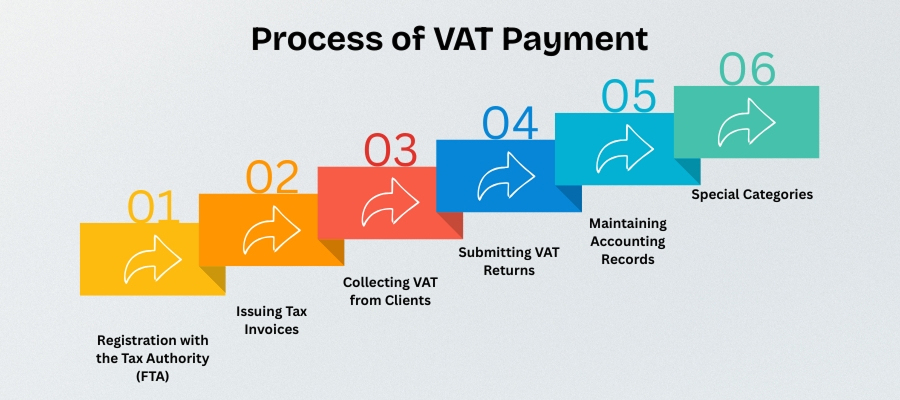

VAT in the UAE has been in place since January 2018 under the Federal Tax Authority (FTA) framework. The rate is 5%, and it covers most goods and services. Any company whose taxable sales or imports go above AED 375,000 in a 12-month period has to register with the Federal Tax Authority. Those under that limit can register voluntarily if it benefits them—for example, to recover input VAT.

Once registered, you have to issue proper tax invoices, collect VAT from clients, submit regular returns online, and keep financial records for at least five years. Some activities are exempt or zero-rated—education, healthcare, certain exports—but each case comes with conditions and paperwork.

The general idea is simple: collect the right amount, file on time, and document everything. The hard part is doing it consistently, which is exactly why many firms prefer to work with professionals who handle it daily.

What VAT Consultancy Services Does Consulting.ae Provide?

Every business in the UAE handles VAT a bit differently. Some just need help registering. Others are already deep into operations and need someone to clean up their filings or deal with an audit letter from the Federal Tax Authority. Consulting.ae covers all of that.

The work usually begins with checking how your company is set up—what you sell, where your clients are, and whether your invoices meet FTA rules. If something’s missing, the team fixes it before it becomes a problem. Once registration is complete, they prepare and file returns, making sure the numbers line up with your accounts.

Plenty of firms have accountants, but accountants aren’t always tax experts. Consulting.ae steps in to bridge that gap. They can train your staff, review your records, and explain what each change in the VAT law means for you. If an FTA officer asks for clarification or starts an audit, they’ll manage the process from start to finish.

The consultants also handle refunds—especially for export-heavy or capital-intensive businesses—and plan future transactions to avoid compliance risks. Everything is done quietly and efficiently. You get straight answers, clear timelines, and no inflated promises. The idea is simple: make VAT something you don’t have to worry about.

Want to learn more about UAE business setup services?

Cost of VAT Consultancy Services in Dubai

There isn’t a fixed rate for VAT consultancy in Dubai because every company’s situation looks different. Some firms have a handful of transactions each month; others process hundreds daily across multiple emirates. That’s why Consulting.ae never throws out random numbers. Instead, they start with a quick conversation or meeting to find out what you really need.

After that, they review your books, systems, and timelines. Once they know the scope, you receive a written proposal that lists the exact deliverables, deadlines, and fee. Nothing hidden, no surprise charges later. The idea is to agree on the scope first and then move forward with a clear plan.

VAT work can range from quick filing support to a complete review of your accounting and tax structure. Sometimes the firm gets involved only once; sometimes they manage compliance every quarter. Either way, you always know what’s being done and why. It’s straightforward, transparent, and built around your company’s reality—not a generic package.

What Affects the Price of VAT Consultancy

Several things can change the final cost:

- Company size and structure – Larger or multi-branch setups require more review time.

- Number of transactions – The more invoices and expenses you handle, the longer the reconciliation.

- Included services – Registration, filing, refunds, audits, and advisory, each has its own workload.

- Urgency – Tight deadlines or pending FTA inquiries usually mean faster turnaround and more hours.

- Type of engagement – One-off help is priced differently from continuous quarterly support.

- Documentation quality – Well-kept records save time; messy data increases review effort.

After the first consultation, Consulting.ae confirms the final fee in writing so you know exactly what to expect before any work starts.

How Consulting.ae Works With Clients

Working with Consulting.ae isn’t complicated. Most clients come in thinking it’ll be a long process full of paperwork, but it’s actually very straightforward.

It usually starts with a short conversation. You tell them what your business does and what sort of support you need with VAT. Your company can be new, you might have experienced problems with earlier filings, or you might simply want to make sure everything is done right. The team listens, asks a few useful questions, and then tells you what needs to happen next.

Once they understand your setup, they go through your records—your invoices, ledgers, and how payments flow. They’re looking for small things that could cause problems later: missing invoice fields, wrong dates, unrecorded input tax. After that check, you get a short summary of what they found and what needs fixing.

Some clients keep them on retainer for ongoing compliance. In that case, they monitor updates from the Federal Tax Authority, file returns regularly, and flag changes that might affect you. It’s continuous, quiet work—nothing flashy, just consistency.

What makes it easier is how direct they are. You get one contact person, fast replies, and clear timelines. No buzzwords, no endless forms. Just steady, transparent work that keeps you compliant and lets you focus on business.

Why Choose Consulting.ae for VAT Consultancy in the UAE

There’s no shortage of tax firms in Dubai. Everyone says they know VAT, but not everyone understands how it really works in daily business life. Consulting.ae does. They spend their days fixing real problems—late filings, refund delays, audit questions—so they know what matters and what doesn’t.

Their team is built from people who’ve worked inside accounting departments, not just behind a desk. They’ve handled logistics companies with hundreds of invoices a week, contractors juggling sub-projects, and new startups trying to make sense of their first FTA registration. That mix of experience makes a big difference when something odd shows up in your books.

The best part is how they talk to clients. You won’t get long presentations or buzzwords. You’ll get straight answers. If something can’t be done, they’ll say so. If there’s a faster way, they’ll show it to you. It’s that simple.

For businesses growing across the Emirates, Consulting.ae acts as a steady partner—checking reports, reviewing contracts, keeping communication open with the Federal Tax Authority, and stepping in fast when new rules appear. Most of their long-term clients stay for the same reason: the work just gets done, quietly and correctly.

So if VAT has been eating up your time, contact Consulting.ae and let them handle it. They’ll look through your setup, explain what needs adjusting, and take care of the rest while you focus on business. In short, they make compliance predictable—something you can stop worrying about.

If your business makes or imports more than AED 375,000 in taxable supplies within a year, you have to register. That’s the rule. It applies to almost every company, no matter the size or free-zone setup. Many owners register earlier, just to stay safe and recover VAT on startup costs.

What happens if I don’t file my VAT returns on time?

The FTA fines you, plain and simple. They don’t send reminders or second chances. Missed deadlines also make later filings harder, because penalties add up. That’s why most firms let a consultant keep the schedule.

How often do I need to submit VAT returns in Dubai?

Usually every three months, but the FTA sometimes assigns monthly filing for large operations. It depends on turnover and risk level. A consultant can check your license and tell you which one you fall under.

Can a VAT consultant help me deal with a VAT audit?

Yes, and that’s when they’re worth every dirham. They know what auditors ask for, how to prepare files, and how to respond without panic. You stay focused on work while they handle the process.

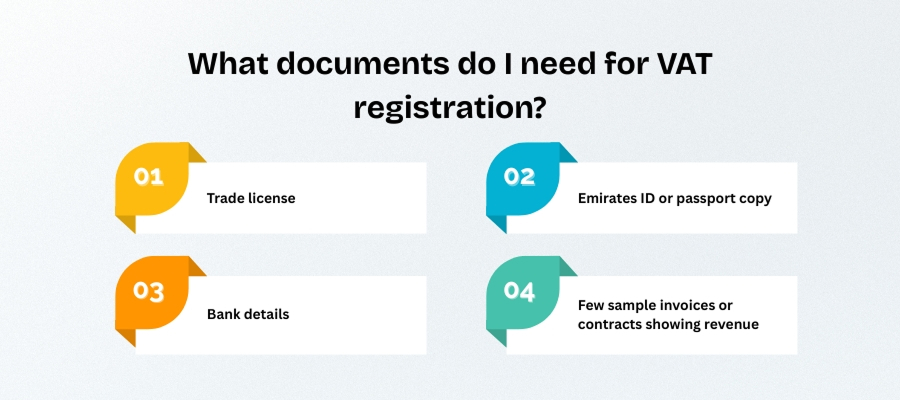

What documents do I need for VAT registration?

Trade license, Emirates ID or passport copy, bank details, and a few sample invoices or contracts showing revenue. The consultant reviews everything before submission so the FTA doesn’t send it back.

Can VAT consultants help me get a VAT refund?