Before you start a business in the Emirates, you should see a clear picture of how the UAE tax system works. It’s not overly complex, but knowing the basics from the start saves you time, money, and plenty of headaches later.

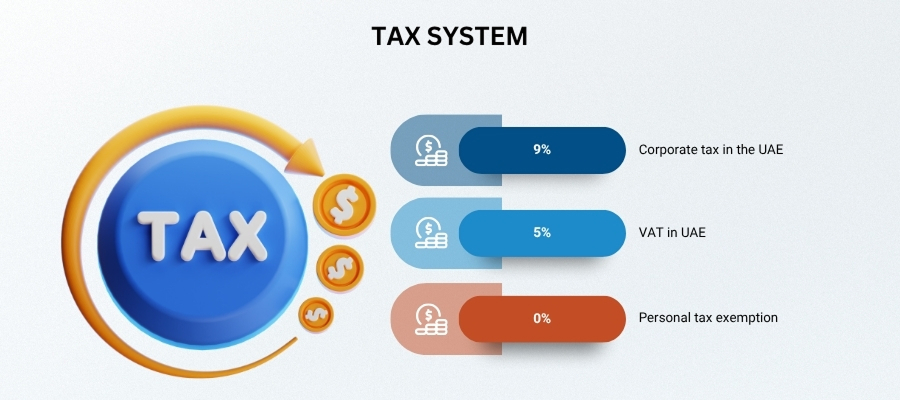

At its core, the system is designed to be business-friendly. Companies deal with a straightforward corporate tax framework, a simple value-added tax, and no personal income tax at all. For entrepreneurs and startups, that balance is part of what makes the country so attractive.

In this guide, we’ll break down the essentials — from business tax rules to personal tax exemptions — so you can focus on growth while staying fully compliant.

How Does the UAE Tax System Work for New Businesses?

The UAE keeps things simple: companies pay corporate tax on profits above a modest threshold, most sales carry a 5% VAT, and individuals generally don’t pay income tax. Learn the few key rules up front and you’ll avoid the usual surprises.

Think of the system as “lean and predictable.” You don’t need to juggle lots of different payroll taxes or complex withholding rules — but you do need to know when to register, file, and keep clean books. That’s the practical side: small friction upfront saves you time and money later.

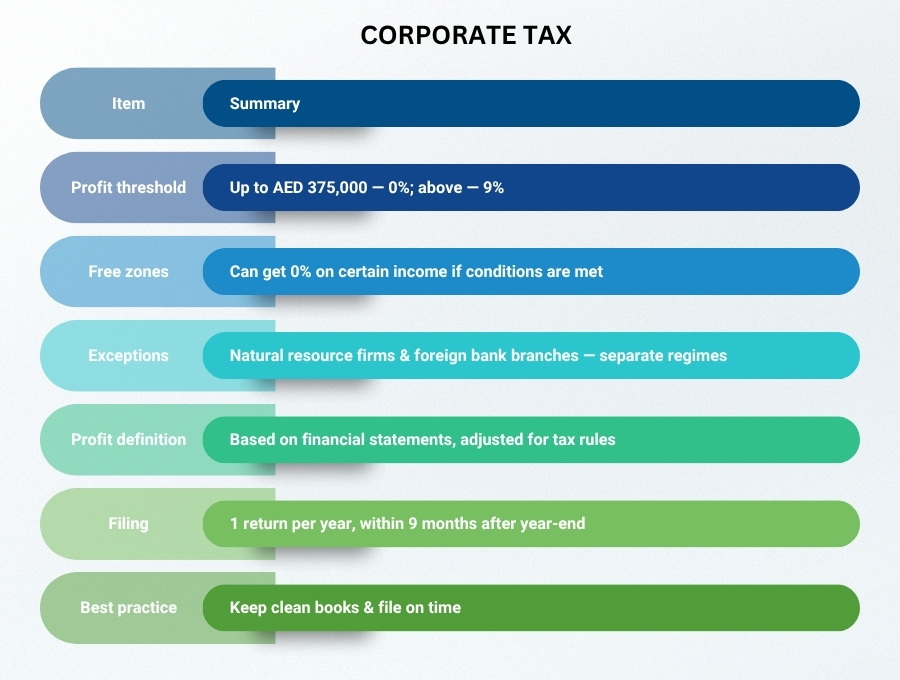

Corporate tax is applied at a low headline rate once profits exceed a set threshold — the UAE’s federal guidance sets a zero rate up to AED 375,000 and a 9% rate above that.

VAT is charged at 5% on most goods and services; resident businesses must register once taxable supplies pass AED 375,000 (with a voluntary registration point at AED 187,500).

There’s also an international element: large multinationals meeting the OECD Pillar Two criteria face a 15% minimum top-up tax under new global rules.

Key Features of the UAE Tax Environment

- Corporate tax in the UAE: 9% on profits above AED 375,000, with 0% below that amount.

- VAT in UAE: 5% standard rate, with mandatory registration once turnover passes AED 375,000.

- Personal tax exemption: no tax on wages, capital gains, or inheritance.

- Free-zone incentives and treaty network: clear rules, low rates, and incentives in many free zones.

What Is the UAE Corporate Tax and Who Needs to Pay It?

If your business in the UAE makes a profit above AED 375,000, you’ll pay corporate tax in UAE at 9%. If you’re below that threshold, the rate is zero, which means most small businesses and early-stage startups don’t feel the pressure right away.

The rules are designed to be straightforward. Earn more than AED 375,000? Set aside 9% for the taxman. Earn less? You’re in the clear. The only exception is for massive multinational groups (think global giants making over €750 million a year). They fall under the OECD’s global minimum tax rules and may be hit with a 15% top-up.

What counts as profit? It’s based on your financial statements, adjusted for tax rules. Each company files one return a year, usually within nine months of year-end. The bottom line: keep clean books, don’t miss deadlines, and you’ll avoid unnecessary headaches.

How Does VAT Work for Businesses in the UAE?

Think of VAT as a small add-on rather than a heavy burden. In the UAE, the rate is a flat 5% — not the 15–20% you see in many other countries. It applies to most goods and services, so if you’re running a business here, chances are you’ll deal with it sooner rather than later.

The rule of thumb is simple: once your sales cross AED 375,000 in a year, you must register. There’s also a voluntary option at AED 187,500. Some founders hold off, but registering early can actually help you recover VAT you’ve already paid on rent, supplies, or equipment.

After registration, VAT becomes part of your routine. You add 5% to invoices, keep track of input and output tax, and file a return (usually every quarter). The math itself isn’t complicated, but the paperwork needs to be tidy.

Where people trip up is with deadlines. Submitting late or forgetting to file doesn’t just mean a slap on the wrist — the fines stack up quickly. Paying your VAT bill is like paying your utility bill—boring, predictable, and necessary.

Handled with discipline, VAT in the UAE doesn’t get in the way of growth. It’s just another line item in your business playbook.

Want to learn more about UAE business setup services?

Are There Personal Taxes in the UAE?

The short answer: no, there’s no personal tax in the UAE. Salaries, freelance income, or dividends you take home aren’t subject to personal income tax — one of the biggest draws for entrepreneurs and expats alike.

It doesn’t stop there. The UAE also skips taxes on capital gains, property sales, or inheritance. That means when you invest or pass wealth to your family, the government doesn’t take a cut.

There are a few limited exceptions, but they apply to corporate activities like oil and gas concessions or branches of foreign banks — not to individual residents. In practice, the personal tax exemption makes the UAE one of the most attractive places in the world to live and do business.

What Tax Exemptions and Relief Options Are Available in the UAE?

One of the biggest advantages of setting up here is the range of tax breaks available to new and growing businesses. The government has built in several ways to lighten the load, especially for startups and international investors.

Free zones are the most talked-about incentive. Many of them allow qualifying companies to enjoy a 0% corporate tax rate on certain income, provided they meet substance rules and stick to local conditions.

The UAE has also signed more than 100 agreements to avoid double taxation. These agreements keep you from having to pay taxes twice on the same income, which makes doing business across borders much easier.

How Can Businesses Stay Compliant with UAE Tax Regulations?

Compliance isn’t glamorous, but it’s the thing that keeps your business out of trouble. In the UAE, the rules aren’t designed to trip you up — they’re clear. The catch is, you’ve got to stay on top of them.

Here’s what that looks like in practice:

- Register early. If your company crosses the thresholds, don’t wait for a warning letter. Register for corporate tax and VAT before the deadline. It shows you’re serious and saves you stress later.

- Keep books that actually make sense. Sloppy records are the fastest way to penalties. Think of your books as your business diary — every number should have a story behind it.

- File on time, every time. Corporate tax returns usually go in within nine months of year-end, and VAT returns are quarterly. Put reminders in your calendar. Missing a filing isn’t worth the fine.

- Don’t ignore transfer pricing. If you deal with related parties, the government expects you to prove your prices are fair. Documentation is your best friend here.

Bottom line: treat compliance like a routine health check. Do it regularly, do it properly, and the tax system in the UAE stays predictable — which is exactly what you want.

Conclusion

The UAE tax system isn’t something to fear. It’s lean, clear, and built to make life easier for businesses. You’ve got one small corporate tax to think about, a simple VAT at 5%, and no personal income tax breathing down your neck. That’s rare in today’s world.

Does that mean you can ignore it? Not at all. Keep your books tidy, register when you’re supposed to, and file on time — do those basics and you’ll stay in the government’s good books.

Think of taxes here less like a maze and more like a checklist. Tick the right boxes, and the UAE leaves you free to do what you came for: build and grow your business.

Do startups in the UAE have to pay corporate tax?

Not right away. Corporate tax in the UAE only applies once profits exceed AED 375,000. Below that, the rate is 0%, giving small businesses and startups breathing space before tax kicks in.

What is the VAT threshold in the UAE?

VAT in the UAE is mandatory if your taxable sales pass AED 375,000 in a year. Voluntary registration is possible from AED 187,500, which can help businesses reclaim VAT on expenses earlier.

Are free zone companies still exempt under the new tax regime?

Yes, but not automatically. Many free zones still offer tax in the UAE at 0% on qualifying income, provided the company meets substance rules and follows the Federal Tax Authority’s conditions.

Do individuals pay personal income tax in the UAE?

No. No personal tax on salaries, investments, or inheritances in the UAE. This personal tax exemption is a major draw for expats and entrepreneurs.

What happens if a company fails to register for VAT or corporate tax?

Missing registration deadlines can lead to fines and backdates. The UAE tax system is strict on compliance, so timely registration and filing are essential.

How can Consulting.ae help with UAE tax compliance?