Opening a corporate bank account in Dubai is a necessity for any company planning to operate in the region or expand into international markets. The main benefit is local banks, which offer direct access to international payments, multi-currency transactions and comfortable management of corporate finances, and with the right preparation, the account opening process can be completed expeditiously.

What Is a Corporate Bank Account?

A corporate bank account is an account opened not for an individual, but in the name of a company. It is needed to officially conduct business operations: to receive payment from clients, pay bills and rent, transfer salaries to employees, work with suppliers and settle accounts with foreign partners. This is the foundation of any legitimate and stable business.

There are several types of corporate accounts in the UAE:

- A resident account is suitable for companies whose owners have a UAE resident visa. Such an account gives maximum freedom: you can use all banking services without restrictions, connect internet banking and work with different currencies.

- Non-resident accounts are available for foreign entrepreneurs without a visa. It is more difficult to open them, and such accounts often have restrictions, for example, limits on transfers or longer checks.

- Offshore accounts in the UAE are usually opened by international companies for ease of settlement outside the country, but they do not give access to local transactions.

The right type of account is a real tool to grow your business and operate safely in the international arena.

Who Can Open a Corporate Account in the UAE?

Both residents and non-residents can open a corporate bank account in the UAE, but subject to certain conditions. First of all, the account is available to companies officially registered in the UAE - in free economic zones (Free Zone), on the Mainland or in an offshore jurisdiction.

The main requirement is the presence of a valid legal entity in the UAE with a full package of constituent documents: licence, articles of association, registration certificates, lease agreement (if required) and proof of company address. Also, as a rule, the bank requires a resident visa for at least one founder or manager, especially for accounts with broad-based facilities.

In general, banks in the UAE are open to customers of any nationality. However, nationals of countries with high sanctions or political risk (e.g. Iran, North Korea or Syria) may be denied an account or required to provide a much larger package of supporting documents.

When opening an account for an offshore company, a local registered agent and proof of business activity are often required. For non-resident accounts, banks have stricter requirements, including detailed justification of the sources of income and the plan of account use.

Thus, a UAE corporate account is available but requires a transparent structure, proven income and readiness for KYC/AML verification.

Required Documents to Open Dubai Corporate Bank Account

To open a corporate bank account in Dubai, a full package of documents must be prepared, which may vary depending on the type of company (Mainland, Free Zone, Offshore) and the status of the applicant (resident or non-resident). The basic list usually includes:

- Passports of all founders and managing directors (copies with notarisation if requested by the bank).

- UAE residence visa - required for resident accounts.

- Emirates ID - required for residents.

- Proof of address (e.g. utility bill, not older than 3 months).

- Company incorporation documents: licence, articles of association, certificate of incorporation, memorandum of appointment of director.

- Proof of office or flexi-desk lease (if applicable).

- Business plan or description of the company's activities - especially important for new and offshore companies.

- Personal and/or corporate account statements for the last 6-12 months.

- Resume of company owner/director detailing professional experience.

For offshore and non-resident companies, banks may request additional documents: confirmation of income sources, references from other banks and proof of real business activity. A complete and transparent package of documents significantly increases the chances of successful account opening.

Want to learn more about UAE business setup services?

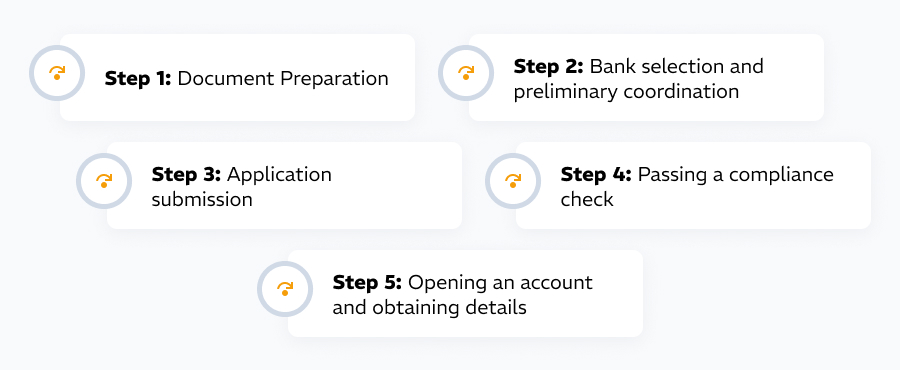

Step-by-Step Process to Open a Corporate Account in Dubai

The process of opening a corporate bank account in Dubai consists of several mandatory steps and requires careful preparation.

It is recommended to agree in advance with the bank on the possibility of opening an account for your corporate structure. Some banks are more loyal to non-residents and certain areas of business.

Collect a full package of constituent, personal and financial documents that meet the requirements of the chosen bank. At this stage, it is important to ensure the transparency of the business.

In most cases, the personal presence of the owner or manager of the company is required to sign bank forms. For non-resident and offshore companies, individual conditions or remote procedures are possible, but more often a personal visit is mandatory.

The bank conducts KYC/AML checks, analyses the origin of funds, business reputation and company structure. This stage can take from 2 to 6 weeks depending on the complexity of the business.

After approval, the bank provides details and activates access to internet banking.

The whole process takes from 4 to 8 weeks, depending on the type of account and the bank.

Corporate Maintenance Cost and Minimum Balance

When opening a corporate account with banks in Dubai, it is important to consider the minimum balance requirements and possible monthly service fees. These conditions depend directly on the bank, the type of account and the corporate structure.

Minimum balance.

- Emirates NBD offers packages with minimum balances ranging from AED 50,000 to AED 300,000.

- First Abu Dhabi Bank (FAB) sets a minimum balance of AED 50,000 for basic business accounts and up to AED 500,000 for premium packages.

- RAKBANK offers flexible terms: basic business accounts often do not require a mandatory minimum balance or set it at AED 25,000.

- In Mashreq (NeoBiz), the minimum balance starts from AED 25,000, and for more advanced packages from AED 150,000.

Monthly fees.

If the minimum balance is not maintained, the bank charges a penalty - standardly between AED 150 and AED 1,000 per month. Some banks (Emirates NBD or FAB) have a mandatory monthly account maintenance fee (typically AED 100-500), regardless of the balance.

Additional charges.

Fees for international transfers, foreign exchange transactions, cheque books and corporate cards may apply.

Failure to meet the minimum balance requirements may result in blocking of the account or restriction of transactions, so it is important to agree the financial parameters with the bank in advance.

Benefits and Limitations of a UAE Corporate Account

Opening a corporate account in the UAE provides entrepreneurs with a number of strategic advantages:

Key advantages:

- Multi-currency: most banks offer accounts in AED, USD, EUR and other currencies, which is convenient for international transactions.

- International transfers: quick access to SWIFT and the ability to make cross-border payments with minimal restrictions.

- Corporate debit and credit cards: a convenient tool for everyday expenses and business operations.

- Confidentiality: high level of bank secrecy, especially in relation to corporate and offshore accounts.

Key restrictions:

- Non-residents and offshore companies often face more complex compliance checks, limited access to banking services, inability to obtain a cheque book or credit.

- Limited access to finance: without a resident visa, banks do not provide business loans and overdrafts.

- Long verification periods: especially for offshore and high-risk industries (IT, crypto, international trade).

Thus, a UAE corporate account is a powerful tool for international business, but it requires careful preparation and a transparent structure.

How We Help with Opening a Corporate Bank Account

Opening a corporate bank account in the UAE is a complex process that requires a thorough understanding of banking requirements, local legislation and international compliance standards. Self-application without professional support often results in rejections or long delays.

Our team provides comprehensive support at all stages:

- Analysing and selecting a bank: we help you choose the right bank, taking into account the specifics of your business, the company's jurisdiction, ownership structure and minimum balance sheet requirements.

- Preparation of documents: our specialists prepare a complete package in advance, taking into account the current requirements of a particular bank, which reduces the likelihood of rejection.

- Organising meetings with the bank: we book visits, accompany the client to interviews and prepare compliance officers for questions.

- Navigating KYC/AML requirements: we explain what documents and justifications will be needed to successfully pass the review, minimising the risks of delay or rejection.

- Post-opening support: we provide support for activation of internet banking, corporate cards, and help resolve current banking issues.

With us, the process becomes transparent, fast and as efficient as possible, and your chances of successfully opening an account increase significantly.

Conclusion

Opening a corporate bank account in the UAE is a good way to access international payments without a complex tax burden. Dubai remains one of the most attractive financial centres in the world thanks to its stable economy, reliable banking system, multi-currency transactions and access to global financial instruments. The business environment in the UAE is characterised by flexibility, confidentiality and a relatively low tax burden. Corporate accounts in Dubai also offer convenient online banking, fast processing of international transfers and the possibility to manage multiple currencies efficiently.

The right corporate account provides your business with financial stability, prompt international payments and convenient access to banking services.

Ready to take the next step? Contact our consultants - we will help you choose the best bank, prepare documents and successfully open an account with minimal risks and maximum efficiency.

Can I open a corporate account in the UAE remotely?

In some cases, you can. Some banks allow remote account opening for Free Zone and offshore companies, but personal presence is often preferred, especially for Mainland companies. Remote procedures usually require detailed documentation and strong business justification. Our consultants can help you choose a bank that supports remote options.

What is the minimum deposit to open a corporate bank account?

Minimum deposit requirements vary by bank and company type. Typically, banks require maintaining a minimum balance from AED 25,000 to AED 500,000. For offshore or high-risk businesses, this amount can exceed AED 1 million. Failure to maintain the balance may result in monthly penalties, or account restrictions.

How long does it take to open a corporate bank account in the UAE?

The timeline varies depending on the bank, business structure, and industry. On average, the process takes from 6 to 8 weeks. Complex businesses, offshore companies, and high-risk sectors like crypto or international trading may face longer compliance reviews. Professional assistance significantly speeds up the process.

What banks work best for corporate accounts?