Starting a company in the UAE isn’t just about filling out forms and getting a license. It’s about making sure your business is set up the right way from day one — legally, financially, and operationally. The UAE has made its company registration requirements much clearer in the last few years, but it has also become more serious about compliance. Miss a step and you might face delays, fines, or even risk losing your license. This guide walks you through the key rules and what they mean in real life, so you can launch your business with confidence.

Why Are Compliance and Regulatory Requirements Important for Company Registration in the UAE?

Because compliance is the difference between running a smooth business and spending half your time fixing problems, the UAE has moved fast to align with international standards, and that means investors, banks, and partners expect you to have your paperwork and reporting in order.

When you follow the rules, you’re not just avoiding trouble — you’re building trust. A properly registered company is easier to open a bank account for, easier to get visas for, and far more attractive to investors. Compliance protects you in court if a dispute arises, and it shields you from big penalties.

The flip side is expensive: late VAT filings, missing UBO declarations, or ignoring ESR reports can lead to thousands of dirhams in fines. In a worst-case scenario, authorities can suspend your trade license until you fix the issue. That’s why regulatory compliance isn’t a one-time step — it’s an ongoing part of running a company here.

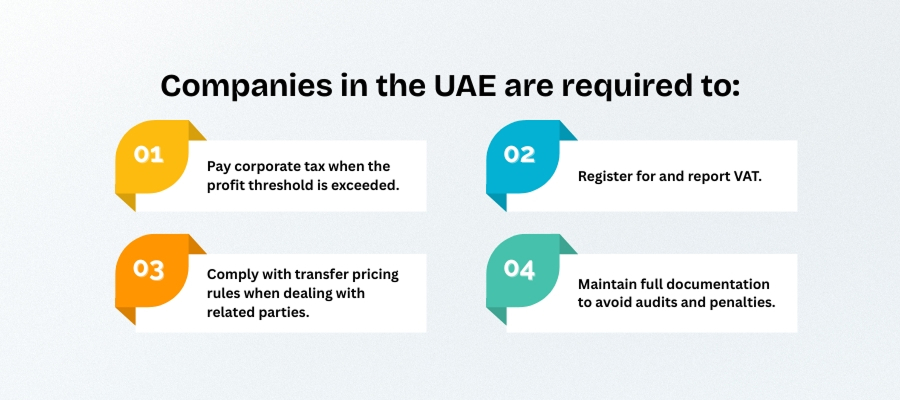

What Are the Tax Compliance Requirements for UAE Companies?

Taxes in the UAE used to be simple — there weren’t any. That changed in the last few years, and now every business owner needs to know the basics. Corporate tax, VAT, and international reporting rules are all part of the game. Get them wrong and you’re looking at late fees or license trouble.

Corporate Tax in the UAE

Since mid-2023, companies pay 9% corporate tax on profits over AED 375,000. Anything under that stays at 0%, which is a nice cushion for small businesses.

Free zone companies can still stay at 0%, but only if they stick to “qualifying income” and prove they have real operations — not just a PO box. Start billing the mainland directly without the right setup, and that 9% rate kicks in.

VAT Registration and Filing Requirements

VAT has been around since 2018 at 5%. If your turnover passes AED 375,000 a year, you have to register. Once you’re in the system, you file either monthly or quarterly, depending on what the FTA assigns you.

Miss a deadline and the fines start small — AED 1,000 — but repeat it and it doubles, plus interest adds up if you owe tax. It’s cheaper to file on time than to fight a penalty later.

Transfer Pricing and International Tax Rules

If you deal with sister companies, parent companies, or other “related parties,” you can’t just pick any price you like. The UAE follows OECD rules on transfer pricing, which means your books must show that those deals were done at market value.

Bigger groups often have to keep master files and local files ready in case the authorities ask for them. It’s paperwork, but skipping it risks a serious audit.

Want to learn more about UAE business setup services?

What Are the Financial Reporting and Auditing Requirements for UAE Companies?

Once your company is up and running, you can’t just toss receipts in a drawer and hope for the best. The UAE expects proper bookkeeping — and in most cases, annual financial statements.

Mainland LLCs must keep full accounting records and have them available for at least five years. Most free zones have the same rule, even if they don’t always ask for them unless there’s an inspection. Some free zones — like DMCC, DIFC, and ADGM — go further and require you to submit audited accounts every year.

If you’re in a free zone with lighter rules, you still need to track revenue, expenses, invoices, and payroll. Using proper accounting software is the easiest way to stay compliant and be ready in case you need to renew your license or apply for a bank loan.

If you want to get more money or sell part of your firm, audits aren't simply a pain in the neck; they also show that your figures are correct. If you don't do them, your license renewal might take longer, or you could be watched more closely.

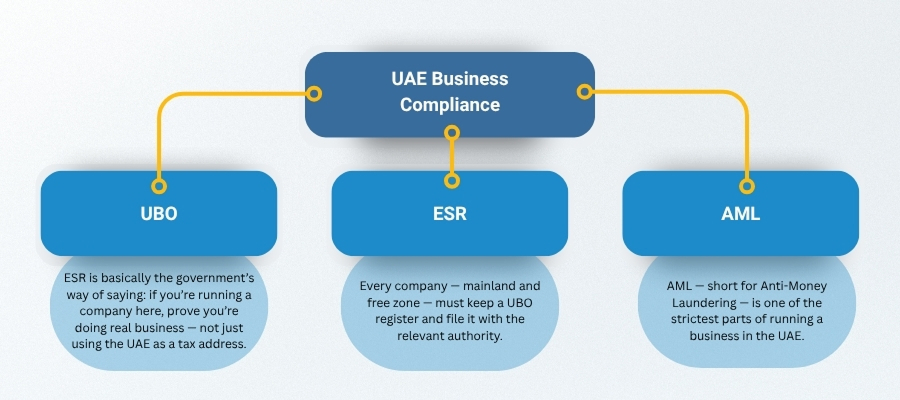

What Is the Economic Substance Regulation (ESR) in the UAE?

ESR is basically the government’s way of saying: if you’re running a company here, prove you’re doing real business — not just using the UAE as a tax address.

It applies to certain activities like banking, insurance, headquarters operations, shipping, and distribution or service centers. If your company falls under one of these “relevant activities,” you have to submit an ESR notification every year and, if required, a detailed ESR report showing where you earn your money, where your people work, and where your management decisions are made.

Companies that don’t file or file wrong information can face fines starting from AED 20,000, and in repeat cases, it can go as far as suspending your trade license. It’s better to file even if you think you’re not covered — the notification is free and shows you’re on the authorities’ radar in the right way.

What Is the Ultimate Beneficial Owner (UBO) Requirement in the UAE?

UBO rules are the UAE’s way of making sure every company can show who really owns or controls it. The ultimate beneficial owner is usually the person holding 25% or more of the shares, or the one who ultimately calls the shots behind the scenes.

Ignoring UBO rules can get expensive fast: fines start around AED 50,000 and can climb with daily penalties if you don’t fix the issue. In extreme cases, the government can suspend your license until your registration is updated. It’s one of the simplest compliance tasks, but also one of the easiest to forget — so it’s smart to set a reminder.

What Are the AML and Regulatory Compliance Requirements for UAE Companies?

AML — short for Anti-Money Laundering — is one of the strictest parts of running a business in the UAE. The rules are designed to keep illegal money out of the system, and they apply to a lot more businesses than people expect.

If you work in finance, real estate, gold trading, accounting, or even company formation, you need to run Know Your Customer (KYC) checks on your clients. That means collecting IDs, verifying where the money comes from, and keeping those records for at least five years.

If you see a transaction that looks suspicious — unusual amounts of cash, complicated transfers with no clear reason — you’re required to report it to the UAE’s Financial Intelligence Unit through the goAML portal. Not doing so can lead to heavy fines and can even put your business license at risk.

The best way to stay safe is to set up a simple compliance process: screen your clients at onboarding, keep proper records, and train staff to flag anything that doesn’t look right.

What Intellectual Property and Data Compliance Requirements Must UAE Companies Follow?

If you’re building a business in the UAE, two things need guarding: your brand and your customers’ information.

On the brand side, register your trademark early. It’s done through the UAE Ministry of Economy and isn’t just paperwork — it’s your legal shield. Once it’s registered, nobody else can legally use your name or logo. Skipping this step is risky if you plan to grow, because fighting over a stolen brand later is slow and expensive.

Then there’s data. The UAE now has a federal data protection law that works a lot like Europe’s GDPR. If you take names, phone numbers, emails, or card details from clients, you have to store them safely and not pass them around without permission.

Think of it this way: collect only what you actually need, keep it secure, and be clear with customers about how you use it. That’s cheaper than paying fines or apologizing for a data leak.

What Judicial and Dispute Resolution Systems Regulate UAE Companies?

So what happens if a deal goes wrong or a partner doesn’t pay? In the UAE, you’ve got options — and knowing them upfront can save time later.

For most businesses, disputes go through the local courts of the emirate where the company is registered. That means Dubai Courts if you’re in the Dubai mainland.

There’s also the DIFC Courts, which run on an English-language common law system. They’re faster, more business-friendly, and often chosen for big commercial contracts.

Arbitration is another popular route — centers like DIAC (Dubai International Arbitration Centre) let you settle things privately instead of dragging them through public court.

The key is to plan ahead. Put dispute resolution clauses in your contracts so you’re not arguing later about where to argue.

What Are the Annual Compliance Requirements for Companies Registered in the UAE?

Running a company here isn’t just about the launch — it’s about keeping everything in good standing year after year. The government won’t chase you for most deadlines, but if you miss them, you’ll feel it fast through fines or license blocks.

Here’s what a typical UAE business needs to tick off every year:

- Renew your trade license – usually every 12 months. No renewal, no legal right to operate.

- Renew visas – for owners, employees, and dependents linked to the company.

- File VAT returns – monthly or quarterly if you’re registered.

- Submit ESR notification/report – if your business is in a relevant activity category.

- Update your UBO register – especially if shareholders or directors change.

- Prepare and approve audited accounts – mandatory in many free zones and for mainland LLCs.

- Pay government fees on time – for immigration cards, establishment cards, and chamber of commerce memberships.

Think of this as your annual health check. Missing even one of these can block license renewal and create a chain reaction of problems (like canceled visas). A simple calendar reminder or working with a compliance service keeps you safe.

What Are the Penalties for Failing Company Registration and Compliance Requirements in the UAE?

The UAE gives you plenty of freedom to run your business, but if you miss compliance deadlines, it reacts fast. Fines don’t stay small for long, and if you ignore them, your license can be put on hold.

Here’s what usually happens when businesses slip up:

- VAT filings late? Expect AED 1,000 the first time and AED 2,000 if you repeat it. Leave a tax balance unpaid, and interest will eat into your cash flow day by day.

- Skip ESR notifications or reports? The penalty jumps from AED 20,000 for the missed notice to AED 50,000 for a missed report — not counting the extra cost of rushing to fix it later.

- Forget UBO updates? Fines start at AED 50,000 and can grow daily until you update the register.

- AML failures? These are the most serious — fines can run into hundreds of thousands, and in extreme cases, your license can be suspended.

- Miss trade license renewal? Your business activity becomes legally frozen until you pay renewal plus late fees.

One missed step might seem harmless, but it can snowball. Late license renewal means blocked visas, which means staff can’t work legally — and suddenly you’re firefighting instead of growing.

Conclusion

Keeping your company compliant in the UAE isn’t paperwork for paperwork’s sake — it’s what keeps your license clean and your business running. The rules are clear once you know them, but they don’t forgive forgetfulness. If you treat company registration requirements as part of running the business — not just something you did on day one — you avoid fines, keep your reputation solid, and stay free to focus on growth.

You’ll need a trade name reservation, passport copies of all owners, an initial approval, a notarized MOA (for LLCs), and a valid office lease or Ejari.

At least one shareholder, one director or manager, a registered address, and a declared share capital — in most free zones, this is just a nominal figure.

Most of them do, but each free zone has its own rules. Many require you to file annual accounts and keep your office within their zone.

You submit the UBO register when you set up the company, and you have 15 days to update it whenever ownership changes.

Every 12 months. Miss it, and the license goes inactive until you pay the renewal plus penalties.