Thinking about how to start a business in Dubai? The UAE isn’t just shiny towers and free zones—it’s one of the few places where ambition actually meets opportunity. Dubai grabs the headlines, sure, but Abu Dhabi, Sharjah, and Ras Al Khaimah all have their own strong cards to play. Together, they’ve turned the UAE into a real playground for entrepreneurs. For anyone wondering how to start a business in the UAE, the path is open if you prepare correctly.

Why Start a Business in Dubai and the UAE?

People don’t move their companies halfway across the world for no reason. The UAE has managed to pull off something rare: a business climate that feels both global and personal. You get solid infrastructure, straightforward rules, and a government that clearly wants you to succeed.

Key Advantages for Entrepreneurs

In all honesty, zero personal income tax is the first thing people notice. Add free zones where you own everything, and the decision becomes easier. However, money is not everything. The airports, ports, and digital backbone make operating smooth. And daily life matters too: safety, international schools, and the fact that you can find a team of people from literally everywhere on earth ready to work with you.

Popular Business Sectors in Dubai and Across the UAE

Dubai is the loud one—tech, e-commerce, tourism, and creative industries. Abu Dhabi plays the long game with finance and energy. Sharjah feels different: more culture, publishing, and education. Then there’s RAK, which quietly built itself into a solid hub for manufacturing and logistics. Each place has a personality, and that’s the real advantage—you don’t just pick “the UAE,” you pick the flavor of growth that suits your idea.

What Documents Are Required to Register a Company in Dubai or the UAE

The paperwork isn’t glamorous, but without it, your business simply won’t exist on paper. The good news? The UAE doesn’t make you jump through endless hoops. Whether you’re in Dubai, Sharjah, or Abu Dhabi, the checklist looks almost the same, with only small differences from place to place.

Here’s what almost everyone has to bring:

- Passports of all shareholders and directors

- Proof of address (a utility bill usually does the trick)

- A certificate showing your trade name is reserved

- The official application forms

- A lease or rental agreement for your office

That’s the backbone. Have it ready, and your file usually moves forward without drama. Miss one piece, though, and you’ll find yourself in limbo for weeks.

Extra Documents for Regulated Activities

Now, if you’re diving into finance, healthcare, or education, prepare for a heavier lift. Professional qualifications, ministry approvals, and audited accounts are required by regulators. It seems excessive, but it shows the system takes these sectors seriously. Give them everything upfront to avoid the “missing documents” email.

What Is the Step-by-Step Business Setup Process in Dubai and the UAE

If you’re wondering how to set up business in Dubai, the good news is the path is clearer than it looks from the outside. Every emirate follows the same basic roadmap, though the timeline shifts a little—what takes two days in a free zone might take two weeks on the mainland. Here’s how it usually plays out.

This is the big one. Are you opening a business in Dubai to trade, consult, or launch a tech startup? Your activity decides whether you go to the mainland, free zone, or offshore.

Pick a name that works under UAE rules. It’s a quick step, but it locks in your brand.

Passports, proof of address, lease agreement, forms. Nothing fancy, but miss one and you’ll sit in limbo.

For mainland setups, it’s notarized; in free zones, it’s filed directly.

The authority checks your file and gives you the green light.

This is the finish line. Once it’s in hand, you can apply for visas and—finally—open your UAE business bank account.

Want to learn more about UAE business setup services?

What Are the Legal Requirements to Start a Business in the UAE

Getting a trade license is just the first step. To run a company here, you also have to play by a few key rules that keep the business environment clean and predictable.

The first is the UBO declaration — basically, the government wants to know who really owns the company, not just whose name is printed on the paperwork.

Then comes AML compliance. Money laundering is a hot issue everywhere, and the UAE doesn’t take it lightly. Banks will ask you where your money is coming from, and you’ll need to keep records that prove your business deals are legitimate.

You also have the economic substance rules. If you claim to be based here for tax reasons, you need to prove you actually operate here: a real office, real staff, and real decision-making happening in the UAE.

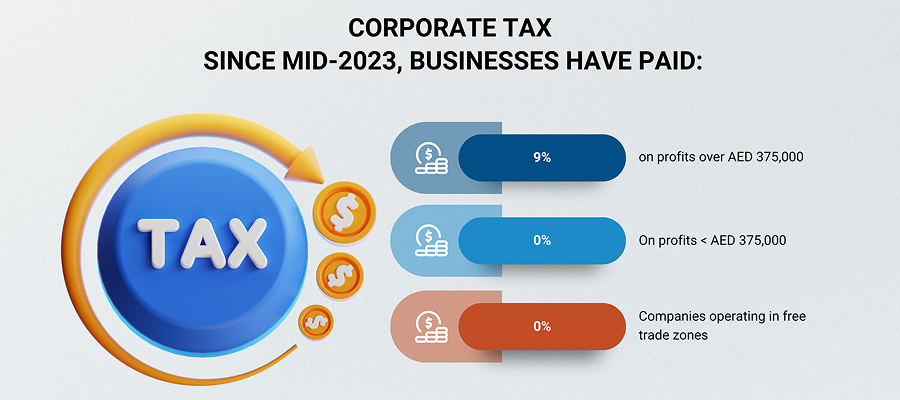

And now there’s corporate tax to think about. Since mid-2023, businesses have paid 9% on profits over AED 375,000. Anything under that stays tax-free, which is good news for smaller startups. Free zone companies can still get a 0% rate if they stick to the qualifying income rules and file the required reports.

None of this is meant to scare you — these rules exist to protect serious businesses and keep the UAE attractive for investors.

How Much Does It Cost to Start a Business in Dubai or the UAE

Typical company setup costs in Dubai and across the UAE start from around $3,000, but the final number depends on your jurisdiction, business activity, and how many visas you’ll need. Prices vary widely between free zones and mainland structures. For a detailed breakdown, see our Company Setup Cost guide.

Can I Open a Bank Account After Registering a Company in Dubai or the UAE?

Opening a bank account is the next step after getting your license. Though easy, don't anticipate a smile when you arrive. Your trade license, shareholder passports, office lease, and a comprehensive explanation of your firm will be required by banks. The KYC procedure is actual, not box-checking.

You can open the account anywhere in the UAE; however, most individuals go to Dubai. Why? Because local and worldwide celebrities are there. More banks mean more options, especially for multi-currency accounts and overseas transactions.

Once the account is live, the business feels different. You’re no longer just “registered”—you’re operational, ready to invoice, pay, and actually trade.

What Are the Common Mistakes to Avoid When Setting Up a Business in Dubai or the UAE?

A lot of people get excited about starting a business in Dubai, but excitement can blur details. The UAE is welcoming, yes, but it’s not “anything goes.” Certain missteps can slow you down—or worse, cost you money you didn’t plan to lose.

One of the biggest mistakes is skipping proper market research. Too many entrepreneurs assume that if something works back home, it will work here too. The reality? Demand shifts between emirates, and consumer habits in Dubai might look very different from those in Sharjah or Abu Dhabi. Spending a little time understanding your audience pays off more than rushing into licenses.

Another common trap is underestimating costs. People hear about tax breaks and free zones and think “cheap.” But setup still comes with fees—trade licenses, office space, visas, and compliance. Forget to budget for these, and you’ll be in for a nasty surprise.

Then there’s compliance. The UAE is serious about paperwork—trade license renewals, UBO declarations, and AML checks. Neglecting these isn’t just sloppy; it can get your license suspended. Staying on top of updates from authorities like the Dubai DED or Ministry of Economy is part of running a company here.

Finally, many newcomers neglect relationships. In the UAE, networking and trusting local partners, suppliers, and banks can open doors that paperwork cannot. Do your homework, budget correctly, follow the rules, and invest in people as well as documentation.

Conclusion

Starting a business in Dubai isn’t just paperwork and approvals—it’s stepping into a place that actually wants you to succeed. The rules are clear, the taxes are light, and the opportunities stretch across every emirate. If you’ve been wondering how to start a business in Dubai, the path is open. The only real question left is whether you’re ready to take that first step.

Not really. Even the smallest setup requires paying for a trade license and basic registration fees. You’ll need at least a modest budget to get started legally.

The lowest-cost options are usually service-based setups in free zones, such as consulting, digital marketing, or freelance-style activities. Costs vary, but they’re far lighter than retail or industrial ventures.

No. To register a company, you’ll need a residency visa. A tourist visa lets you explore options but not complete the setup.

In free zones, you can often be registered in 2–5 working days. Mainland companies usually take 2–4 weeks, depending on approvals.

Yes, but you’ll need to apply for an amendment to your trade license. Some changes are straightforward, while others may require new approvals.