If you have businesses in several countries, you already know how crazy it can become with all the varied rules, paperwork, and tax surprises that come up. The only method to remedy it is to establish a holding company in the UAE. It provides you with a single structure where all of your shares, assets, and intellectual property are kept.

The holding company itself doesn’t run day-to-day operations. It owns. It holds. That’s the point. You separate control from activity, which means if one business takes a hit, the others stay safe. Investors love this model because it gives order to the chaos — everything connected but ring-fenced.

Here’s the thing: the UAE built an entire ecosystem for this. No personal income tax. A straightforward 9 % corporate tax that only kicks in above certain thresholds. And a menu of free zones — DMCC, ADGM, DIFC, RAK ICC — where registration is quick and entirely online. You can own 100 %, no local sponsor required, and you get a jurisdiction that’s globally respected.

So whether you’re running a family office, consolidating overseas subsidiaries, or just tired of managing assets through five different countries, a UAE holding company gives you stability, privacy, and a clear legal base to grow from.

Why Set Up a Holding Company in the UAE?

The short version? It protects what you’ve built and makes your life easier. The longer version has a few key angles worth understanding.

- Real protection for your assets. Each subsidiary sits in its own box. If one goes down, the others don’t follow. Your property, trademarks, or shares stay shielded under the holding company instead of being dragged into operational risks.

- Everything under one command. You get a single point of control — one set of accounts, one set of signatures, one annual renewal. Family offices and global investors love that simplicity because it cuts the admin work to almost nothing.

- Smart tax positioning. The UAE’s tax setup is friendly but transparent. 0 % personal income tax and 9 % corporate tax above the profit threshold. Add in dozens of double-tax treaties and you’ve got a structure that’s efficient without being shady. Compliance rules like ESR and UBO keep the system credible for banks and auditors.

- Freedom to expand. You can own local or foreign subsidiaries from your UAE base, move profits around legally, and structure international investments with far fewer roadblocks.

- Privacy with proper oversight. Free zones protect shareholder data while following global reporting standards. Transfers and inheritance planning are straightforward — a big reason wealthy families choose this route.

Mainland vs Free Zone: Where to Register a Holding Company

When you decide to register a holding company in the UAE, the first real choice is location — mainland or free zone. Both work, but they serve different goals. Think of the mainland as your “local network” and the free zones as “international hubs.”

Mainland companies are regulated by the Department of Economic Development (DED) in each emirate. You can own 100 % of your entity, sign local contracts freely, and hold stakes in other onshore businesses. It’s great if you plan to interact with UAE-based subsidiaries, property, or government projects. The trade-off is a bit more paperwork, local accounting requirements, and direct corporate-tax exposure once profits cross the federal threshold.

Free zones such as DMCC, ADGM, DIFC, or RAK ICC were built for holding structures. You can form a company online, skip the physical-office hunt, and operate in a tax-neutral environment (subject to ESR and UBO rules). Free zones are perfect for investors who mainly hold overseas assets or UAE free-zone subsidiaries, not for those running daily local trade. Each zone has its own registrar, fees, and compliance cycle, but overall, the system is streamlined and business-friendly.

In practice, many investors start in a free zone for speed and cost reasons, then migrate to a mainland setup later if they need wider commercial rights.

Pro tip: If you’re unsure which route fits your structure, talk to a specialist before you file anything. The right jurisdiction can save months of corrections later. Consulting.ae helps investors compare jurisdictions and choose the right setup for their specific portfolio or family-office needs.

Who Should Open a Holding Company in the UAE?

Not everyone needs a holding company, but if you’ve got money, assets, or businesses scattered around, it’s probably time to think about one. The UAE setup fits people who want structure, safety, and a cleaner way to manage what they own.

- Family offices and private investors. If you’ve got a few properties, a small portfolio, or family assets to protect, a holding company puts them in one basket — legally organized, not tangled in personal ownership. It also makes inheritance planning smoother and less emotional.

- Business groups. When you run several subsidiaries or have partners in different countries, things can get messy fast. A UAE holding company lets you pull everything under one roof, in a jurisdiction that banks and auditors actually respect.

- Entrepreneurs and early investors. People holding stakes in multiple startups, ventures, or side projects use holding companies to isolate risk. One collapse doesn’t sink the rest.

- Anyone expanding abroad. If you want a neutral, trusted base for your global operations, the UAE gives you exactly that — reputation, treaties, and speed.

In short, it’s for anyone serious about long-term growth and tired of juggling too many moving parts.

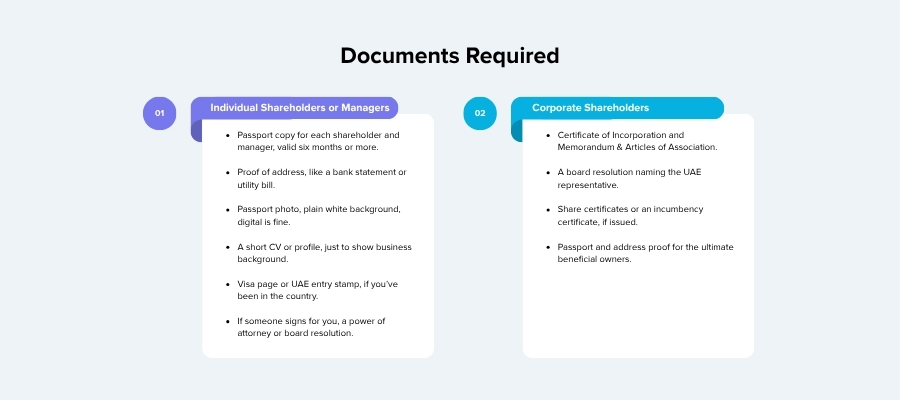

Documents Required for Holding Company Registration in the UAE

Paperwork isn’t glamorous, but it’s what decides whether your license flies through or sits in review for weeks. The UAE process is simple when the documents are clean, stamped, and in the right order. The exact list depends on where you register — mainland, free zone, or offshore — yet most authorities ask for the same core set.

Individual Shareholders or Managers

If you’re applying as a person, you’ll need:

- Passport copy for each shareholder and manager, valid six months or more.

- Proof of address, like a bank statement or utility bill.

- Passport photo, plain white background, digital is fine.

- A short CV or profile, just to show business background.

- Visa page or UAE entry stamp, if you’ve been in the country.

- If someone signs for you, a power of attorney or board resolution.

Keep everything in color, readable, and—if it comes from outside the UAE—get it notarized before submission.

Corporate Shareholders (Parent Company Documents)

When another company owns the shares, the file’s heavier:

- Certificate of Incorporation and Memorandum & Articles of Association.

- A board resolution naming the UAE representative.

- Share certificates or an incumbency certificate, if issued.

- Passport and address proof for the ultimate beneficial owners.

Every corporate document must be attested and legalized back home, then stamped by the UAE Embassy. Skip that step, and the registrar will hit pause.

Want to learn more about UAE business setup services?

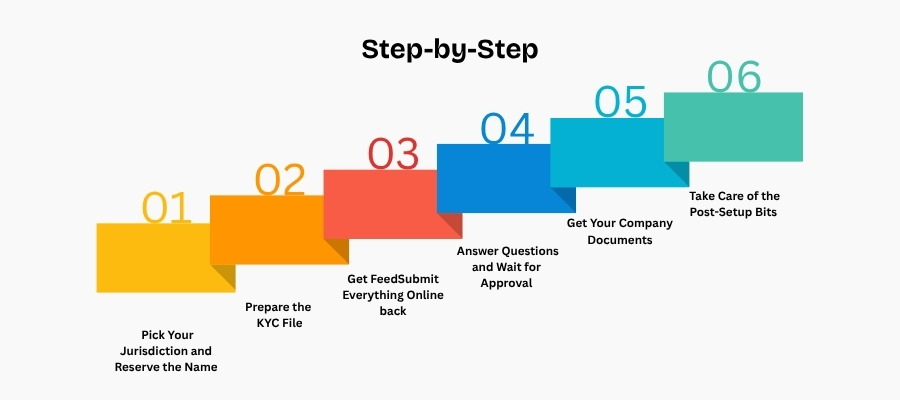

How to Register a Holding Company in the UAE: Step-by-Step

Setting up a holding company in the UAE isn’t complicated, but the order matters. Everything runs through online portals now, so once the paperwork is ready, the rest moves fast. What usually causes delays are small things — a missed stamp, a blurry scan, or an attestation that never got legalized.

1. Pick Your Jurisdiction and Reserve the Name

Decide first where your company will live. The mainland suits groups that plan to own UAE-based businesses. Free zones such as DMCC, ADGM, DIFC, or RAK ICC are better for international holdings. Each has its own portal and fee chart. You’ll check that your chosen name is free and select the activity “Holding Company.” When the registrar gives the green light, you get an email with the pre-approval.

2. Prepare the KYC File

Every shareholder and manager needs a passport copy and proof of address. If a corporate entity is involved, its incorporation papers and board resolution must be attested back home and legalized at a UAE embassy. Make sure documents are in color and passports have at least six months left.

3. Submit Everything Online

Upload the files, double-check the data, and pay the first round of fees. Most authorities review within a few working days. If something’s off, they’ll send a quick request for clarification.

4. Answer Questions and Wait for Approval

You can expect a few questions from security about who owns the business or where the money is coming from. That's how it is. Quickly and clearly answer. After the file is cleared, you'll get a draft card to check.

5. Get Your Company Documents

After the final payment, you’ll receive:

- Certificate of Incorporation

- Memorandum and Articles of Association

- License listing “Holding Company” as the activity

- Share Certificates

They’re delivered by email; you can later order stamped copies for banks or auditors.

6. Take Care of the Post-Setup Bits

To open a bank account or sponsor staff, apply for an establishment card so that the immigration file exists. Then make sure the company meets the UAE’s Economic Substance Regulations — proof that management and reporting genuinely happen inside the country.

Getting the license is the easy part. Choosing the right jurisdiction and staying compliant is what protects you later. Consulting.ae helps investors handle every stage, from registration to ongoing filings, so you spend time growing assets instead of chasing paperwork.

Cost of Holding Company Setup in the UAE

The real cost of registering a holding company in the UAE depends on where you set it up and how your structure looks, but for most investors, it lands somewhere between AED 12,000 and AED 20,000. That figure covers the official parts — registration, name approval, business license, and the basic government paperwork.

Free zones vary. DMCC and DIFC tend to charge more because of their brand and location, while RAK ICC or smaller zones come in cheaper and faster. Mainland setups sometimes add extra costs for Arabic translations, notarization, or office registration.

On top of that, keep an eye on the smaller pieces that stack up:

- Getting your documents attested or translated, if your parent company or shareholders are abroad.

- Paying for courier and legalization services at embassies or consulates.

- Optional extras like a bank account or establishment card if you want visas later.

These side costs can add another AED 2,000 to 5,000, depending on how many papers need to travel and which zone you’re working with.

One thing people often forget: the prices you see online rarely include professional service fees. Those vary, but paying a setup firm usually saves time, and mistakes cost more than the consultant’s invoice.

We list all of our fees at Consulting.ae, from government fees to optional extras, so you know exactly what you're paying for before you ever touch a dirham.

Why Choose Consulting.ae for Holding Company Setup?

When you’re forming a holding company in the UAE, the difference between a smooth process and a stressful one often comes down to who’s handling it. Consulting.ae works directly with major free zones and government departments, which means your paperwork doesn’t bounce around between middlemen.

The team knows the small details that most investors miss — how to align your structure with ESR and UBO rules, when to legalize documents abroad instead of locally, and which authority will process your file the fastest. That experience cuts through weeks of trial and error.

Clients typically value honesty the greatest. Before anything begins, you receive a detailed analysis of the costs, advice on how to maintain the business compliant year after year, and continuous help if you wish to grow or create additional subsidiaries later.

From family offices to multinational groups, Consulting.ae builds holding structures that meet both local and international standards. If you’re serious about asset protection and efficiency, you’ll want a partner that knows the system inside out — and in the UAE, that’s Consulting.ae.

What is a holding company in the UAE?

It’s a company that owns other companies or assets — not one that sells products or runs daily operations. The idea is to keep ownership and control in one place while reducing exposure to risk. It’s the structure investors use when they want stability and clean management.

Do I need a physical office for a holding company?

Usually not. Most free zones let you register with just a virtual or shared desk address since the company won’t have daily staff. Mainland setups sometimes need a small registered office, but nothing major.

How long does it take to register a holding company in the UAE?

If the paperwork is ready, most free zones finish the process within a week. Mainland companies might take a few extra days because of notarization or document attestation.

Do holding companies pay corporate tax or file ESR reports?

It depends on the income. If the company only holds shares and doesn’t earn trading revenue, it often falls outside corporate tax. Still, most have to submit an Economic Substance Notification each year to show basic management activity in the UAE.

Do I need VAT registration for a holding company that doesn’t trade?

No. A pure holding company with no sales or services doesn’t register for VAT. But once it starts invoicing or charging management fees, registration becomes mandatory.

What are the yearly renewal and compliance steps?

Each year, you renew the license, confirm shareholder and UBO details, and keep your accounting records up to date. If you’re in a free zone, renewal is quick and online.

Consulting.ae can help you with every step of starting a holding company in the UAE, from registration to compliance to renewals and even growth. This way, you can concentrate on your strategy instead of filling out documents.