Dubai HealthCare City free zone has been part of Dubai’s landscape since 2002, created to house hospitals, clinics, universities, and support services in one regulated district. From the start, the aim was not to be another general trading hub but to focus only on health, wellness, and education. That focus still defines it today.

For a business owner, the attraction is practical. If your activity is clinical practice, medical consultancy, training, or research, the free zone already has the framework in place: license categories, inspection procedures, and an environment designed for healthcare. Unlike broader zones that mix many industries, DHCC places you among peers and institutions working in the same field.

The setup process itself is straightforward. Documents are standard, approvals are clear, and many steps can be completed remotely. Costs are competitive compared to other Dubai zones, but what really makes DHCC stand out is the credibility that comes with operating inside a dedicated healthcare district.

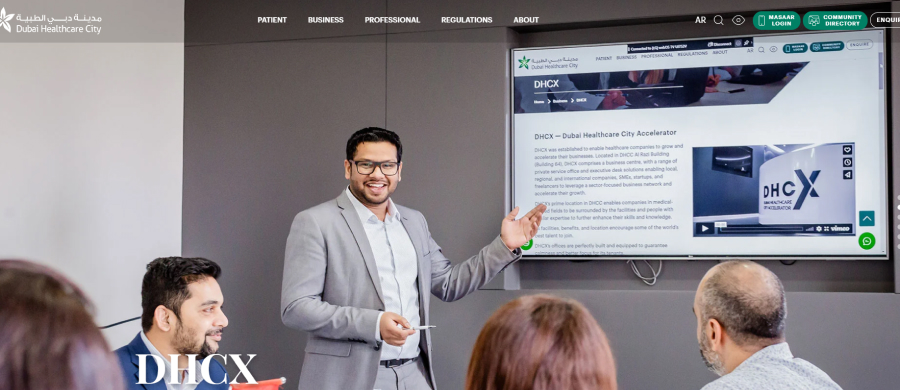

Why Choose Dubai HealthCare City for Business Setup?

For anyone in medicine, research, or wellness, choosing a location is not just about price — it’s about credibility and access. Dubai HealthCare City free zone was set up to deliver both. Instead of mixing dozens of unrelated industries under one umbrella, the authorities carved out a district where only healthcare-linked activity takes place. That decision means new businesses here immediately stand among hospitals, clinics, and universities rather than in a general trading park.

About Dubai HealthCare City

More than twenty years ago, Dubai launched HealthCare City with a simple purpose: to anchor world-class healthcare services in the emirate. Backed by the Government of Dubai, the zone operates under its own authority, which issues licenses and monitors compliance. Over the years, it has grown into a district of hospitals, specialist centers, laboratories, training institutes, and wellness providers. Its position in Oud Metha keeps it close to the airport and the business heart of the city, an advantage for both patients and professionals flying in.

This focus makes DHCC different from zones such as DMCC or IFZA. Here, a medical consultancy sits next door to a diagnostic lab, and a university program may share the same campus with a teaching hospital. The ecosystem itself becomes a reason to set up.

Business Activities Allowed in Dubai HealthCare City

The scope of activities is wide but always tied to health or education. Companies can open clinics, dental practices, or physiotherapy centers. Universities and training schools use the free zone for medical programs and professional development courses. Research groups base their laboratories here for biotech or clinical trials. Even wellness brands — from nutrition to rehabilitation — are welcome, provided they meet the authority’s licensing rules.

Some activities, especially those involving direct patient care or research with human subjects, require additional approval from the regulator. Others, like consultancy or non-clinical training, pass through with standard documentation. The key point is that the zone gives each type of business a clear framework without mixing them into unrelated sectors.

Want to learn more about UAE business setup services?

Step-by-Step Dubai HealthCare City Freezone Company Formation and Registration

Company formation in Dubai HealthCare City free zone is handled through a clear sequence managed by the Dubai HealthCare City Authority. In this zone, the stages are comparable to those in other zones; however, there is an extra layer of compliance specifically for clinical and medical activities.

If you want to set up in Dubai HealthCare City, you’ve got three options. The most common is a Free Zone Limited Liability Company (FZ-LLC) — basically a brand-new company created under DHCC law, open to both individual and corporate shareholders. If you already run a business abroad, you can register a Branch of a Foreign Company, which lets you operate in Dubai but keeps everything legally tied to the parent. Local firms can do the same by opening a Branch of a UAE Company. The structure you pick matters because it changes what paperwork you’ll need. An FZ-LLC calls for a Memorandum of Association and a resolution from the shareholders, while branches must present legalized incorporation documents and a board resolution from the parent. This choice is the starting point, since the DHCC Authority handles each application based on the form you select.

Required Documents and Timeline

Applicants begin by preparing standard personal documents. Shareholders and directors must provide copies of valid passports, recent proof of residential address (such as a utility bill or tenancy contract), and recent photographs. Healthcare professionals are also required to submit qualifications, certificates, and, in some cases, letters of good standing from regulators in their home country.

Alongside these personal documents, DHCC requires company-side paperwork depending on the chosen structure. For an FZ-LLC, shareholders must issue a formal resolution approving the incorporation. Any company engaged in clinical activity — such as a clinic, hospital, or diagnostic laboratory — must also prepare a business plan following DHCC’s prescribed format.

Once submitted, the documents are reviewed by the authority. Non-clinical businesses typically receive approval in under two weeks, while medical institutions may wait longer due to extra regulatory checks. In most cases, between fifteen and thirty working days pass between submission and the issuance of a license. If visa applications are included, the timeline can extend slightly to cover entry permits, medicals, and residence stamping.

Remote Registration Option

An important advantage of this free zone is that incorporation does not always require a personal visit to Dubai. The authority accepts applications online, and most of the verification can be managed remotely. In practice, this means that an entrepreneur based overseas can complete the bulk of the setup without travelling. Identity checks are handled by secure video calls, and licensed agents are able to sign or attest documents on behalf of the applicant. In some cases, original papers must be sent by courier, but the majority of the process is digital.

For many foreign investors, this flexibility is decisive. A doctor planning to relocate from Europe, or a health-tech founder operating from Asia, can secure a license and only travel to Dubai later when visas are ready to be stamped. This reduces the initial costs of relocation and allows the business to exist legally in the UAE while the founder is still abroad.

Types of Licenses and Costs in Dubai HealthCare City Freezone

In DHCC, there’s only one license on offer — a Commercial License. What changes from case to case is the activity you’re approved for. Some businesses fall into the clinical side — hospitals, clinics, labs, dental practices, anything that deals directly with patients. Others are non-clinical, like consultancy, training, wellness centers, or research outfits.

So you’re not picking from several license types. You’re applying for the same license, but the authority reviews your file differently depending on whether you’re running a clinic or, say, a training institute.

Costs are fairly competitive compared with other free zones. Small outfits can get started with limited space and keep the annual fees down, while larger players — universities or medical centers — can scale up by leasing more space and adding staff. Renewals are yearly, and the pricing is straightforward: government fees plus whatever optional services you choose.

Visa Packages and Pricing Breakdown

In Dubai HealthCare City, visas are not bundled into packages with the license. Instead, the process follows a clear sequence. Once the company is registered and the Commercial License is issued, the next step is to obtain an Establishment Card. This card opens the company’s immigration file with the authorities and allows the business to act as a sponsor for its owners and employees.

Once the Establishment Card is in place, you apply for visas one by one. How many you can get isn’t fixed in a package — it depends on how much office space you rent and what activity you’re licensed for. Each visa goes through the usual UAE steps: first the entry permit, then medical checks, Emirates ID, health cover, and finally the residence stamp.

This approach gives businesses flexibility. A solo consultant may apply only for their own residence visa, while a clinic or university can gradually add doctors, staff, or teaching faculty as the operation expands. Costs are transparent, since every visa is billed separately on top of the license and office lease, with government fees clearly listed.

Dubai HealthCare City Corporate Tax, VAT, and Duties

Dubai HealthCare City operates under the same federal tax framework as the rest of the UAE, but with free zone benefits that make it highly attractive. Firms in DHCC can still benefit from a 0% corporate tax rate, as long as they actually carry out their activities inside the free zone and don’t drift into non-qualifying business with the mainland. From June 2023, the UAE began applying a 9% federal tax on profits above AED 375,000, but companies that stick to the free zone rules can continue to enjoy the exemption.

VAT in the UAE is set at 5%. In practice, though, many healthcare services — especially treatment and preventive care — don’t attract VAT at all. Certain types of education are also zero-rated. Companies in DHCC still need to register once they cross the federal turnover threshold, even if their actual corporate tax stays at 0%.

On the customs side, DHCC enjoys the same benefits as other free zones: equipment and goods brought in for licensed activities aren’t hit with import or export duties.

Where most firms trip up is paperwork — VAT registration, ongoing filings, and making sure the business qualifies for exemptions. That’s where consultants earn their keep, helping new investors avoid mistakes and take full advantage of the tax breaks available in DHCC.

Dubai HealthCare City Company Formation: Who Should (and Shouldn’t) Choose This Free Zone?

Every Dubai free zone has its niche, and Dubai HealthCare City is one of the most specialized. That focus is a strength, but it also creates clear boundaries on who benefits and who does not. For investors, entrepreneurs, and professionals evaluating their options, it helps to look at the free zone in practical YES/NO terms.

Who should choose DHCC (YES):

- Freelancers and consultants in healthcare, wellness, or life sciences. A medical consultant or nutrition advisor gains credibility by operating from a healthcare-only district.

- Licensed doctors, dentists, and medical specialists who want to open outpatient clinics or private practices. The zone already has inspection systems and licensing paths tailored for them.

- Universities, colleges, and professional training providers delivering medical or healthcare-related courses. Students and staff benefit from proximity to hospitals and labs.

- Research labs, biotech firms, and clinical trial operators that need cooperation with existing healthcare facilities.

- Wellness providers — physiotherapy centers, alternative medicine, rehabilitation programs — that want to be in a regulated environment aligned with their services.

Who should not choose DHCC (NO):

- Traders and import–export companies. DHCC does not issue commercial trading licenses, so such businesses are better off in JAFZA, DMCC, or IFZA.

- Manufacturers and industrial firms. The free zone does not offer factories or warehouses, so those setups belong in industrial zones like KIZAD or RAKEZ.

- Entrepreneurs in unrelated sectors such as general e-commerce, IT development, or logistics. They will find the activity list too narrow.

- Businesses that require VAT registration for broad trading purposes, since DHCC’s licensing focus does not cover this.

- Applicants from high-risk nationalities, who often face longer review times or outright restrictions.

The point is simple: if your company belongs in the healthcare, education, or wellness ecosystem, Dubai HealthCare City free zone adds real value by placing you in the middle of it. If your business is outside that ecosystem, the specialization will feel more like a limitation than an advantage.

Conclusion

Dubai HealthCare City is unusual among the UAE’s free zones because it doesn’t try to cover everything. It was built for healthcare and wellness, and it has stuck to that mission. For anyone working in medicine, research, or education, that focus is exactly the reason to choose it. A doctor opening a clinic, a university adding a medical faculty, or a biotech team running trials will find the environment ready-made, with regulators who know what those businesses require. Being inside a district of hospitals and labs also carries weight: patients, students, and partners can see immediately that you are part of a recognized healthcare hub.

Costs are not the lowest in the UAE, but they are predictable. A one-person consultancy can keep expenses down with a flexi-desk package and a single visa, while bigger institutions can expand as needed. The process is fairly straightforward, and the fact that much of it can be done remotely reduces the barrier for foreign investors.

Of course, this is not the right zone for traders or manufacturers. If your company needs warehouses, VAT registration for imports, or a broad commercial license, another jurisdiction will be a better fit. DHCC is valuable precisely because it limits itself: the businesses here all speak the same language of healthcare.

For entrepreneurs who see their future in that space, the next step is practical. Work out which license category matches your activity, decide how many visas you will need, and seek advice before filing. Experienced advisors are able to assist you in navigating the paperwork and ensuring that permissions are obtained in a timely manner.

If you are interested in establishing a company in Dubai that is focused on healthcare, our team is able to assist you in navigating Dubai HealthCare City from the very beginning to the very end.

Yes. Most of the paperwork is handled online. You upload documents, do the ID check over a video call, and wait for approvals. The only stage where you have to be in Dubai is when your residence visa is stamped in your passport.

There’s just one license: a Commercial License. Inside that, your activity is tagged as either clinical (like clinics, hospitals, labs, dental practices) or non-clinical (consultancy, education, wellness, research). The category tells the authority what extra checks you’ll face.

You can set up a Free Zone Limited Liability Company (FZ-LLC) or, if you already have a business, register a branch. Branches can be of a UAE company or of a foreign parent. Each option comes with its own paperwork.

First comes the license. Then you apply for an Establishment Card, which is the company’s immigration file. Once you’ve got it, you can sponsor visas one by one. The number you can get depends on how much office space you lease and what activity you’re licensed for.

Corporate tax in the UAE is 9% on profits above AED 375,000, but free zone companies like those in DHCC can still qualify for 0% on “free zone income” if they stay within the rules. VAT is 5% across the UAE, though many healthcare services are exempt and some education activities are zero-rated.