Starting a company here means more than getting a trade license — it also means registering for corporate tax. UAE corporate tax registration is the step that connects your business to the Federal Tax Authority and keeps you on the right side of the new tax law. It’s not meant to slow you down; it’s meant to keep things clear. You fill out a few key details, submit the right papers, and your company becomes officially recognized for tax purposes. Done right, it’s quick, compliant, and one less thing to worry about later.

Corporate Tax Registration in the UAE: What It Involves

Corporate tax registration in the UAE is simply your company’s way of telling the Federal Tax Authority (FTA), “We’re active and ready to report income.” It’s a one-time process that gives you a Tax Registration Number (TRN) — the ID you’ll use for all future filings, payments, and correspondence.

The point isn’t just to tick a legal box. Registration puts your business on the FTA’s radar and confirms it’s operating properly under the new tax system. Once you have your registration number, you can handle returns, apply for exemptions where they apply, and show anyone — from a bank to an auditor — that your company’s setup is clean and compliant.

Who Must Register for Corporate Tax

Most businesses in the UAE have to register for corporate tax — there’s really no way around it. Mainland companies are first in line since they fall under the standard 9% rate. Free zone entities also need to register, even if they qualify as a QFZP and expect a 0% rate. Registration is what keeps that benefit safe; it tells the Federal Tax Authority (FTA) you’re following the rules and deserve to keep the incentive.

Branches of UAE or foreign companies register under their parent’s tax profile, while foreign firms with a Permanent Establishment (PE) here are treated just like local ones. If you earn income in the UAE, you register — simple as that.

Some organizations, like government bodies, pension funds, and natural resource operators, can be exempt, but even they usually need to apply for that exemption formally. The same goes for holding companies or dormant licenses — not trading doesn’t mean you’re invisible to the FTA. They still expect you to be on record.

Freelancers and sole proprietors fall into a similar space. If your income comes from ongoing business activity, you’ll likely need corporate tax registration in Dubai or whichever Emirate you operate from. And just to be clear — registration doesn’t always mean you’ll pay tax; it simply means you’re part of the system and ready when the FTA calls.

Documents Required for Corporate Tax Registration

Getting your paperwork ready is half the job done. Corporate tax registration in the UAE isn’t complicated, but the Federal Tax Authority (FTA) will only move forward once they see that your business is real and your details match across documents. A little preparation saves a lot of time — here’s what you’ll actually need on hand.

Documents for Legal Entities

If you run a company — mainland, free zone, or a branch — have these ready before starting corporate tax registration services:

- Your Trade License and any branch licenses

- The Memorandum and Articles of Association or similar founding papers

- A Certificate of Incorporation, if your setup involves foreign ownership

- Passport and Emirates ID copies for all owners and authorized signatories

- A Power of Attorney for whoever will submit the application

- Your registered office address and contact details

- A short summary of business activities

- Recent financial statements or management accounts, if available

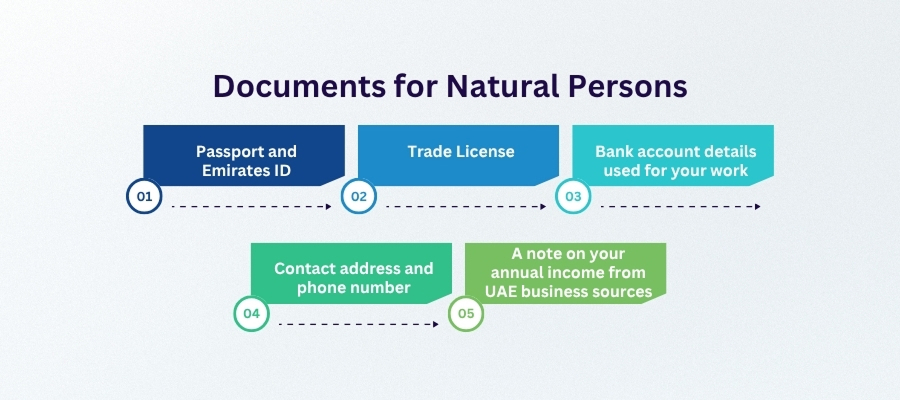

Documents for Natural Persons (Sole Proprietors / Freelancers)

If you’re registering as an individual or freelancer, the FTA keeps it simple:

- Passport and Emirates ID

- Trade License (if you have one) or proof of your business activity

- Bank account details used for your work

- Contact address and phone number

- A note on your annual income from UAE business sources

Once these are ready, applying through an experienced corporate tax registration service in Dubai becomes quick and frustration-free — no chasing missing documents later.

How to Register for Corporate Tax in the UAE: Step-by-Step

Registering for corporate tax isn’t difficult, but the details matter. The entire process happens through the Federal Tax Authority (FTA) portal, and once it’s done, your company gets its official tax ID — the TRN. From there, everything else (filings, exemptions, group registration) connects back to it.

Go to the FTA website and open a business profile. It takes a few minutes — just basic company details and an email for verification.

After logging in, you’ll find the option right on the dashboard. Click it, and the real work begins.

Include your business's license number, legal name, who owns the business, and how to reach you. Watch out, because what you type here will show up on all future filings.

Attach your license, IDs, and supporting papers. Keep filenames clear; it makes reviews faster.

Make sure everything is correct, then click "Submit." Usually, the FTA confirms receipt within a few days.

When your UAE corporate tax registration is approved, your TRN becomes the number that all accountants will ask for.

Want to learn more about UAE business setup services?

Registration Windows and Deadlines for Corporate Tax Registration (FTA Scheduling)

There isn’t one big deadline for everyone. The Federal Tax Authority (FTA) assigns each business its own window for UAE corporate tax registration, usually based on when your trade license was issued or when the company was first established. Think of it as your personal time slot — miss it, and you’ll still have to register, but with a penalty attached.

If your company is new, the registration window usually appears once your license is active. Older businesses get their schedule through the FTA system or direct email. It’s worth logging into your e-Services account to double-check, because those dates aren’t fixed forever; they’re updated as the FTA rolls out new batches.

Free zone companies aren’t off the hook either. Even with QFZP status or a 0% rate, you still need to register on time. The rule applies to everyone — mainland, branch, or group.

This is where having a good corporate tax registration service in Dubai helps. They track your company’s window, file before the deadline, and save you from the headache of rushing paperwork when it’s too late.

Penalties for Late Registration and Non-Compliance

The Federal Tax Authority (FTA) doesn't offer you much time to wait. According to current FTA rules, if you miss the deadline to register for business taxes, you will have to pay a fine of AED 10,000 right away. That's just the beginning. If you don't keep on time, you could get extra fines for filing late, missing updates, or not reporting changes to your firm.

The fine isn’t the only problem. Once you’re late, small things start getting messy — your license renewal might stall, or a routine filing suddenly needs extra clarification. If the FTA flags your account once, every new delay gets a closer look. It’s not dramatic, just inconvenient and avoidable with a bit of planning.

The smart move is to check your assigned deadline early and register well before it closes. If you’ve already missed it, don’t ignore it — you can still file and fix it before the next penalty kicks in. A professional corporate tax registration service in Dubai can handle the cleanup quickly and get your record back in good standing with the FTA.

How Consulting.ae Handles Corporate Tax Registration

At Consulting.ae, we don’t treat registration as paperwork — it’s the first real test of how your company’s details hold up under the Federal Tax Authority (FTA) system. We start by getting to know how your business is built: the licenses, the ownership structure, the daily flow of money. Once that picture is clear, we prepare the file exactly the way the FTA expects it — no missing pages, no mismatched numbers, no guesswork.

We file the application for you and keep an eye on it until it’s approved. If the FTA comes back with a question — and they often do — we handle the reply right away, without making you dig through the system yourself. For clients running several licenses or group structures, we make sure all the information lines up before submission so there’s no confusion later. It’s practical, patient work, and it saves a lot of backtracking once the process is live. It’s quiet, careful work, but it’s what keeps the process smooth.

Why Choose Consulting.ae for Corporate Tax Registration in the UAE

We’ve seen how confusing tax registration can get in the UAE — different free zones, shifting FTA updates, mixed deadlines. That’s exactly why Consulting.ae exists: to make the process clear, predictable, and fully compliant.

You won’t get templates or vague advice from us. You’ll get a clear plan, realistic timelines, and someone who actually answers the phone when the FTA changes a form overnight. Our approach combines legal accuracy with practical sense — the kind that comes from helping hundreds of businesses register the right way, not just the fast way.

If you’d rather handle your tax setup once — correctly — a dedicated corporate tax registration service in Dubai like Consulting.ae is the easiest way to do it.

Yes — every active business needs to register with the Federal Tax Authority (FTA). Even if you’re not making big profits yet, registration shows you’re on the radar and compliant from day one. It’s quick to do and saves trouble later.

I’m in a free zone — do I still need to register now?You do. Free zone companies also register to confirm their QFZP status and keep the 0% rate. It’s a simple step, but skipping it can mean losing your tax benefit.

Start with your Trade License, passport and Emirates ID copies, and proof of ownership. Add your business address and a short activity summary. If you’re unsure, a corporate tax registration service in Dubai can check your set before you upload.

Once your file is complete, the FTA typically approves it in a few working days. If names or numbers don’t match, expect a short delay. That’s why we always double-check before hitting submit.

Yes. We handle group applications so each entity fits neatly under one registration. It keeps reporting simpler and avoids conflicts between your licenses.

Of course. We take care of both the registration and the first reporting cycle. It’s one less thing for you to juggle while getting operations running.