Running a business in the UAE means dealing with change — fast, constant, and sometimes confusing. Taxes are no exception. Corporate tax compliance isn't just a rulebook you tick through once a year. It's the rhythm of your financial life. Each report, each return, each record says something about how solid your company really is. The FTA isn't just watching; it's expecting clarity, accuracy, and honesty. When those boxes are checked, you can breathe easier. You know your numbers stand up. You know your strategy is sound. That's what real corporate tax compliance in the UAE feels like — calm, clean, and under control.

What Corporate Tax Compliance Covers in the UAE

We’ll keep it simple — corporate tax compliance is about proving your business runs clean. It means your numbers make sense, your books are in order, and the Federal Tax Authority can trace every dirham without raising an eyebrow. It's not just about paying your taxes; you have to show that you know the rules and follow them. That's what makes you sure when rules change, which they do a lot of the time.

In practice, real compliance means:

- Registering your business for corporate tax and keeping your details current with the FTA.

- Filing your annual tax return accurately — no last-minute guesswork, no missing attachments.

- Keeping proper records for at least seven years so you can answer any audit question without panic.

- Knowing your taxable income — what counts, what's deductible, what's exempt.

- Handling FTA requests calmly and on time; silence is never a good idea.

- Following the latest guidance from the Ministry of Finance and the FTA, because small updates can have big effects.

In short, corporate tax compliance in the UAE is the quiet discipline that keeps your business steady while others scramble to catch up.

Who Needs Corporate Tax Compliance & Advisory

Almost every serious business in the UAE needs corporate tax compliance and advisory at some point. Mainland companies face the standard 9% rate, sure, but the real challenge is staying consistent when rules shift. Free zone entities, on the other hand, need to show that they meet QFZP conditions or risk losing their tax breaks. If they miss one detail, the whole thing can change.

Then there are growing groups juggling multiple entities, startups scaling faster than their accountants can breathe, and foreign investors setting up Permanent Establishments here for the first time. Each new branch, cross-border deal, or ownership change adds another layer of complexity.

The truth? The moment your business starts moving — expanding, hiring, signing international contracts — you need someone keeping an eye on compliance while you focus on growth. That's not bureaucracy. It's protection — the kind that lets you sleep at night.

Core Corporate Tax Compliance Services

Behind every smooth business operation in the UAE lies one thing most founders don't brag about — good compliance. It's the quiet, consistent work that keeps your company in the clear and your mind at ease. Real corporate tax compliance services go far beyond ticking boxes; they keep your records tight, your filings correct, and your structure ready for whatever the Federal Tax Authority (FTA) decides to review next. Here's what that actually looks like.

Return Preparation and Filing

Here's where all of your accounting, structure, and accuracy come together: on your tax return. It's not enough to just copy numbers from a balance sheet when making them. Every number has to be correct according to FTA rules, all the information has to be given correctly, and the submission has to be made by the due date. A single delay can lead to fines, and a small mistake can lead to an FTA review.

A proper compliance team reviews trial balances, reconciles adjustments, and ensures the right exemptions and deductions apply. They also make sure filings match your declared Qualifying Free Zone Person (QFZP) status, if relevant. The goal isn't just to “file and forget” — it's to build filings that hold up under any scrutiny, anytime.

Record-Keeping and Audit Readiness

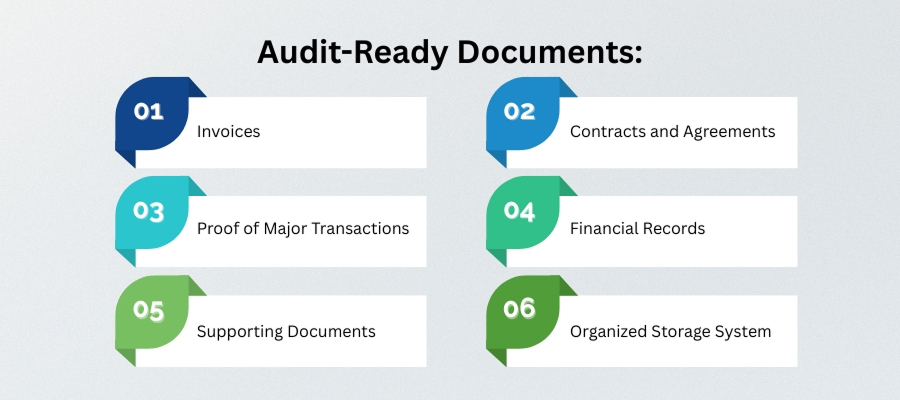

If there's one thing businesses underestimate, it's documentation. The UAE requires companies to keep clear financial and transactional records for at least seven years — and not just invoices, but contracts, agreements, and proof of every major transaction.

Being audit-ready means having these records in shape before anyone asks for them. No panic searches through folders, no missing data when the FTA calls. It's about showing that your internal systems reflect the same numbers you submit. A good compliance partner doesn't just store data; they organize it in a way that makes every audit or internal check simple, quick, and uneventful.

Handling FTA Queries and Notices

You could get an FTA query even if everything looks good on paper. It's not always bad news; sometimes it's just a question or a check to make sure everything is okay. What matters is how you handle it.

Good advisors don't panic. Their response is factual, calm, and well-documented, and it talks the FTA's language. They carefully read the notice and track down the numbers in question. Because there isn't much time to respond, accuracy and tone are more important than volume. A measured, confident answer keeps the dialogue professional and often closes the matter before it turns into a formal review.

Strategic Advisory (Planning, QFZP Conditions, Risk Reviews)

Compliance is the baseline; strategy is the edge. This is where corporate tax advisory services really shine. In real life, this means sitting down with your leadership team and looking beyond this quarter's filings to ask, "How will our structures, contracts, and incentives hold up next year or five years from now?"

Advisory work in the UAE often starts with the details: verifying QFZP eligibility, mapping how profits move between entities, or identifying exposure hidden in intercompany pricing. But the bigger goal is always the same — to keep your structure compliant while giving it room to grow.

Cost of Corporate Tax Compliance & Advisory Services

The price of corporate tax advisory service in Dubai and in the UAE in general depends on how complex your business truly is. There's no flat rate because every company has a different story — some manage one legal entity, others juggle ten. Costs usually go up or down depending on how big your business is, how many tax returns you file each year, and whether you need QFZP or group-level guidance. The work load is also increased by urgent projects or a lot of FTA interactions.

Typical engagements include annual tax return preparation, record checks, advisory sessions, and support with notices or audits. Some work naturally sits outside the usual scope — like fixing old filings or preparing voluntary disclosures.

Most corporate tax advisory services in the UAE keep things flexible. You can hire them for a one-time review or ongoing support, depending on how much your team can handle internally. The goal is simple: build an arrangement that fits your pace, not someone else's template.

Why Choose Consulting.ae for Corporate Tax Compliance & Advisory in the UAE

At Consulting.ae, our focus is on clarity and precision. We break down complex tax rules into plain, workable steps so you always know what needs to happen and when. The advice you get is based on the latest FTA and Ministry of Finance guidelines. There is no guesswork or filler in the advice; it is just clear instructions that help you stay in line and work efficiently.

We focus on facts, precision, and accountability. Whether it's confirming QFZP eligibility, preparing your next filing, or managing an FTA query, you'll know exactly what's being done and why.

If your business values accuracy and structure over slogans, let's talk. Consulting.ae offers the kind of corporate tax compliance and advisory support that stands up to both audits and growth.

It means registering, filing returns, paying the right tax, and keeping proper records. In short, you follow FTA rules and prove your numbers are accurate. If you're unsure, get a quick compliance review.

Yes. You must file and meet QFZP conditions to keep preferential rates. A periodic check helps confirm you still qualify.

Yes. Late filings can often be corrected through voluntary disclosure with the FTA. Contact us early to limit penalties and fix the timeline.

Keep invoices, contracts, ledgers, bank statements, and supporting documents for seven years. The FTA may ask for them during reviews. Set up a simple index so you can retrieve items fast.

How often will you handle returns and payments for us?Returns are annual, but monitoring should run year-round. Most clients choose ongoing support so updates and notices are handled on time. We can tailor the cadence to your workflow.

It's Qualifying Free Zone Person status that allows a preferential rate if strict criteria are met. You need the right activities, substance, and reporting. Ask for a QFZP checkpoint before year-end.