One of the first things people ask when they think about launching in the UAE is simple: what’s it going to cost me? And honestly, it’s the right question to start with. The Dubai free zone company setup cost can look straightforward on a brochure, but the reality shifts once you factor in visas, office space, and the type of license you pick.

Dubai free zones are attractive because they give you full ownership, speed, and credibility. But head outside Dubai and you’ll often find lighter packages in places like Sharjah or Ras Al Khaimah—cheaper on paper, but different in scope.

This isn’t about picking the “cheapest” option. It’s about knowing what you get for your money, avoiding surprise add-ons, and choosing a setup that fits the way you actually want to run your business.

What Factors Affect the Cost of Company Registration?

Not a single number can be used to describe how much it costs to start a business in a UAE free zone or on the mainland. Businesses in the same zone may pay very different amounts, based on what they do, how big their office is, or what kind of visa they need. Here are the main factors that influence your budget.

- Business Activity. Not all activities cost the same. Consulting and e-commerce have lower fees, but regulated industries like healthcare and education demand more permissions. Choosing the right activity also determines whether you need clearances from external government bodies.

- Number of Visas. Visas are tied to your business package and office space. A “zero visa” package is the cheapest, but each additional visa can raise costs by several thousand dirhams. If you plan to build a team, budget for a larger visa quota.

- Office Requirements. A flexi-desk or shared workspace is the most affordable option and is common in many free zones. A private office or warehouse drives costs up significantly, and some authorities require physical offices for certain activities.

- Authority Fees. Each free zone or mainland authority charges differently. They include company registration, trade name reservation, and license issuing. They are non-negotiable and vary by emirate and jurisdiction.

- Service and PRO Fees. If you use a consultant or PRO (Public Relations Officer) to handle paperwork, there will be additional service charges. While optional, many businesses pay them to save time and avoid mistakes during the process.

How Much Does It Cost to Register a Company in a Dubai Free Zone?

Dubai has over 30 free zones, and the gap in pricing reflects the different roles they play. Entry-level packages in some zones are built to attract startups, while others are clearly designed for global firms in finance, media, or trade. The spread runs from roughly AED 9,000 at the low end to AED 50,000 or more in the most specialized zones.

|

Free Zone |

Starting Cost (AED) |

Focus Area / Reputation |

|

DMCC |

~9,000–10,000 |

Flagship trading hub, strong global name |

|

IFZA / Dubai South |

~12,000–15,000 |

Cost-effective packages for SMEs, e-commerce, logistics |

|

Dubai Internet City / Media City |

~15,000–25,000 |

Tech, IT services, creative industries |

|

DIFC |

40,000–50,000+ |

Finance, banking, fintech, legal firms |

For many business owners, price goes beyond license. Partners and banks see DMCC licenses as international credibility. Smaller consultancies and freelancers like IFZA because it's simple and affordable. On the other hand, DIFC is expensive but the only option for regulated finance.

DMCC

So while all of these are technically “Dubai free zones,” the company registration in the Dubai free zone mirrors the status and sector focus of each one. The smart move is to match your budget with the reputation that fits your clients’ expectations.

How Much Does It Cost to Register a Company in the UAE Free Zones?

Short answer: outside Dubai, you’ll usually pay less up front, but the totals still depend on visas, office choice, and the licence you need. A simple package in a smaller emirate can feel almost shockingly affordable — but don’t treat the sticker price as the whole story.

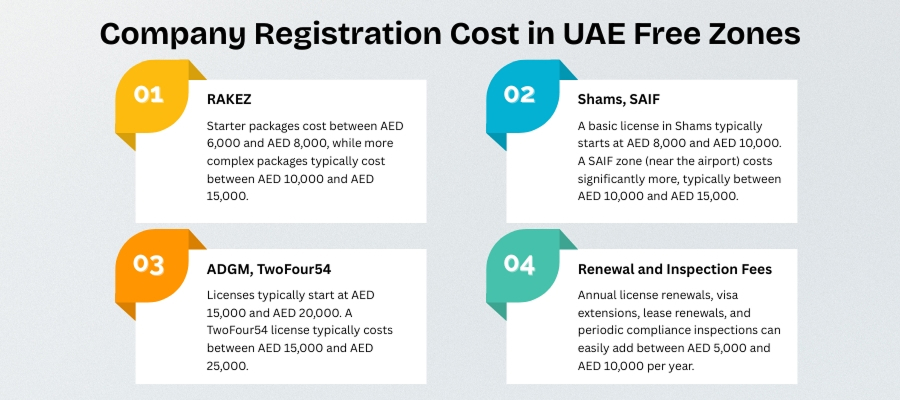

Ras Al Khaimah (RAKEZ)

RAKEZ is the go-to for people who want a solid base without a big headline price. We’ve seen starter packages advertised from roughly AED 6,000–8,000, and more complete setups (with a basic visa allowance and office) commonly land in the AED 10,000–15,000 band. It suits manufacturers, traders, and cost-conscious startups.

Sharjah Free Zones (Shams, SAIF)

Sharjah’s options skew practical. Shams often starts around AED 8,000–10,000 for simple licenses — handy for freelancers and small consultancies. SAIF Zone (near the airport) is a step up, generally AED 10,000–15,000, and is useful if you need warehousing or stronger trading infrastructure.

Abu Dhabi Free Zones (ADGM, TwoFour54)

Abu Dhabi zones are more niche and sit higher on price. ADGM targets finance and related services; entry points commonly begin in the AED 15,000–20,000 range. TwoFour54—aimed at media and creative industries—typically falls in the AED 15,000–25,000 bracket. You’re paying for specialization and the credibility that comes with it.

Renewal and Compliance Fees

Don’t forget the ongoing costs. Annual renewals, visa renewals, lease extensions and occasional compliance checks easily add AED 5,000–10,000+ per year, depending on how many people you employ and what approvals you need. Put simply, save enough for the recurring costs in addition to the one-time expenses; a low price tag doesn't necessarily indicate a low price tag in the long run.

Want to learn more about UAE business setup services?

What Are the Hidden Costs of Free Zone Business Setup?

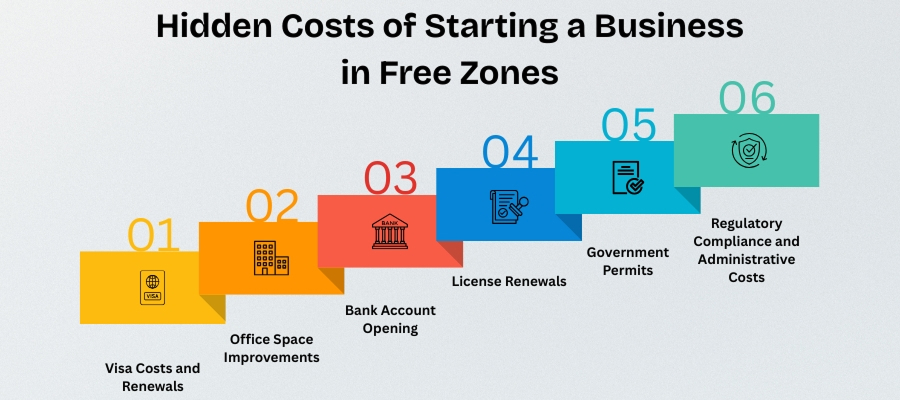

The “headline” package price is rarely the full story. Once you start operating, a handful of extra charges show up—some small, some significant. Planning for them up front saves stress later.

- Visa costs and renewals. A zero-visa package looks cheap, but every employee or dependent visa adds several thousand dirhams. Renewals come around every few years and aren’t optional.

- Office upgrades. Flexi-desks are affordable, but as soon as you need a private office or warehouse, the rent jumps. Some activities also require physical space, no matter what the sales team says.

- Bank account setup. There may be monthly fees, minimum balance requirements, or required deposits when opening a business account, all of which can eat into available funds.

- License renewals. Annual renewal fees are usually close to what you paid in year one. Miss a deadline and penalties stack quickly.

- Government approvals. Certain industries—media, healthcare, education—require external approvals or certifications that carry their own fees.

- Compliance and admin. It may not seem like a lot, but PRO services, notarizations, and document authentication add up quickly if you have to deal with a lot of visas or changes.

How Can Businesses Reduce Company Setup Costs in Dubai and UAE Free Zones?

Starting lean is the single best move you can make to reduce the Dubai free zone company formation cost. Set up only what you need today and keep the rest for when revenue justifies it. That way, you don’t lock cash into visas, rent, or fancy offices before the business earns them.

Practical, money-saving moves you can use right away:

- Take only the visas you need. Each visa costs money and paperwork; hire slowly and add visas as hires happen.

- Use a flexi-desk or shared office at first. It’s legal, tidy, and far cheaper than a private office — upgrade when the team needs privacy.

- Choose the right free zone (or emirate). If prestige isn’t essential, places outside Dubai often give the same legal cover for less cash.

- Bundle services wisely. One consultant who handles licensing, PRO work, and bank introductions can save time and money by not having to pay twice for the same work.

- Plan renewals and cash flow. Note renewal dates now and set aside the money — late fines are unnecessary leaks.

If you treat setup as staging, not a one-shot splurge, you’ll keep control of cash and scale with confidence.

Conclusion

The real trick with the Dubai free zone company setup cost isn’t hunting for the lowest brochure price — it’s understanding what those numbers actually buy you. A cheaper package in one emirate might look good on day one, but if you plan to grow fast, Dubai’s bigger name and credibility can pay for itself. On the flip side, if you just want a lean, low-overhead start, smaller zones outside Dubai keep more cash in your pocket. The smart move is matching the setup to your reality, not someone else’s sales pitch.

A Dubai free zone license typically starts around AED 9,000–12,000. Premium zones like DIFC can exceed AED 40,000 depending on the activity.

Yes. Dubai zones charge more for their reputation, facilities, and location. The UAE free zone business setup costs in Sharjah or Ras Al Khaimah often start from AED 6,000–8,000.

The registration fees themselves are not subject to VAT. But once your business is up and running and makes more than AED 375,000 in sales, you have to register for VAT.

Some free zones and consultants let you pay in installments, but it depends on the authority. Always check the payment terms ahead of time.